-

Democrats will attempt to unseat Trump before the end of his term

-

25th Amendment unlikely to be invoked

-

Impeachment proceeding will not end before Trump leaves White House

-

Conviction could ban Trump from running for President in 2024

-

Minimal market impact

Last week's siege on Capitol Hill and Trump's initial refusal to condemn violence has started a discussion that it may be too dangerous to let the incumbent US President remain in office until the end of his term. Many politicians, mostly Democrats, started to question Trump's mental health and kept reminding that Trump still has control over the US nuclear arsenal.

Democrats in the US House of Representatives will vote today on a resolution asking Vice President Pence to invoke 25th Amendment, that allows to remove the President from office due to inability to perform duty. In this case, Democrats claim that Trump's behaviour during last week's attack on Capitol Hill makes his mental stability look questionable. While Pence did not comment on those plans, media sources say that he is opposed to the idea. In such a case, Democrats plan to launch the second impeachment process of Donald Trump on the back of insurrection charges. However, this is where obstacles start. The Senate is unlikely to work on the matter before January 19, which is also Trump's final day in the office.

As Trump will not be removed from the office before the end of his term, he will not be strapped out of control over the US nuclear arsenal or the ability to declare a war. However, there are some factors that could justify pushing with the impeachment anyway. First one is the fact that the siege on the center of US democracy has been an unprecedented event and failing to condemn such an act was simply wrong and Trump should be punished. There is also a political factor to it - even if Congress convicts Trump long after his term has finished, he would be unable to run for the President in 2024.

Impact on the markets

While the whole situation is serious, it should not have a major impact on the markets. Why? Trump is already set to leave the office next week and impeachment proceedings will not change it. Invoking the 25th Amendment could end Trump's term sooner but it is a highly unlikely option. While barring Trump from running for President in 2024 looks significant, it should be noted that he now has a lot of enemies in the Republican Party and winning the nomination for the race in 2024 looks unlikely. While he could run as an independent candidate, such a move would only steal votes from the Republicans and boost Democrat odds in future elections. Impeachment proceedings could have some impact on markets if the Senate starts to work on the issue before Biden's inauguration as in such a scenario, Biden would be unable to appoint his Cabinet for some time and passage of a new economic relief package would be delayed. Nevertheless, stimulus will be coming sooner or later so there is a high chance it will be played down as well.

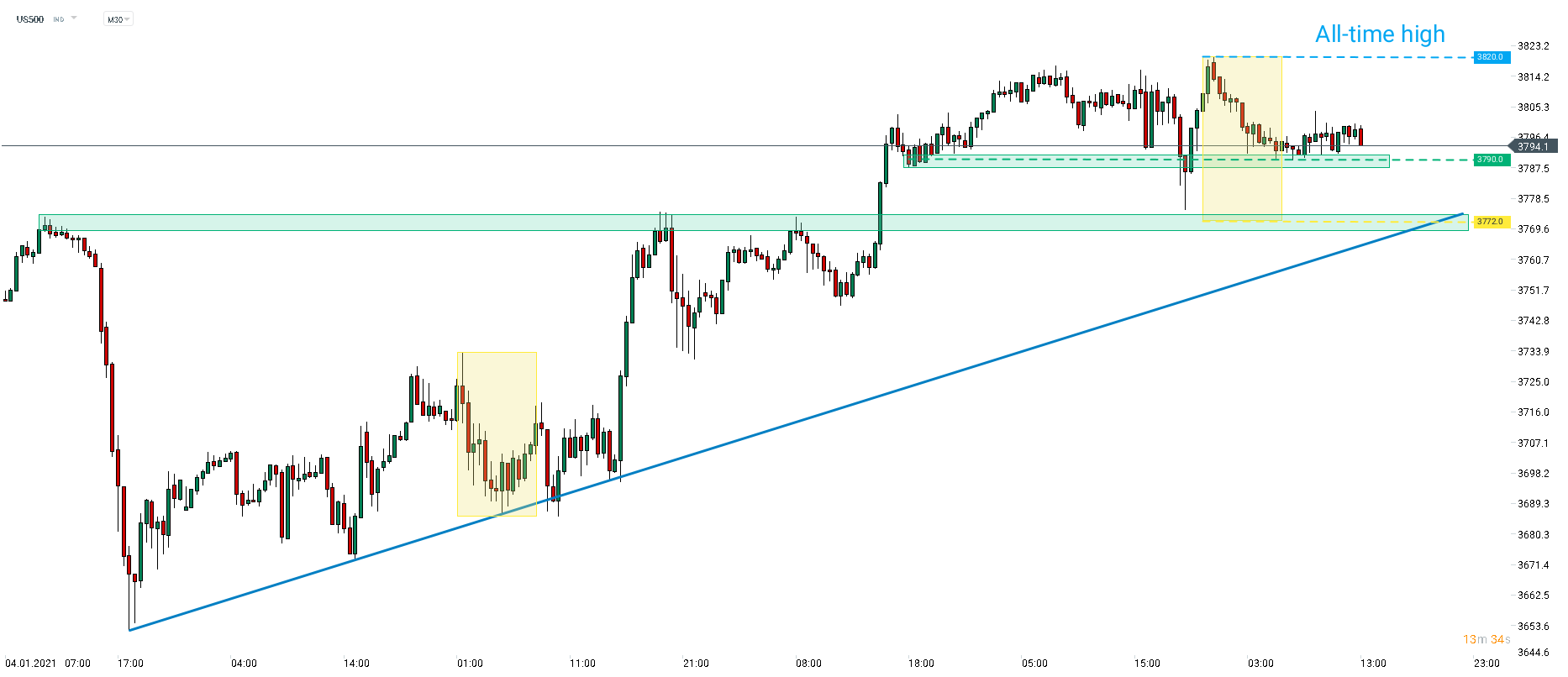

US indices did not experience a long-lasting reaction to last week's attack on the Capitol Hill, nor to the announcement that Democrats will attempt to unseat Trump before the end of his term. Today's pullback on the global equity indices can be ascribed to recent US actions that risk further deterioration in relations with China. However, US500 is trading less than 1% below its all-time high and has already started recovering after testing a short-term support at 3,790 pts. A key support in near-term can be found at 3,772 pts and is marked with the lower limit of the Overbalance structure and previous price reactions. Source: xStation5

US indices did not experience a long-lasting reaction to last week's attack on the Capitol Hill, nor to the announcement that Democrats will attempt to unseat Trump before the end of his term. Today's pullback on the global equity indices can be ascribed to recent US actions that risk further deterioration in relations with China. However, US500 is trading less than 1% below its all-time high and has already started recovering after testing a short-term support at 3,790 pts. A key support in near-term can be found at 3,772 pts and is marked with the lower limit of the Overbalance structure and previous price reactions. Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.