- Palantir: priced for perfection, but can its Q3 results deliver the expected goods?

- The mayoral elections should not impact stock prices, but there could be a mini wobble for NYC- headquartered companies if Mamdani wins a big majority

- ADP is the new NFP

- Palantir: priced for perfection, but can its Q3 results deliver the expected goods?

- The mayoral elections should not impact stock prices, but there could be a mini wobble for NYC- headquartered companies if Mamdani wins a big majority

- ADP is the new NFP

US stocks have had a strong start to November. The Nasdaq is higher by more than 1% today, led by Netflix, Apple, Amazon and Tesla, and nearly two thirds of the Nasdaq are posting gains on Monday. There are multiple factors driving positive sentiment towards the US markets right now, including easing trade tensions between the US and China, M&A deals specifically in the tech sector, and seasonality. November tends to be a strong month for stocks. The focus for investors will be on whether the US indices can play catch up, as on a YTD basis they are underperforming the likes of Japan, Spain and Germany.

This is another big week for the US, which could have big ramifications for stocks. Below, we take a closer look at three events that could determine where markets go next.

1, Palantir results

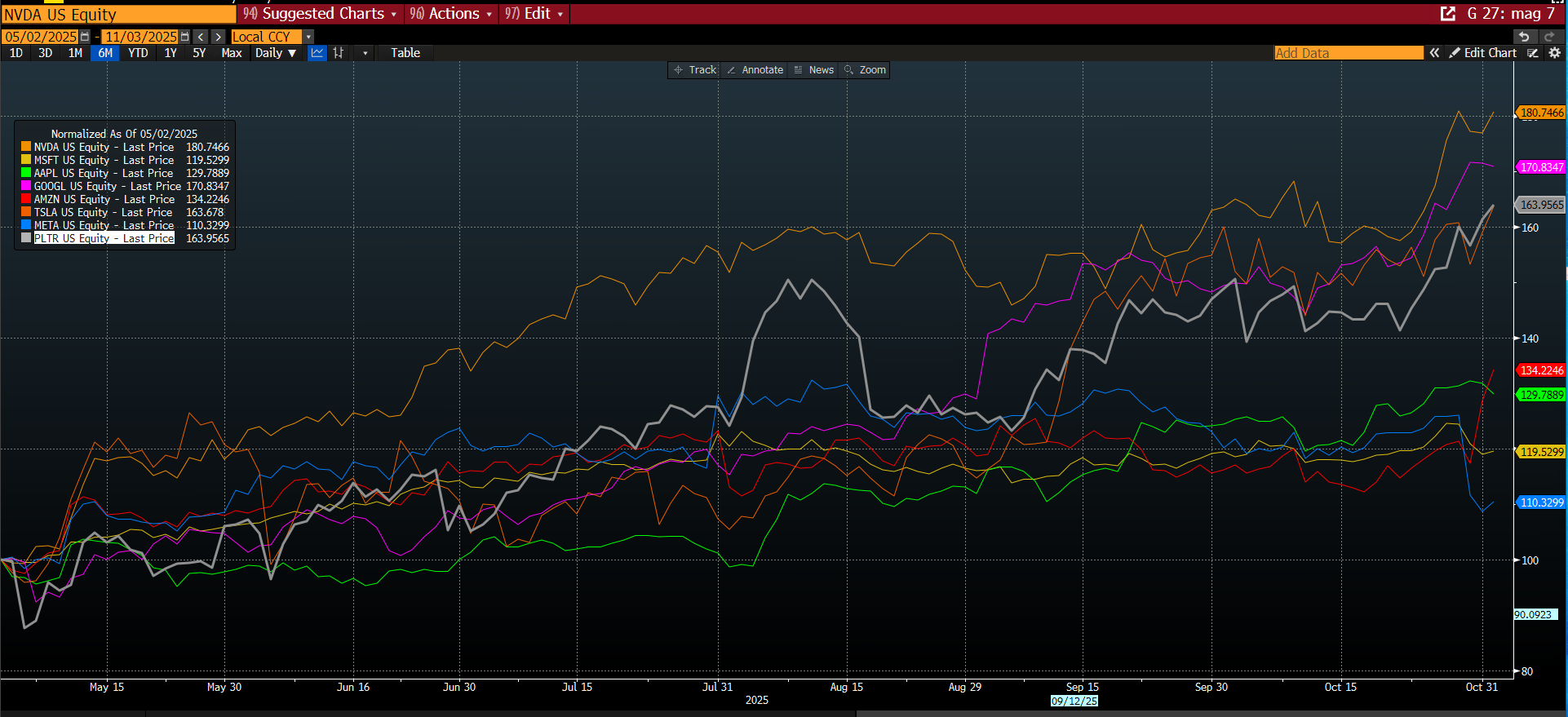

The AI and data management firm will report earnings after the close later this evening. Palantir is not one of the magnificent 7, however, its stock price has kept pace with the top performers in the Magnificent 7, as you can see below. This is even though Palantir is a fraction of the size of the big tech giants in the US.

