Traders are waiting for the FOMC decision scheduled for the evening (6:00 pm GMT). Volatility is expected to be elevated as not only the decision will be announced but also the latest set of quarterly macroeconomic forecasts will be released. GOLD, DE30 and US100 are among markets that may experience big moves in the aftermath of Fed's meeting.

GOLD

Let’s start today’s analysis with the gold market. Looking at the daily interval, one can see that an upward correction was launched after price bounced off the $1,700 support. Should the current sentiment prevail, an attack on the $1,760 resistance may be on the cards. In case price breaks above this handle, the upward move may expand towards resistance marked with the upper limit of 1:1 structure ($1,879) and 50% Fibonacci retracement of the downard move started in August 2020. On the other hand, if sellers manage to break below the aforementioned $1,700 support, the way towards the next demand zone at $1,580 will be left open.

GOLD D1 interval. Source: xStation5

GOLD D1 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

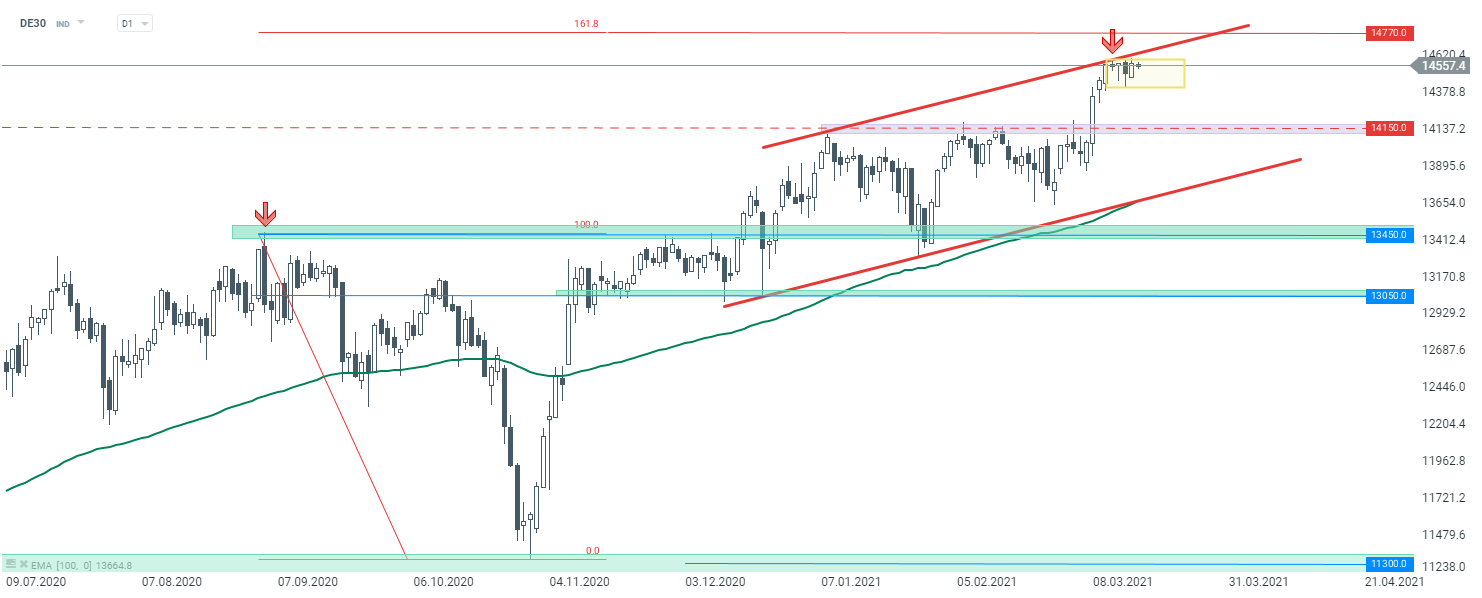

DE30

German Dax (DE30) has been trending in an upward move recently. However, upward momentum slowed down after the index reached the upper limit of the local upward channel at the end of the previous week. Looking at the chart at a daily time frame, we can see that the price trades sideways in a local trading range marked with a yellow rectangle. Until the range is broken, continuation of a sideways move is the base case scenario. However, today’s FOMC meeting may provide an opportunity to break out from the range. In case a break higher occurs, a resistance at 14,770 pts, marked with the 161.8% Fibonacci exterior retracement, could be the potential target for market bulls. On the other hand, breaking below the range could see price decline towards a support at 14,150 pts.

