- Revenues reached USD 113.2 billion, and adjusted EPS was USD 2.92, exceeding analyst expectations.

- The Medicare Advantage segment and the expanding role of Optum drive revenue growth and operating margins.

- Despite a year-to-date stock decline of approximately 40 percent, the company’s financial and operational fundamentals indicate the potential for gradual stock recovery.

- Revenues reached USD 113.2 billion, and adjusted EPS was USD 2.92, exceeding analyst expectations.

- The Medicare Advantage segment and the expanding role of Optum drive revenue growth and operating margins.

- Despite a year-to-date stock decline of approximately 40 percent, the company’s financial and operational fundamentals indicate the potential for gradual stock recovery.

UnitedHealth Group Q3 2025 Results

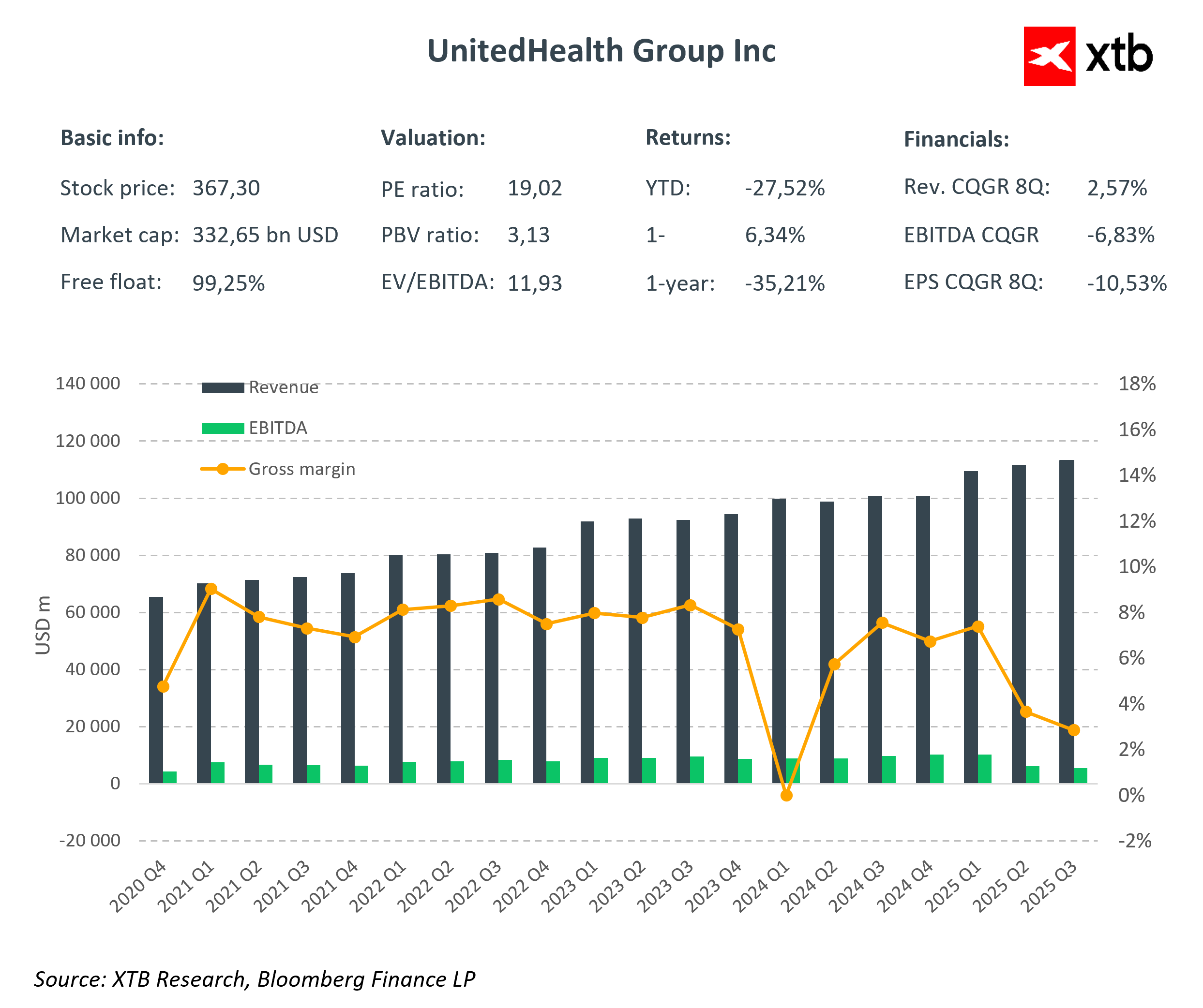

UnitedHealth Group once again confirmed its leading position in the health insurance and medical services sector, delivering results well above market expectations. Despite cost pressures and regulatory changes, the company continues to maintain stable growth and high profitability.

