Summary:

-

More gains for UK100 and GBP

-

Did Draghi cause the reversal after ECB?

-

Double bottom forming in EURUSD

Compared to last week, the current one has been less eventful on the Brexit front, with UK assets stabilising as the heightened drama subsides a little - at least for the time being. The pound is the best performing G10 currency once more, making the largest gains against the Japanese yen, and with talk of a possible compromise on the backstop that would cover just Northern Ireland the prospects of an agreement are improving slightly once more. The FTSE is also set for another weekly gain, with the leading UK benchmark looking to make it 3 in a row. The mining sector has been one of the main contributors to the gains, with Glencore and Antofagasta both rising as positive news on the US-China trade front has boosted sentiment.

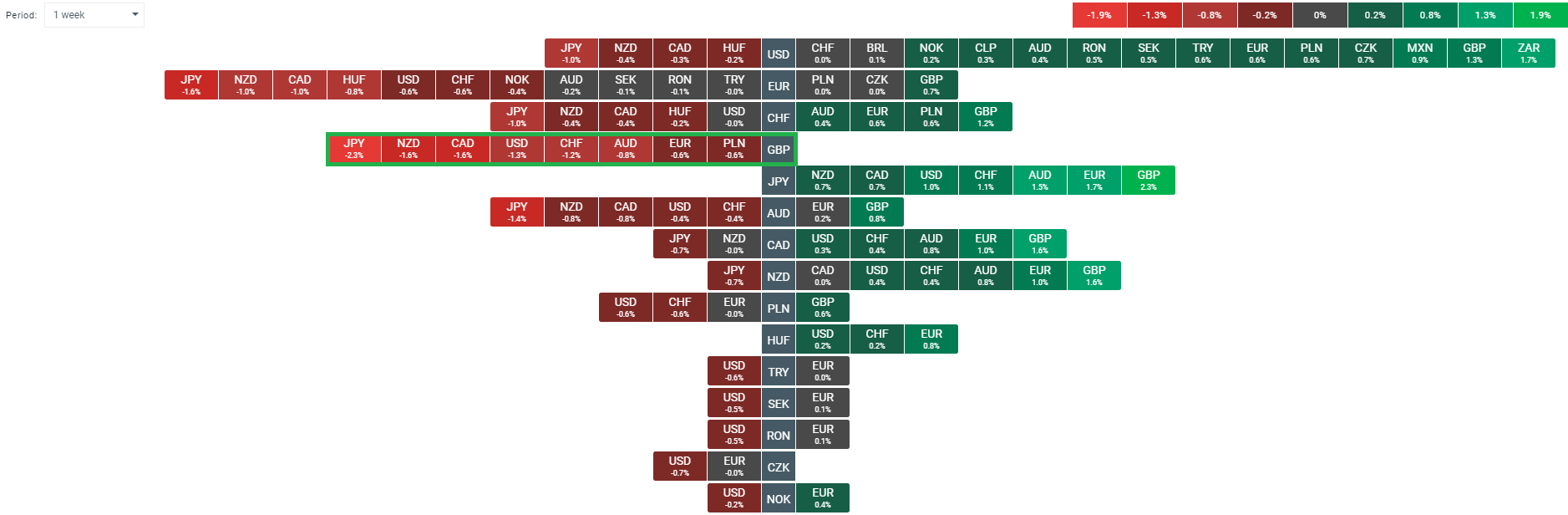

The pound is rising once more with gains seen on the week across the board. The largest appreciation can be seen against the JPY and NZD. Source: xStation