D30 D1 interval. Source: xStation5

D30 D1 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

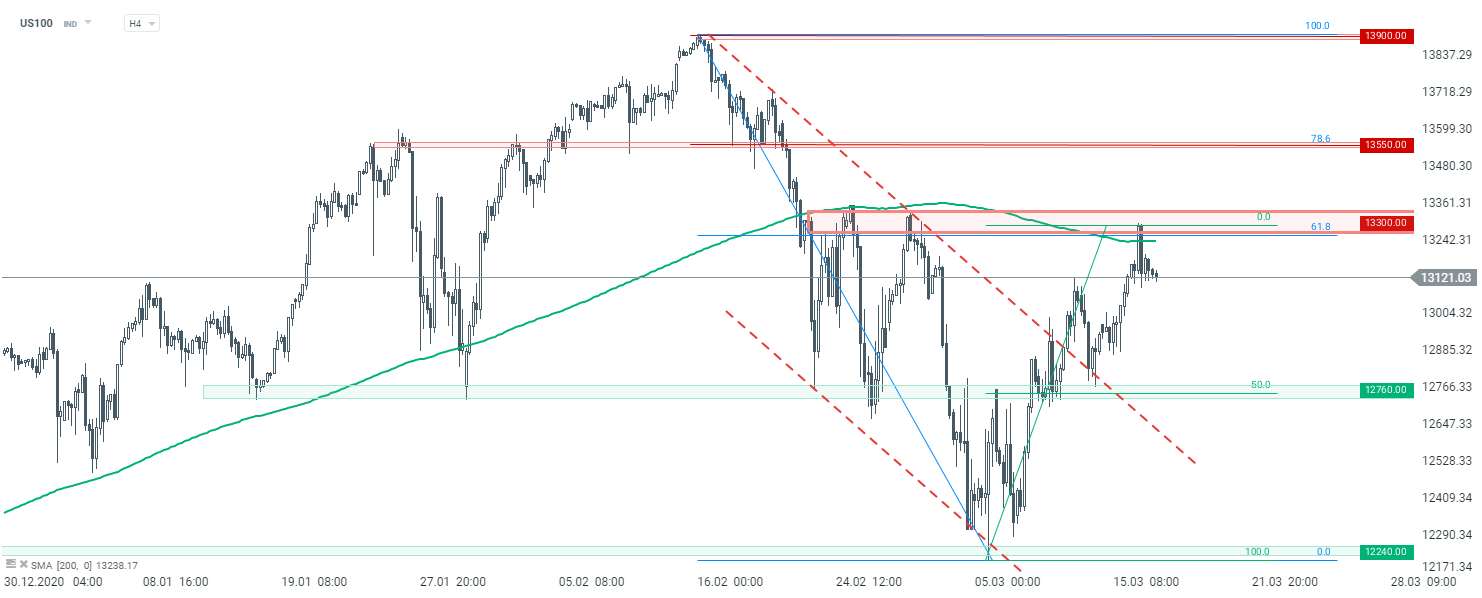

US100

Last but not least, let’s take a look at the US tech index - Nasdaq (US100). Looking at the H4 interval, one can see that recent downward correction might have finished already. Market bulls managed to halt declines at the 12,240 pts support and the price broke above the downward channel, signaling possibilly resumption of the uptrend. However, the subsequent upward move was stopped at the key short - term resistance at 13,300 pts, marked with previous price reactions and the 61.8% Fibonacci retracement of the recent downward move.Should buyers manage to break above it, an upward move may accelerate. On the other hand, if the price stays below 13,300 pts, downward correction may be resumed and deepened.

US100 H4 interval. Source: xStation5

US100 H4 interval. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Markets attempt to rally on positive news from Iran

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.