Financial Results

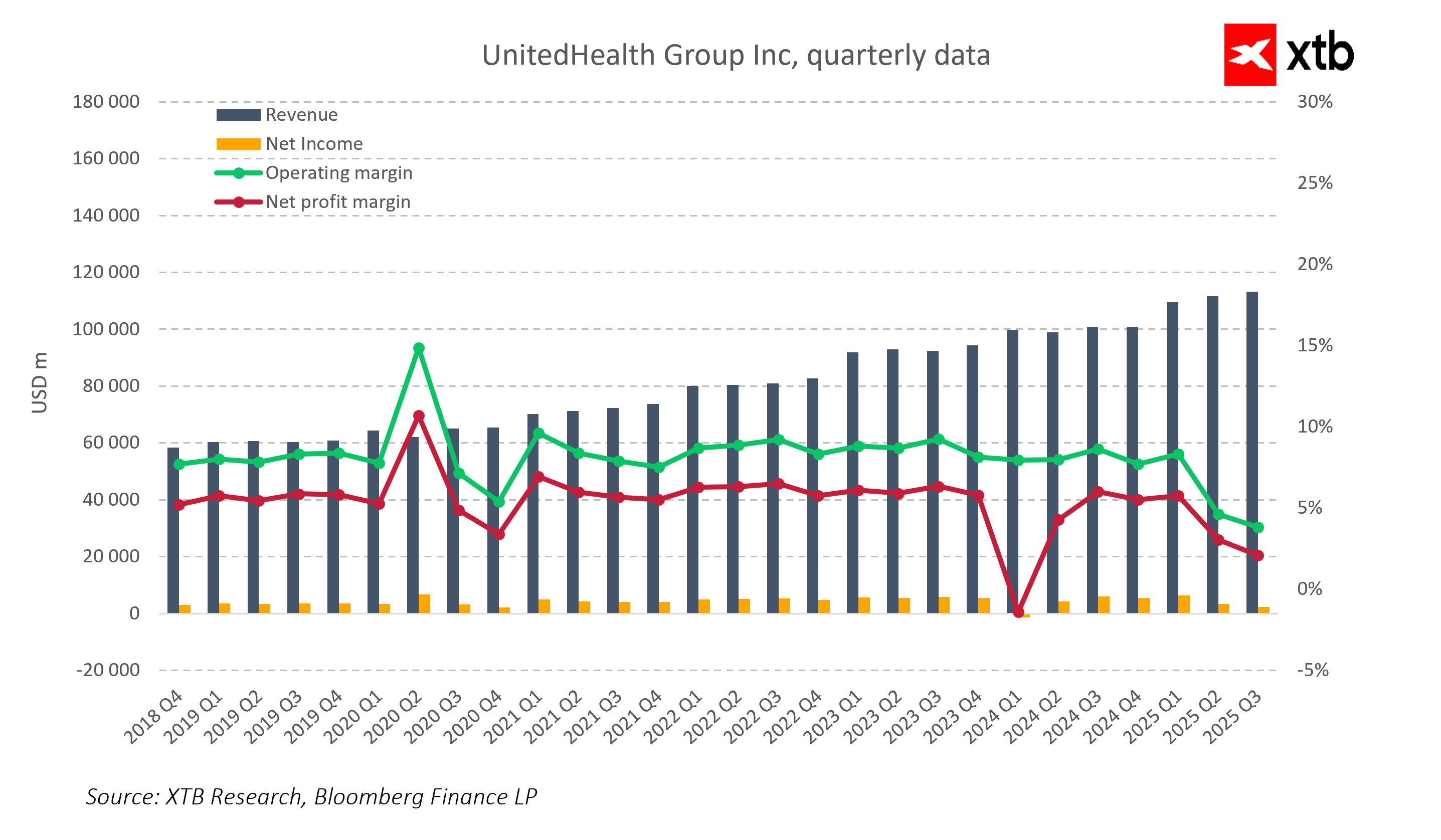

In Q3 2025, UnitedHealth generated revenues of USD 113.2 billion, representing a 12 percent year-on-year increase. The UnitedHealthcare segment recorded revenues of USD 87.1 billion, up 16 percent year-on-year. Growth was driven primarily by the Medicare & Retirement and Community & State programs, which increased membership and strengthened the company’s market position.

The Optum segment also saw solid growth, with revenues rising 8 percent to USD 69.2 billion. Optum Rx, responsible for pharmacy benefits management, performed particularly well, increasing revenues by 16 percent to USD 39.7 billion due to growing prescription demand and integrated healthcare services. Optum Health maintained stable revenues at USD 25.9 billion, demonstrating the resilience of the company’s operating model in a volatile market.

Earnings per share (EPS) stood at USD 2.59, while adjusted EPS reached USD 2.92, surpassing the analyst consensus of USD 2.79. The medical loss ratio (MLR) remained at 89.9 percent, and the net margin was 2.1 percent. Operating cash flow reached USD 5.9 billion, more than double the net income.

Notably, UnitedHealth raised its full-year 2025 adjusted EPS guidance to at least USD 16.25 per share, up from the previous forecast of USD 16.00.

Medicare Advantage Segment

The Medicare Advantage segment remains a key driver of UnitedHealth’s growth. In Q3, membership in these plans increased, significantly boosting UnitedHealthcare’s revenues. The rising popularity of Medicare Advantage plans stems from their advantages over traditional Medicare, including better care coordination, broader service coverage, and more favorable financial terms.

The company continues to invest in service quality improvements and process digitization, enabling cost control and maintaining stable margins. High plan quality ratings, known as Star Ratings, further enhance competitiveness and UnitedHealth’s market position.

