Summary:

-

UK CPI Y/Y: +1.7% vs +1.8% exp. +1.7% prior

-

Barnier and Boirs meeting in focus for GBP traders

-

GBPUSD remains close to 5-month high of $1.28

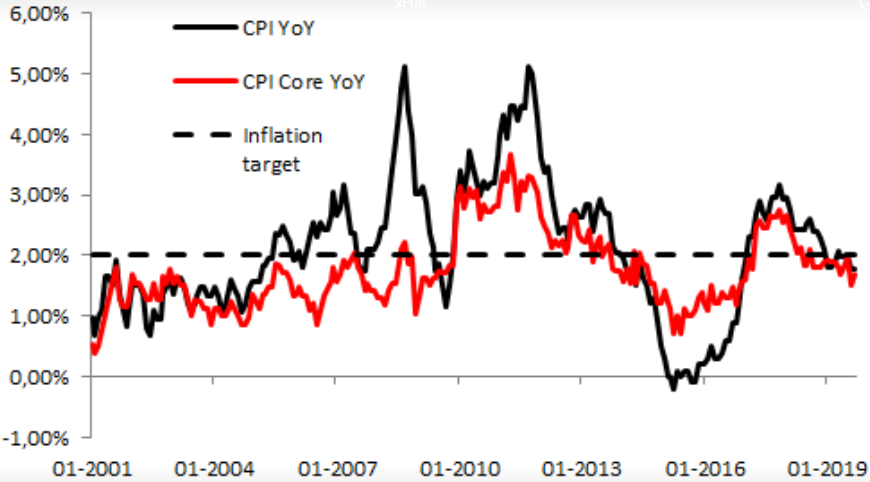

The current week is the busiest of the month as far as UK economic data is concerned, however this has been almost entirely overshadowed by the latest developments on the Brexit front. Inflation for September remained flat according to the most recent release, with the headline CPI Y/Y remaining at 1.7% despite an expectation for a small uptick. The core CPI Y/Y rose to 1.7% as was forecast but on the whole it seems that there has not been much change in inflationary pressures.

UK inflation has fallen back below the BoE’s 2% target in recent months but could be levelling of not far beneath the threshold. Source: XTB Macrobond

As has been the case for the past week or so, markets remain highly sensitive to Brexit headlines with several scheduled events throughout the day possible catalysts for sharp moves. This afternoon Barnier is set to brief EU ambassadors before Boris Johnson chairs a cabinet meeting and addresses the 1922 committee. At the moment we’re seeing pretty wild swings several times a day as comments from either side hit the news and this will likely continue into the weekend - and possibly beyond.

The tone of the latest remarks has been a little bit less optimistic on the whole with concerns growing that even if a deal can be reached it may not pass through parliament. While the latest Brexit situation remains in a state of flux, overall markets seem to remain fairly hopeful that a deal can be reached with the pound trading not far from its highest level against the US dollar since May which was made just yesterday.

GBPUSD rose to the $1.28 handle yesterday to trade at its highest level since May. The pair has rallied an incredible 600+ pips in less than a week on hopes that a Brexit deal will be secured. Source: xStation

GBPUSD rose to the $1.28 handle yesterday to trade at its highest level since May. The pair has rallied an incredible 600+ pips in less than a week on hopes that a Brexit deal will be secured. Source: xStation

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.