- Indices try to recover from yesterday's sharp sell-off before the Fed makes a key decision

- The Fed is expected to raise interest rates by 25 basis points, but will announce the end of the rate hike cycle

- Regional bank stocks continue their sell-off following JP Morgan's acquisition of First Republic Bank. Western Alliance and PacWest Bancorp lost the most

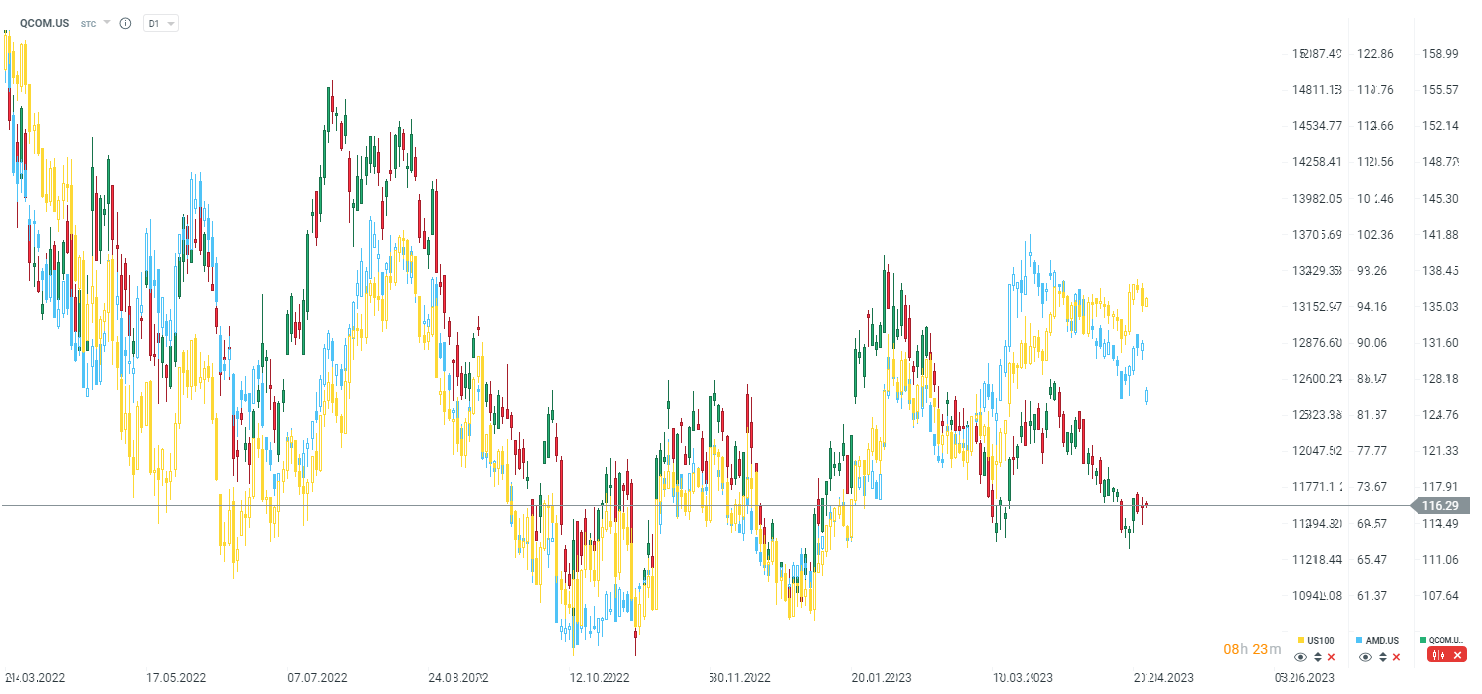

- Today after the session on Wall Street: results of the chip company Qualcomm. Expectations are mixed, not only because of the weakness of AMD stock after yesterday’s results

- Starbucks lost in after-hours trading, despite good results, but because it did not improve its full-year 2023 guidance

The most important event today is undoubtedly the Fed's interest rate decision. The Fed is expected to raise rates by 25 basis points, but at the same time signal the end of rate hikes or a pause. This is expected to be related to the ongoing problems of regional banks. According to the Fed, turmoil in the banking sector led to a significant tightening in credit which may be treated as an additional hike. On the other hand, JP Morgan's longtime CEO Jamie Dimon indicated that the banking crisis is most likely over after the FRC takeover. On the other hand, shares of regional banks such as Western Alliance and PacWest Bancorp were losing heavily yesterday.

We are already after the release of very important data from the US economy. The ADP report showed nearly doubled jobs change in comparison to expectations. These numbers are tricky for the Fed, however, the reports showed also a slowdown in wage growth.

The US500 is trying to recover from yesterday's plunge fueled by declines in bank stocks. We are also seeing a further decline in yields, which should be supportive for the stock market, but at the same time, it may mean an increase in investor concerns. 4100 remains a very important support level, even though US500 managed to break through this level yesterday. On the other hand, 4200 remains an almost unbreakable resistance. It is worth keeping in mind the old market saying "sell in May and go away". Statistics actually do not favor buyers in early May, but last year, after the initial sell-off in May, the market later rebounded quite noticeably (similarly in 2021).

Source: xStation5

News from companies:

Starbucks (SBUX.US) presented decent financial results for the past quarter, beating analysts' expectations. The company presented a significant improvement in the Chinese market. EPS was 74 cents against expectations of 65 cents. Revenue was $8.72 billion against expectations of $8.4 billion. The company showed strong growth in the US and a significant rebound in sales in China, the second most important market for the company. Despite this, the company decided not to increase guidance for 2023, which caused a sell-off in shares among investors. SBX.US is losing 5% at the start.

Qualcomm (QCOM.US) is scheduled to release financial results after the Wall Street session. Expectations are quite mixed, not only by the weak guidance illustrated by AMD stocks after yesterday’s results but also due to concerns about inventories. Qualcomm is expected to show a 40% drop in net profit for the past quarter in the face of a significant drop in chip demand. High inflation and previous chip shortage problems were expected to cause a significant increase in contractors' chip inventories, limiting demand for new orders. EPS is expected to be $1.77 versus $2.57 a year earlier. Qualcomm is losing only 0.05% at the start of the session, while AMD is losing as much as 6% at the opening bell.

AMD is opening with a wide bearish gap and Qualcomm is not responding, despite mixed expectations ahead of the earnings release. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.