Market Reaction and Stock Context

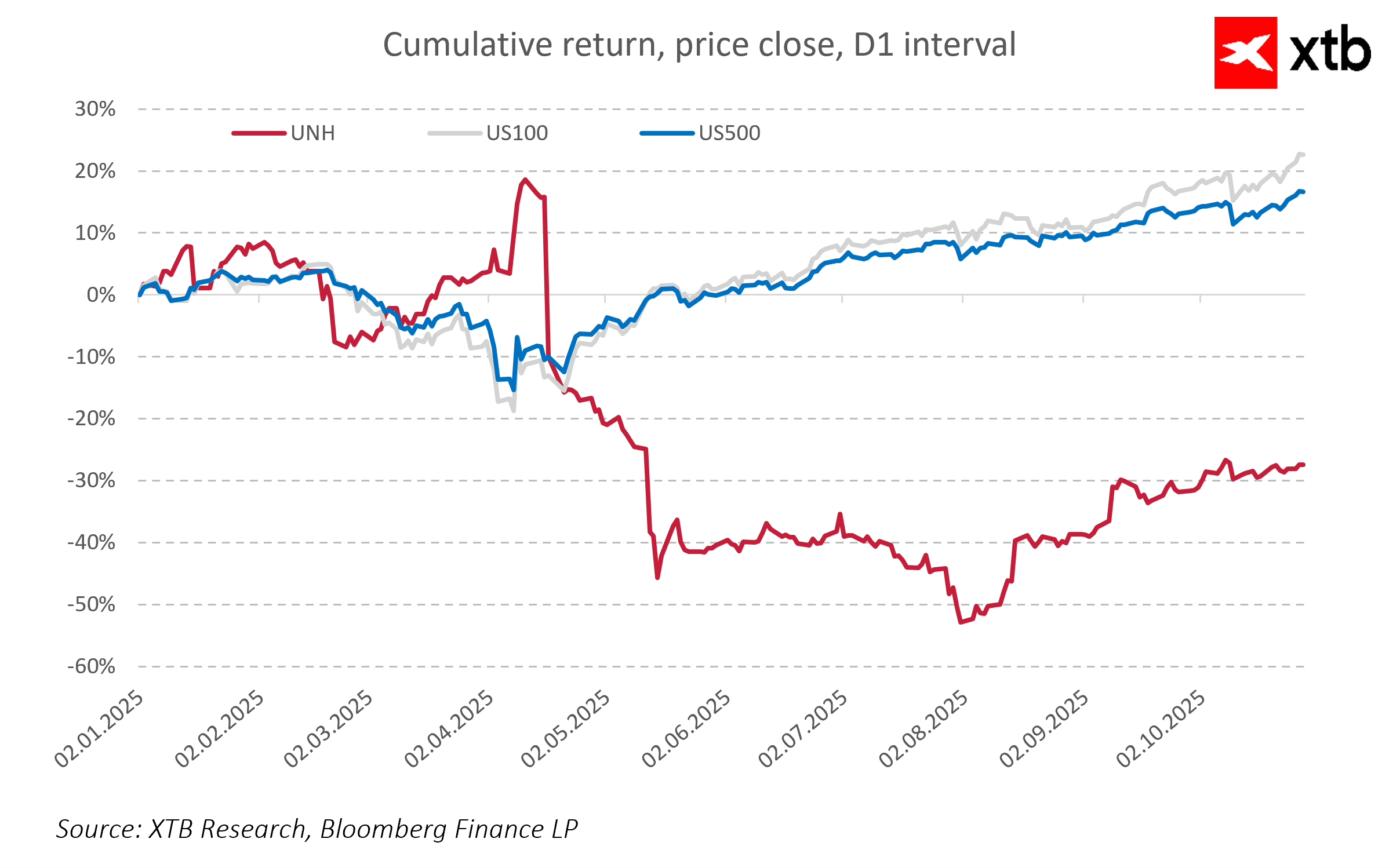

The EPS guidance raise triggered a positive market reaction, with UnitedHealth shares rising more than 4 percent in early trading. After the initial surge, the stock retraced slightly.

Despite this short-term improvement, year-to-date performance remains significantly weaker than the broader market. Since the beginning of 2025, UNH shares have fallen approximately 30 percent, while the S&P 500 has gained over 15 percent. The decline reflected concerns over rising medical costs, regulatory uncertainty, and changes to the Medicare program.

However, the company’s fundamentals are beginning to stabilize and improve. Steady growth in UnitedHealthcare and Optum, cost control, and rising demand for Medicare Advantage plans suggest operational recovery. Analysts emphasize that the high-quality customer base, Optum’s efficiency, and a strong balance sheet could support gradual stock price recovery in the coming quarters.

Summary

Q3 2025 results confirm the resilience and effectiveness of UnitedHealth’s business model. The company is able to generate profits even in a challenging market environment. The growing contribution of the Optum segment, UnitedHealthcare’s stability, and the positive momentum in Medicare Advantage provide a foundation for further growth and stock price recovery in the coming months.

Daily Summary: Markets curb daily gains; Iran to use mines in the Strait of Hormuz🚨❓

📈US100 bounces back above the 100-day EMA

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.