Summary:

- DOE inventories: +5.8M vs -3.4M exp and -12.6M prior

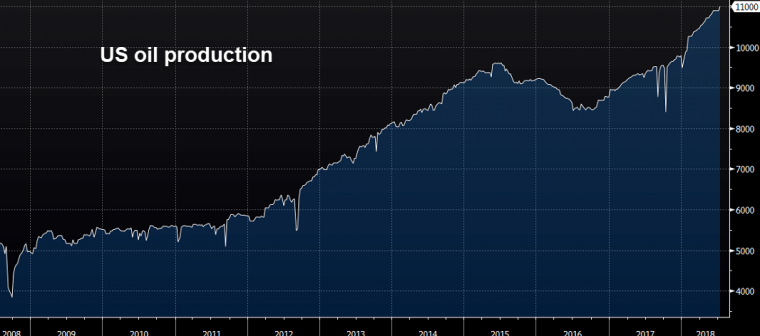

- US oil production hits 11M

- Oil dips lower but finds some buyers near 3-month lows

The weekly DOE inventories has thrown up some surprising releases of late, and this afternoon’s didn’t disappoint with an unexpectedly large build. As well as the sharp increase in US stockpiles the US production topped 11M to set another record high, but despite some initial selling the price of Oil has found some buyers stepping in near its lowest level in since April.

Looking at the release itself, the reading of +5.8M marked a sharp beat on the -3.4M expected and comes after last week saw a decline of 12.6M. Last night’s API showed a rise of 0.6M. The print itself is the joint highest since the beginning of May and could be seen to suggest that the recent run of declines, with 4 of the past 5 releases showing sizable drops, may be coming to an end. As well as the headline print there was the following readings int he components, written int he form of actual vs expected:

- Distillate: -0.4M vs +1.2M

- Cushing: -0.9M vs -2.1M (prior)

- Gasoline: -3.2M vs -0.7M

These readings could be seen as mildly supportive of price with some larger than expected drops, but they pale into significance compared tot he headline really. Furthermore, US oil production increased further, hitting the 11M mark to extend the gains seen in recent years.

US Oil production extended its uptrend and breached the 11M mark last week. Source: Bloomberg

Overall there’s little to get excited about here for Oil bulls, although the price has jumped markedly higher since the release. These gains given the seemingly negative data could be seen as telling, with the last hours trade producing a large bullish engulfing candle. The lows around 71.20 could now be seen as important support with price presently testing the recent highs around 72.30.

Oil has jumped around 100 ticks since making a low of 71.23 just after the release. The positive reaction is surprising given the data itself and may reveal an underlying strength that the recent declines are over. Source: xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.