Summary:

-

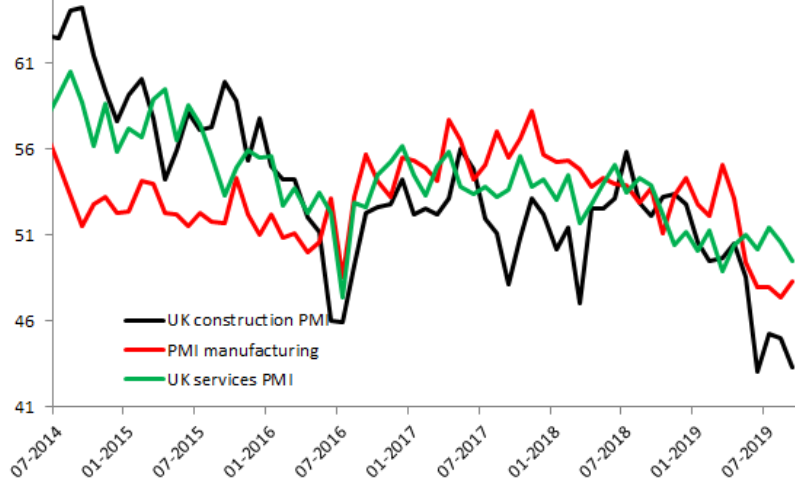

UK services PMI: 49.5 vs 50.3 exp. 50.6 prior

-

Reading hints at fair chance of technical recession

-

Minimal reaction in GBP however; far more interested in Brexit

The most recent look at the service sector has raised some serious concerns about the health of the industry with the PMI reading for September falling below the 50 mark and into contractionary territory. Coming shortly after weak readings from the manufacturing and construction sector this data makes it a triple whammy of bad news for the UK economy is as many days and points to a GDP fall of 0.1% in Q3. Should this occur then the UK would enter a technical recession under the widely held definition of two consecutive quarters of negative growth - and that’s before we’ve even got that close to the current October 31st deadline for leaving the EU.

The PMI readings from the UK make for pretty grim viewing with the only bright spot lately coming from manufacturing which has been artificially propped up from contingency measures surrounding Brexit. Source: XTB Macrobond

Earlier the equivalent releases from across Europe on the whole came in worse than expected with German, French and Euro-wide services PMIs all missing forecasts. This afternoon we get the leading industry survey on the US service sector and this could have further reaching implications than just for US assets.

Some fairly small scale selling was seen in the pound since the data dropped and a tick higher in UK bonds proved short lived and traders remains far more interested in the latest developments on the Brexit front. EURGBP is back near the prior resistance level around 0.8914 which also broadly coincides with the 23.6% fib retracement of the recent declines. Source: xStation

A disastrous reading on Tuesday from the ISM manufacturing release sent global stocks into a tailspin with the indicator falling to its lowest level in a decade and raising serious doubts about the notion that the world’s largest economy is holding up relatively well against a backdrop of slowing global growth. Another disappointment later would ratchet up these concerns further and with the concerns on the trade front growing once more after Trump’s administration announced plans to impose 25% tariffs on a wide range of EU imports, risk sentiment is clearly vulnerable at present.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.