Inflation surprised to the upside in March when it came out at 2.6% y/y but the markets ignored the data amid soothing comments from the FOMC. This time the market consensus is already at 3.6%. What if actual inflation is even higher? To what extend can the Fed keep ignoring it?

The narrative from the Fed is simple – inflation spike is transitory and is mainly a result of very low level from a year ago. Indeed a spike of inflation in March was driven mainly by fuel costs – 0.7pp in transport alone (so without this, inflation would be 1.9%) and this will get much worse today as fuels lowered inflation in April 2020 by 1.2pp!

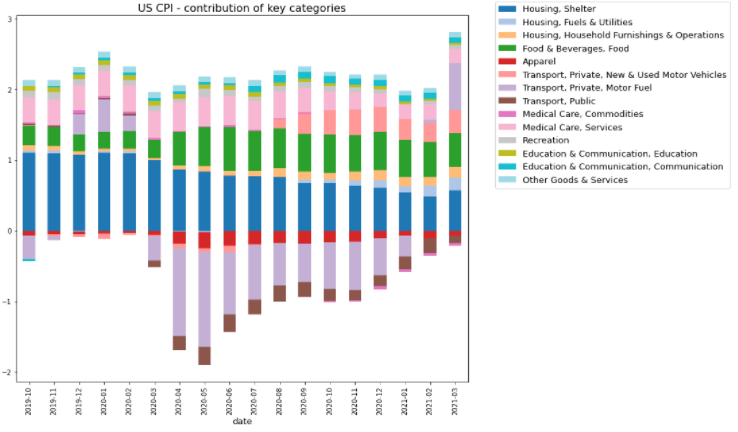

Pick up of inflation in March was mainly a result of higher fuel prices while other categories will tell us more on the seriousness of the inflation pressure. Source: Macrobond, XTB Research

Pick up of inflation in March was mainly a result of higher fuel prices while other categories will tell us more on the seriousness of the inflation pressure. Source: Macrobond, XTB Research

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

The question is, to what extend will other categories contribute? In March there were no clear signs of a broad inflation pressure. Used cars was the only category outside fuels that saw outsized contribution (which will be probably much higher today). This broad inflation needs to be seen before the Fed actually reacts in any way.

Market reaction is another thing. If the Fed was officially worried about inflation, higher reading would have obvious ramifications. But because the Fed maintains it’s transitory, inflation would need to be probably much above expectations (perhaps above 4%) to spook the markets.

US100 has actually stabilized after a sell-off. This is the market that can react the most directly to the CPI release. Source: XTB Trading Platform

US100 has actually stabilized after a sell-off. This is the market that can react the most directly to the CPI release. Source: XTB Trading Platform

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Markets attempt to rally on positive news from Iran

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.