GOLD

Let’s start today’s analysis with the gold market. Looking at the daily interval, we can see that the price of this commodity has been trading in a downward channel recently. Buyers appeared on the lower limit of the aforementioned channel yesterday but the main sentiment remains bearish. Should the fall continue, the $1690 area will be the next key support to watch. In case of a break below it, declines may accelerate. On the other hand, should buyers become more active, the nearest resistance to watch lies in the $1773 area, which is marked with the previous price reactions and the 50% Fibonacci retracement.

GOLD D1 interval. Source: xStation5

GOLD D1 interval. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appDE30

German index painted a fresh all-time high this morning but the upward move was stopped in the vicinity of recent highs at 14,150 pts. DE30 has pulled back from this area three times already, but the major trend remains bullish. Should the price break above the zone, the next potential target for buyers will be 14,770 pts resistance which is marked with a 161.8% exterior Fibonacci retracement. Bears should also pay attention to the upper limit of the local upward channel. Today's session would need to finish before the 14,150 pts area in order to outlook shift to slightly more short-term bearish.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

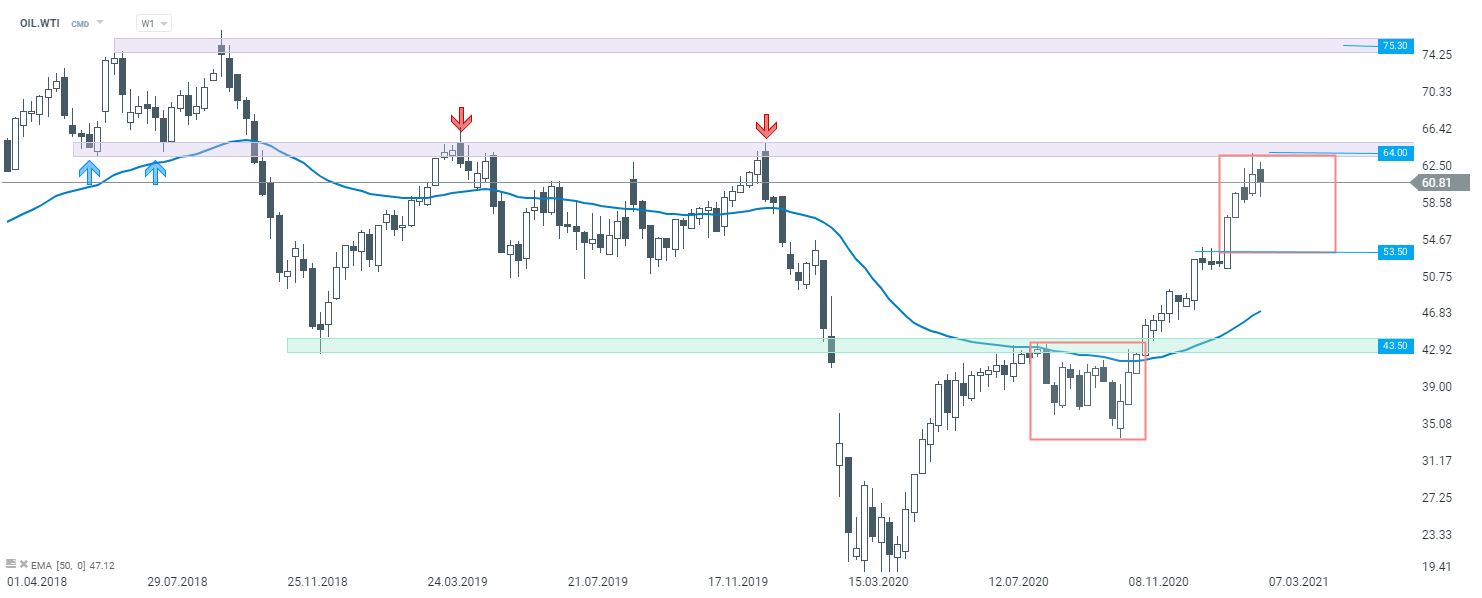

OIL.WTI

Last but not least, let’s take a look at the oil market. Taking a look at the commodity from a broader perspective, one can spot that the price reached a key long-term resistance at $64.00, where sellers appeared. Of course, the main sentiment remains bullish but there risk of downward correction is high. Considering such a scenario, the nearest key support to watch can be found at the lower limit of 1:1 structure ($53.50). On the other hand, if buyers manage to break above the aforementioned $64.00 resistance, the way towards $75.3 will be left open.

OIL.WTI D1 interval. Source: xStation5

OIL.WTI D1 interval. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.