DE30

We will start today's analysis with the German stock index. DE30 has come under selling pressure in recent days by which an important support zone was overcome. Looking at the H4 interval, the quotations have broken through below the zone of 13 400-13 350 points without much problem, which puts the index in a very unfavorable technical situation. It seems that as long as the price remains below, an attack on the level of 13010 points is possible. Overcoming it, in turn, could even lead to a descent towards the July minima. On the other hand, a change in sentiment to an upward one can only occur when the price returns above the level of 13400 points.

DE30 H4 interval. Source: xStation5

US100

The US indices have also suffered in recent days. Nevertheless, yesterday's as well as today's session bring a deceleration of declines. Looking technically at the technology index (US100) on the D1 interval, we observe a reaction at the height of a key short-term support - 12875 points. This level is derived from the lower limit of the 1:1 system, as well as previous price reactions. If buyers successfully stop further discounting, it is not impossible to generate another upward wave. On the other hand, a break of the price below 12 875 points, may pave the way towards the support zone at 12 165 points.

US100 interval D1. Source: xStation5

USDJPY

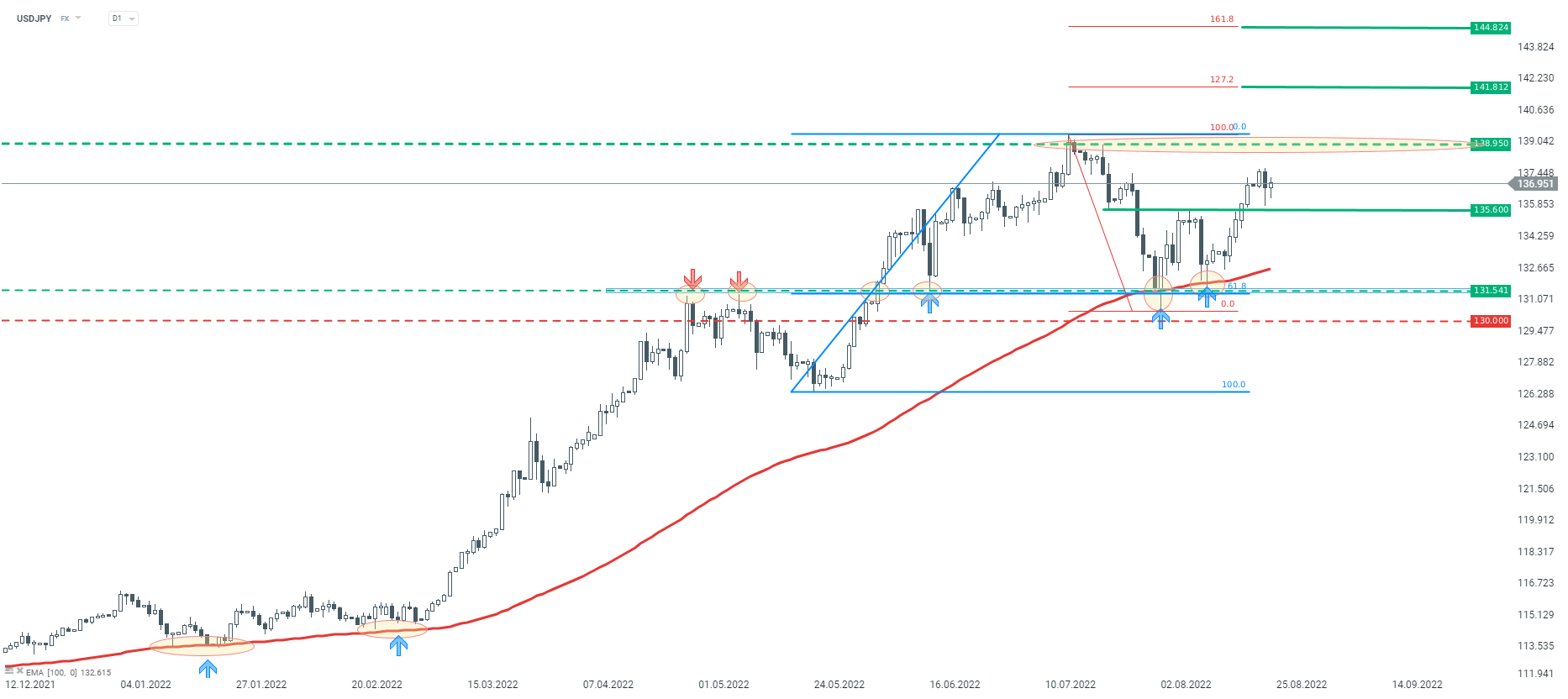

Finally, let's take a look at the USDJPY currency pair, which continues to move within the uptrend. Looking at the D1 interval, the quote has recently bounced off the key support zone at 131.50 and is now just short of the July highs. Currently, the key short-term support remains the zone at 135.60, and it seems that as long as the price is above it, the question of attacking the recent high is a matter of time. In turn, a possible break of this support, could lead to another attack on support at 131.5.

USDJPY interval D1. Source: xStation5

Chart of the Day: JP225 (20.10.2025)

The Week Ahead

BREAKING: Producer Inflation in Germany lower than expected

Morning wrap (20.10.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.