Summary:

-

US stock markets called to open higher with US100 the biggest gainer

-

Indices remain in consolidation mode after recent declines

-

Several more blue-chips deliver latest results

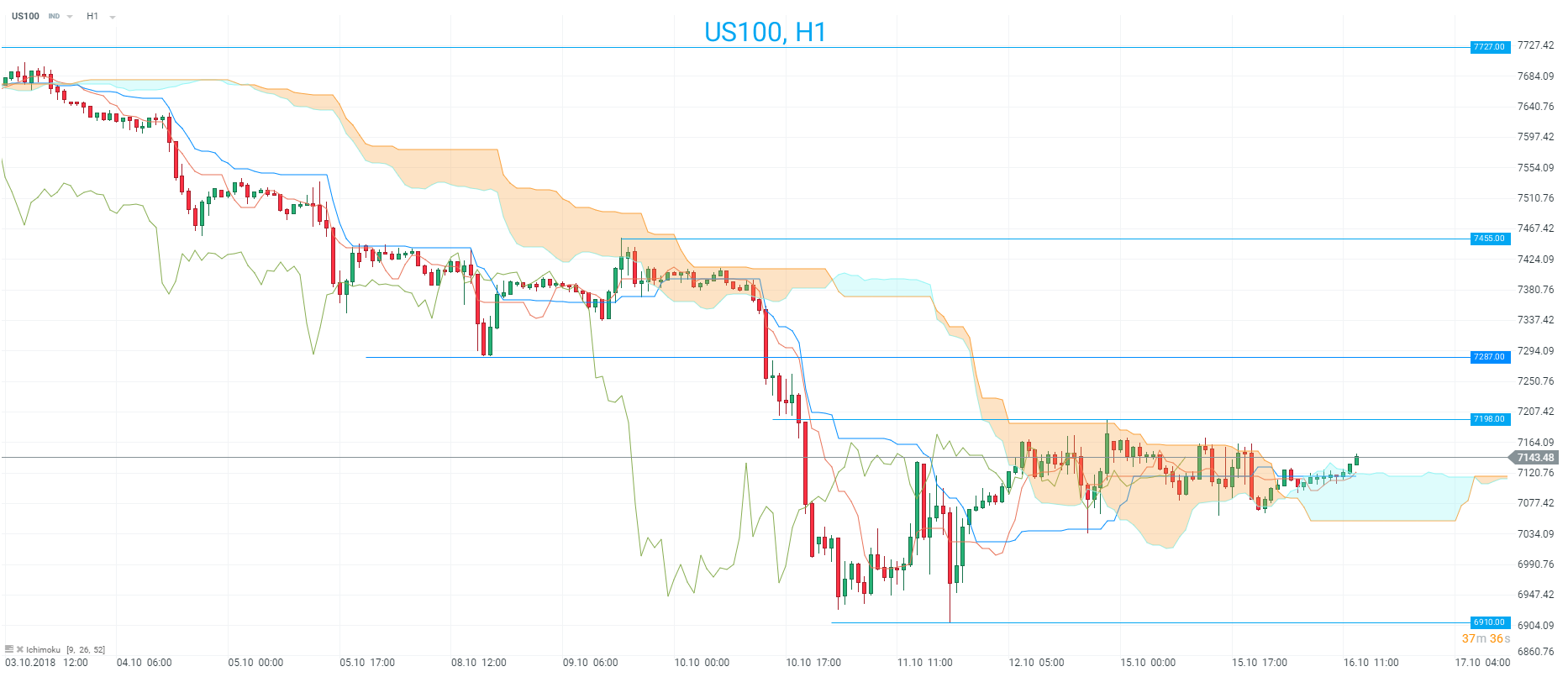

The North American session looks set to start on the front foot for stock markets, with sizable gains seen throughout Europe this morning boosting sentiment and increasing hopes of a recovery. All the major US indices are in the green at the time of writing with the tech focused US100 the biggest gainer and higher by around 1% on last night’s close. Price has breached the H1 cloud to the upside in recent trade, but a break above prior resistance around 7198 is needed before a larger rally can occur with 7287 the next level to look to if it does. 7287 was previously support and a break below there last week preceded the large sell-off down to a low of 6910.

The US100 has broken above the cloud on H1 and in doing so potentially changed its short term trend. However, a break above 7198 is needed before a larger rally can occur. Source: xStation

Earnings season stateside is now in full swing with several more large companies reporting today ahead of the opening bell. The following results are shown in terms of EPS vs expected with the pre-market move indicated in parenthesis:

Morgan Stanley: $1.17 vs $1.01 (+2.6%)

Goldman Sachs: $6.28 vs $5.38 ( +1.5%)

Johnson & Johnson: $2.05 vs $2.03 (+0.05%)

Blackrock: $7.52 vs $6.84 (-3.0%)

Summarising the results it looks like more pleasing figures from the banks with Morgan Stanley and Goldman Sachs both comfortably beating forecasts. One blot on the Goldman report was that it appears the fixed income slimp has resumed with revenues falling 10% Y/Y but this negativity was outweighed by a strong performance at the investment banking arm. There’s not much doing with Johnson & Johnson on the whole with the update solid but pretty much in line with market expectations. The initial reaction in Blackrock is interesting with the world’s largest asset manager beating on the bottom line but seeing an adverse market reaction. Comments from CEO Larry Fink on CNBC could be the cause for the move after he stated that the firm saw massive outflows before last week’s 4% drop in the S&P500. There's a huge commentary that we are at peak earnings," Fink said, adding that commentary is debatable, and the firm expects "we have a couple more good quarters." Its revenue of $3.576 billion fell short of a $3.648 billion forecast. Sales from BlackRock's advisory, administration and lending business hit $2.88 billion, below a StreetAccount estimate of $2.97 billion.

Goldman Sachs shares ended yesterday close to key longer term support around 210. The better results have seen the stock called to open higher and as long as this level isn’t breached then some of the recent declines may be recouped. Source: xStation

Goldman Sachs shares ended yesterday close to key longer term support around 210. The better results have seen the stock called to open higher and as long as this level isn’t breached then some of the recent declines may be recouped. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.