Picking the bones out the ECB announcement

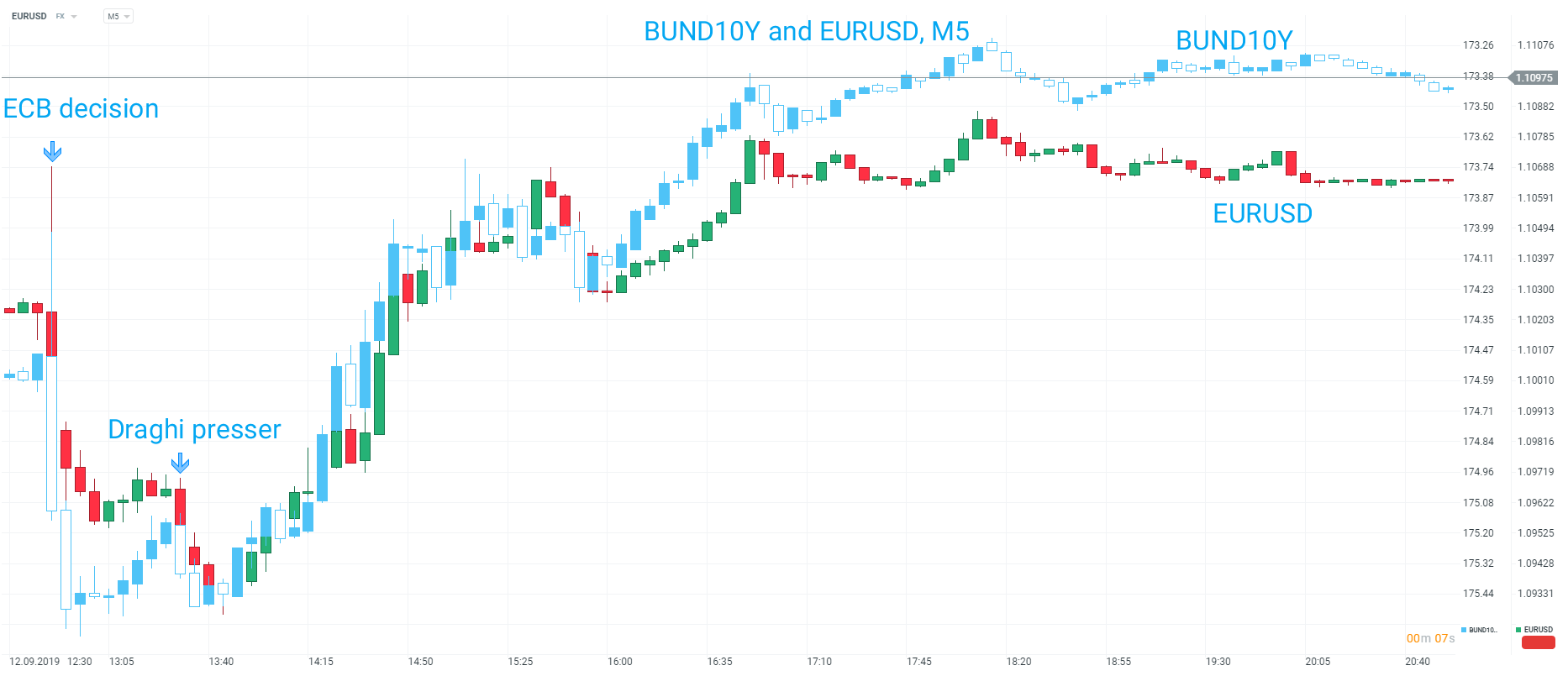

Thursday’s ECB meeting was one of the most eagerly anticipated events of the year and it didn’t fail to deliver with volatile moves seen across several asset classes. The central bank unveiled a large-scale stimulus package that was broadly in keeping with market expectations - while the size of the QE at €20B/month was less than expected this was more than offset by the term being described as indefinite, after most had expected a fixed programme of 9-12 months - and the initial reaction was what one would expect after another “Draghi bazooka”, as stocks and bonds soared while the Euro tumbled. However, these moves reversed during the Draghi press conference 45 minutes after the initial announcement and while this could be attributed to a simple buy-the-fact-sell-the-rumour type of move there were 3 points from the presser which could be attributed to causing the reversal.

Firstly, Draghi was decidedly vague when asked during the Q&A session whether the decision was unanimous, with his reluctance to state that it was seen by many as an admittance that the package wasn’t supported by all the Governing Council (GC). When pressed on the unanimity of the decision, Dragih also revealed a second point by stating that one thing the GC were unanimous on was the need for a fiscal stimulus package to support the newly announced monetary one. ECB members have hinted at this several times before but this is the most explicit statement yet on this front and could be seen to ramp up the pressure to act. This sort of package would be clearly positive for growth and bond yields began to recover, leading to a recovery in the Euro.

The initial moves in German 10 year bonds and the EURUSD reversed with yields rising sharply during the Draghi press conference and leading a recovery in the single currency. Note the Bund10Y axis is inverted so rising candles indicate lower prices and higher yields. Source: xStation

One final factor which may have played a role was a comment from Draghi that there would be no immediate changes to the capital key, meaning that once the QE programme starts in November the assets purchased will be a similar mix to the last iteration. This could be seen to bring into question the “QE to infinity” narrative as without a relaxation on the rules that govern which assets can be purchased there are limits to the size of the new stimulus measures. This will now become a problem for his successor, Christine Lagarde, which will not be particularly welcomed given the controversy associated with purchasing corporate bonds and possibly even stock ETFs.

All of these potential factors weren’t too obvious at the time and have only come to light with the benefit of hindsight, but the most important thing to note is the price action. Whether these factors are decisive or whether it was simply a buy-the-rumour-sell-the-fact type of move is almost besides the point with the key thing to focus on being that, as the dust settles, bond yields are notably higher along with the single currency. Looking at the EURUSD pair the market has potentially made a double bottom around 1.0925 and as long as this level which now becomes a potentially key support remains intact then a recovery could well lie ahead.

A potential double bottom is forming around 1.0925 in the EURUSD with a bullish hammer printed on D1 after the ECB decision. Positive divergence also seen on MACD. Source: xStation

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.