Summary:

- Turkish lira crashed on Friday as traders bet against the TRY ahead of local elections due March 31

- Lira erases losses after Erdogan has warned that those shorting the lira will pay “a very heavy price”

- Asian markets slide following substantial drops on Wall Street at the end of the past week

Turkish lira seesaws

The Turkish currency plunged over 5% against the US dollar on Friday as traders were buying foreign currencies ahead of local elections scheduled for the next Sunday, March 31. It was the largest one-day drop since a currency crisis in Turkey seen in August last year. It also needs to be said that the TRY’s dramatic decline during the last trading day last week was also aggravated by overall sour moods after European PMIs came in well below expectations fueling risks of an imminent recession. On top of that the Friday’s fall was, at least in part, due to data released by the central bank on Thursday showing that FX deposits including metals held by Turks hit a record high in the week to March 15. If this trend unfolds over the next couple of days, we may experience even a deeper pullback. The lira’s plunge has been recovered to some extent in early European trading hours after President Recep Erdogan warned over the weekend that “if you are soaking up foreign currencies from the market and engaging in provocative actions there will be a heavy price for that.'' Earlier we got also some information from Turkey’s banking and market regulators that they had launched investigations into complaints related to a JP Morgan’s report which may have pushed the TRY so low. The report suggested shorting the Turkish lira in anticipation of the local elections’ outcome. The lira is bouncing 2.3% against the USD this morning being the best performing currency.

The USDTRY jumped on Friday but stalled just ahead of the important technical resistance at around 5.90. This level is also underpinned by the 38.2% retracement. The price is currently trading in the vicinity of another crucial technical level 5.585 which is supported by the 23.6% retracement. If the price manages to stay above this line, bulls could hope for the continued upward move. Source: xStation5

The USDTRY jumped on Friday but stalled just ahead of the important technical resistance at around 5.90. This level is also underpinned by the 38.2% retracement. The price is currently trading in the vicinity of another crucial technical level 5.585 which is supported by the 23.6% retracement. If the price manages to stay above this line, bulls could hope for the continued upward move. Source: xStation5

Equity markets drive lower

Deteriorated market sentiment pushed also equity markets in the US and Europe much lower and this has translated into Asian markets this morning. On Friday the NASDAQ (US100) plummeted as much as 2.5% while the SP500 (US500) moved down 1.9% and the Dow Jones (US30) fell 1.8%. As a result we are seeing massive falls in Asian markets this morning with the Japanese NIKKEI (JAP225) moving down as much as 3% (the Japan's stock market is back after holiday hence the move could understandably by larger compared to other markets). The Hang Seng is falling 2.4% while the Shanghai Composite (CHNComp) is going down 1.4%. Let us also remind that fears on Friday were additionally fuelled by the 3month/10year yield curve inversion for the first time since 2007. The move occurred following a tremendous decline in longer-date rates in anticipation of a possible recession. Moreover, short-date rates also moved down after the Fed scrapped the notion of higher rates this year. Instead, investors decided to purchase medium-term bonds with maturity ranging from 2Y to 7Y so the yield on these bonds fell. As a consequence, we have got the U-shaped curve.

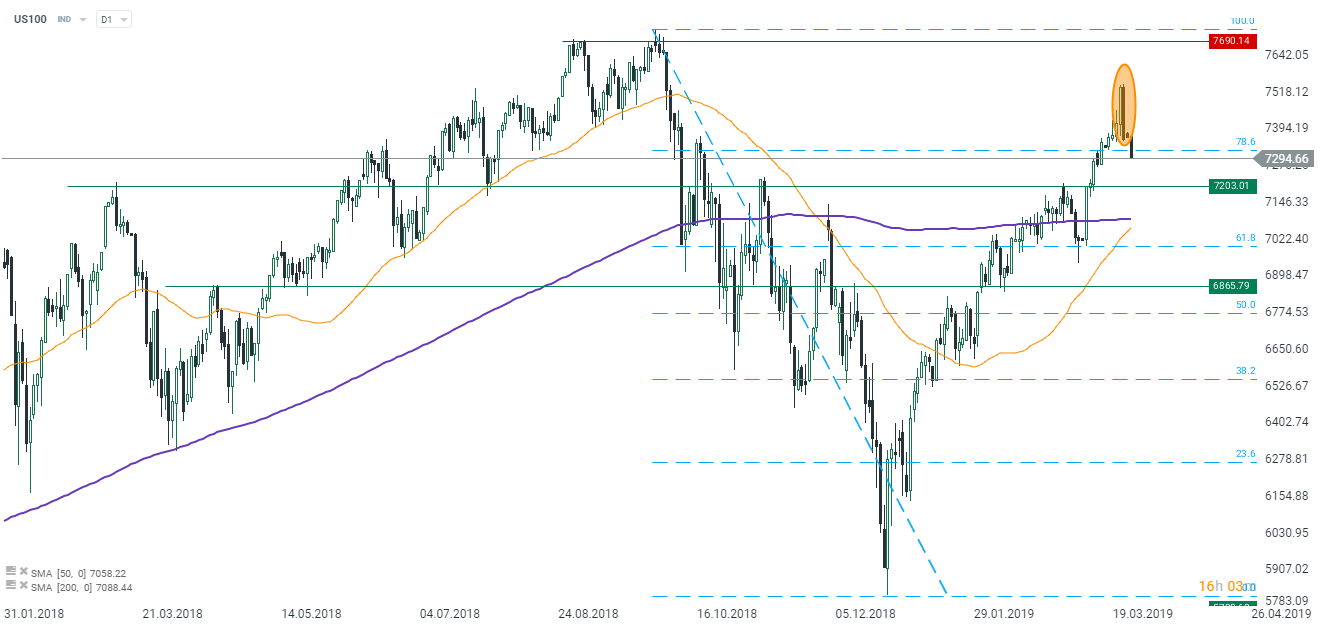

The NASDAQ (US100) drew a bearish engulfing on Friday. The price keeps on moving lower this morning. Source: xStation5

The NASDAQ (US100) drew a bearish engulfing on Friday. The price keeps on moving lower this morning. Source: xStation5

In the other news:

-

Prime Minister Theresa May may need to step down in order to get support of MPs for her Brexit deal, people familiar with the matter said

-

Fed’s Evans said the US economy was in a strong position but he did not expect a rate hike until the second half of 2020

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.