The stock price is higher by more than 160% so far this year, and it rose by nearly 10% last week alone. Arguably, the stock is priced for perfection, so tonight’s earnings report needs to be flawless to trigger further upside for this stock. It is worth noting that this stock is also very volatile around earnings reports. For instance, the average price move the day after results is 14.2%, based on the last 8 quarters.

Digging into the details a bit more closely, the market expects $1.09bn of revenue for last quarter, which is a 31% YoY growth rate. Net income is expected to come in at $433mn, which is 26% higher than a year ago, and revenues and net income are expected to rise compared to Q2.

The market will be focusing on Palantir’s large language model capabilities, which is seen as vital for future growth. The company has an ambitious target of $10bn in revenue without significantly increasing its workforce. The US government is an important customer for Palantir, and analysts expect robust government sales due to strong defense spending in the US and elsewhere. There has been a 25% increase in sales estimated for 2025, so to propel the stock price further more positive commentary from the company is needed, especially around the strength of future contracts and revenue possibilities.

Palantir is important for the tech sector, even though it is not part of the Magnificent 7. It is experiencing a rapid period of growth, and it is the poster boy for a future powered by Artificial Intelligence. Thus, a strong earnings report may be necessary to feed another leg higher in the tech trade and in US stock indices more generally.

Chart 1: Magnificent 7 and Palantir (grey line)

Source: XTB and Bloomberg

2, New York Mayoral elections

The New York mayoral elections take place on 4th November, and right now Polymarket is predicting a win for social democrat Zohran Mamdani at 94%. Early voting in New York closed on Monday and the initial numbers show the highest early voting turnout for a non-presidential election in the city. The latest poll from the Manhattan Institute has Mamdani up 15% points over his closest rival Andrew Cuomo.

Interestingly, although some key figures in Wall Street have warned about Mamdani due to his progressive leftist agenda, there is hope that he will moderate his positions once in office. Some of his plans include hiking taxes on the wealthiest, raising corporation tax, and imposing rent controls.

The impact on financial markets from this election is hard to gauge, since New York is one state. Added to this, if Mamdani does impose his agenda in full, then companies could leave the city and move to other states that have more tax-friendly policies. While this would lead to some disruption to personnel, it is likely to be neutral for share prices.

Some of the biggest names in finance are headquartered in New York, including JP Morgan, Goldman Sachs, American Express, and Citi. Other firms based there include Pfizer, Verizon and AIG. So far, these companies have not seen any noticeable decline in their share prices based on the mayoral elections. For example, JP Morgan’s share price is higher by nearly 30% so far this year, and it rose by 2.5% last week. Pfizer has had a tough experience this year and its share price is lower by 8% YTD, however, that is due to weak earnings and uncertainty caused by President Trump’s tariff policies, rather than who will be the next NY mayor.

However, a shock defeat for Mamdani could trigger a short relief rally for the NYC-based firms included in the S&P 500, but we think this is a low probability event.

3, Labour Market: ADP is the new NFP

Since the US government is still shut down, there won’t be an October jobs report. This means that other non -government produced economic reports will take on greater significance. For example, Wednesday’s ADP report. Although the ADP report is not traditionally considered to have a strong correlation with the NFP report, the market will likely react to it on Wednesday.

The market expects the ADP report to show a 35k increase in private sector payrolls, which is low, but better than the 32k decrease in September. A weak outlook for the jobs market is not necessarily bad for the stock market since it could trigger a rush to reprice a rate cut from the Federal Reserve in December. Currently there is a 67% chance of a cut next month priced in by the Fed Fund Futures market. Since last week’s FOMC meeting, there has been a scaling back of rate cut hopes for December after Fed chair Powell pushed back on the chance of another cut at the end of the year. This helped to drive a recovery in the USD last week. Thus, a repricing g of Fed rate cut expectations could trigger some volatility in the FX market in the coming days.

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Join NFP Live Now

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.