- US stocks open higher

- US home price growth slowed in August- S&P Case-Shiller

- Facebook (FB.US) stock rises despite mixed quarterly results

US indices launched today's session higher, with the Dow Jones and the S&P 500 extending record highs, as another set of upbeat corporate results lifted market sentiment. Earnings from 3M, UPS and General Electric beat analysts’ estimates while Eli Lilly raised its full-year forecasts. Meanwhile, Microsoft, Twitter and Alphabet will release their quarterly earnings after the closing bell. On the data front, the S&P CoreLogic Case-Shiller 20-city home price index increased 19.7% yoy in August, slightly below a record 20% rate in the previous month and compared to forecasts of 20%. There are signs that price growth could be cooling off in the otherside red-hot housing market, according to S&P Case-Shiller.

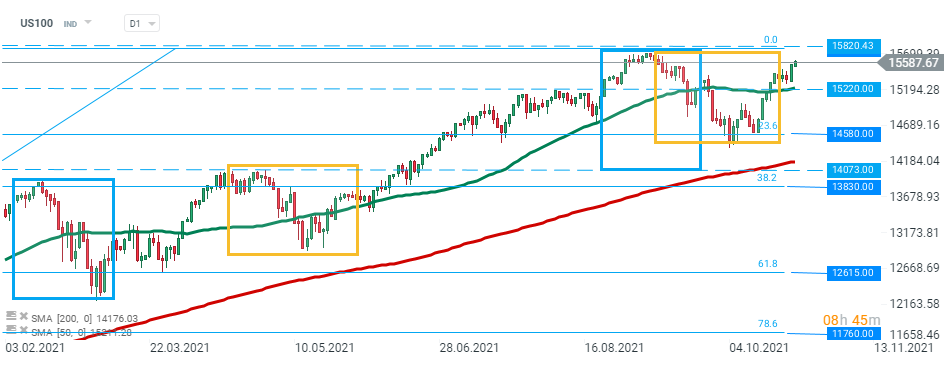

US100 launched today’s session higher and is approaching all-time high at 15,820 pts which coincides with the upper limit of the 1:1 structure. However if sellers manage to halt advances, then another downward impulse towards support at 15220 pts may be launched. Source: xStation5

US100 launched today’s session higher and is approaching all-time high at 15,820 pts which coincides with the upper limit of the 1:1 structure. However if sellers manage to halt advances, then another downward impulse towards support at 15220 pts may be launched. Source: xStation5

Company news:

Facebook (FB.US) stock rose 1.9% in the premarket after the social media giant posted mixed quarterly figures. In the second quarter. company earned $3.22 per share, slightly above analysts' estimates of $3.19 per share, however revenue came in below market estimates as ad sales growth slowed in the face of Apple’s (AAPL.US) new privacy restrictions. Number of daily active users reached 1.93 billion, in-line with expectations, while average revenue per user reached $10.00 (exp. $10.15). Company announced a $50 billion boost to its buyback program.

Facebook (FB.US) stock has experienced a bigger downward correction recently, however buyers managed to halt declines around major support zone at $325.00, which coincides with 23.6% Fibonacci retracement of the upward wave launched back in March 2020, lower limit of the 1:1 structure and 200 SMA (red line). As long as the price sits above this zone, another upward impulse towards all-time high at $385.00 may be launched. On the other hand, if sellers will manage to break lower, then downward move may accelerate towards support at $290.00. Source: xStation5

Facebook (FB.US) stock has experienced a bigger downward correction recently, however buyers managed to halt declines around major support zone at $325.00, which coincides with 23.6% Fibonacci retracement of the upward wave launched back in March 2020, lower limit of the 1:1 structure and 200 SMA (red line). As long as the price sits above this zone, another upward impulse towards all-time high at $385.00 may be launched. On the other hand, if sellers will manage to break lower, then downward move may accelerate towards support at $290.00. Source: xStation5

Uber (UBER.US) stock rose 0.5% in premarket after the ride-hailing company agreed to launch a new rapid grocery delivery service in Paris with Carrefour (CA.FR), Europe’s largest retailer.

Tesla (TSLA.US) stock rose 3% in premarket after the company passed the $1 trillion dollar mark in value during Monday’s trading.

General Electric (GE.US) stock rose more than 15% in premarket after the company posted mixed quarterly figures. General electric earned 57 cents per share well above analysts’ estimates of 43 cents per share. On the other hand, revenue figures disappointed investors. The company also reported better-than-expected free cash flow.

Verizon (VZ.US) is partnering with Amazon (AMZN.US) to use the satellite internet system the tech giant is developing to expand rural broadband access in the United States.“We’re proud to be working together to explore bringing fast, reliable broadband to the customers and communities who need it most,” Amazon CEO Andy Jassy said.

United Parcel Service (UPS.US) stock jumped 5% in the premarket after the company posted strong quarterly results. UPS earned $2.71 per share, 16 cents a share above estimates. Revenue also beat market estimates on strong e-commerce demand.

Coinbase (COIN.US) stock rose over 1.0% in premarket after Citigroup initiated coverage on the cryptocurrency exchange with a ‘buy’ rating, saying it offers significant upside for investors looking for exposure to the asset class.

NVIDIA Beats Expectations: The AI Powerhouse Saving the Future

Daily Summary: Market attempts recovery, all hope in Nvidia

Constellation Energy and Three Mile Island — Nuclear Past and Future

US100 gains 1% before Nvidia earnings📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.