Summary:

- The Turkish Lira has recovered after hitting its lowest ever level last month

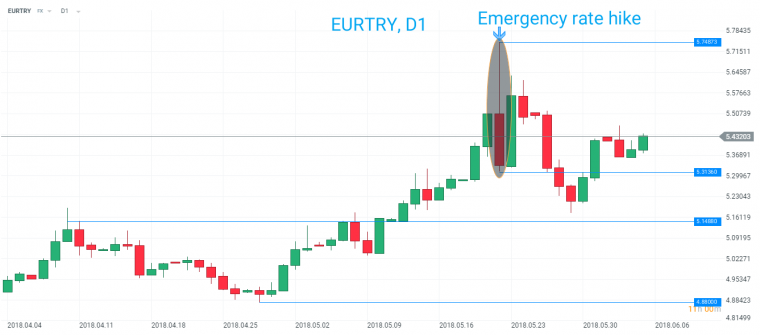

- Emergency rate hike saw major reversals in EURTRY and USDTRY

- Central Bank rate decision Thursday 12PM (BST). Will they hike again?

One of the biggest moves seen in the markets this year has been in the Turkish Lira, with the currency experiencing a rapid depreciation due to an unorthodox central bank policy. The EURTRY has gained 19% year-to-date and hit its highest ever level at 5.75 just over 2 weeks ago, before an emergency interest rate hike from the Turkish central bank (CRBT) saw the market plunge almost 7% ( an incredible 4000+ pips) from its new record peak in just a matter of hours. Given this move it is not hard to see why tomorrow’s scheduled rate decision presents a potentially great trading opportunity.

The EURTRY dropped sharply from its all-time high after the CRBT announced an emergency interest rate hike of 300 bps for its late liquidity rate to 16.5%. Source: xStation

Looking ahead to tomorrow’s rate decision at Midday (BST), according to Bloomberg the 1-week repo rate is expected to remain unchanged at 16.5% - there are some adjustments that can be made to effectively hike rates without moving this; explained further here. There is not a scheduled press conference to follow the event but there will be an accompanying statement and this could well prove decisive as far as market reaction goes.

Looking more closely at the EURTRY chart a fib retracement taken from January reveals some potentially key levels to keep an eye on going forward. The obvious place to look for resistance is the all-time high at 5.75 but before that the 23.6% at 5.48 could also attract sellers. As for support the 50% fib around 5.18 provided a floor and ended the recent sell-off but if we get a TRY positive outcome and price breaks below there then t would pave the way for a larger pullback.

Fib retracements of the advance since January may provide levels to watch over tomorrow’s event with the 23.6% at 5.48 possible resistance and the 50% at 5.18 potentially key support. Source: xStation

Even though there’s been a strong run higher in this market in recent months, to put it in its true perspective we can look at a very long term chart. Going back to 2003 when the rate was around 1.50 there has been a parabolic advance with price taking off - in particular since the start of 2016 when the market was around 3.16.

The fundamental reason for this rise was a reluctance to raise rates despite inflation rapidly rising. President Erdogan pushed an unorthodox monetary policy whereby he stated, contrary to popular opinion that higher interest rates don’t curb inflation and the Lira plummeted in value.

EURTRY has experienced a parabolic rise in recent years, but if Turkey can convince the markets that they will get inflation under control then there’s plenty of scope for a large pullback. Source: xStation

However, recent events such as the emergency rate hike may seem to suggest that Erdogan has finally realised that enough is enough and that rates needs to rise in order to curb runaway inflation. If this is the case, and more importantly, if the market believes this to be the case then there’s plenty of scope for a pullback ahead as these gains could be handed back.

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.