American stock exchanges open Thursday's session in positive spirits, supported by a mix of better macroeconomic data and expectations regarding further actions by the Fed.

The broad market experiences gains, and all major indices in the USA opens at new ATH. The Federal Reserve adds fuel to an already heated market. For investors, this is a signal that the FED supports the market even if the real economy continues to send signals of strength. This increases risk appetite and pushes indices towards new highs, but exerts pressure on the dollar.

Macroeconomic Data:

FOMC decided yesterday to lower the interest rate by 25 basis points, marking the first such move since December.

The Fed signals that further reductions are possible within the year if risks related to the labor market intensify, but they are not certain. The market positively receives the balanced stance of the Fed.

The number of new unemployment benefit claims fell to 231000 noticeably below market forecasts, indicating a slight stabilization after a previous increase. Simultaneously, the Philadelphia Fed Manufacturing Index surprised exceptionally positively, rising to 23,2 against expectations of only 1,7. This is the highest result in months, indicating a strong revival in the region's industry. Together, these two readings show that despite growing concerns about the labor market, the American industrial sector is showing clear signs of recovery.

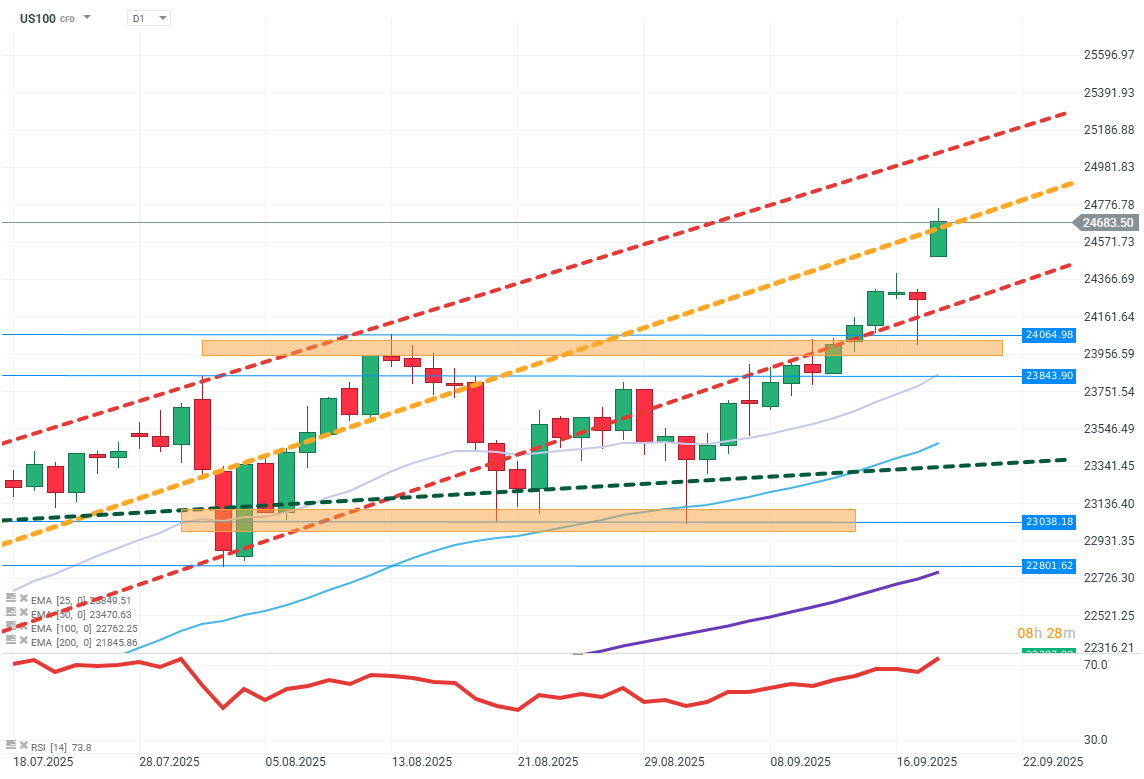

US100 (D1)

Source:xStation

The US100 index remains in a clear upward trend, moving within the upper range of the channel and maintaining momentum after breaking previous resistances. The arrangement of moving averages supports the demand side, and the rising candles from recent sessions indicate strong buying interest. The RSI indicator already signals the overbought zone, suggesting that the market is heated, and a technical correction may occur in the short term.

Company News:

Intel (INTC.US), Nvidia (NVDA.US) - Nvidia announced a $5 billion investment in Intel and project collaboration on new chips. Intel's valuation rises by over 30%, and Nvidia's by 3%.

AMD (AMD.US) - Intel's main competitor loses 4% at the opening in reaction to the news of the investment in Intel.

89bio (ETNB.US) - Roche announced the purchase of the biotech company at $14.5 per share, which currently represents a premium of about 80%. As a result, the company's valuation rises by that much at the opening.

CrowdStrike (CRWD.US) - The cybersecurity and cloud company rises by 6% on the wave of information following the publication of forecasts about AI revenues.

Cracker Barrel (CBRL.US) - The restaurant chain's stock valuation falls by nearly 10% following the publication of weak results.

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.