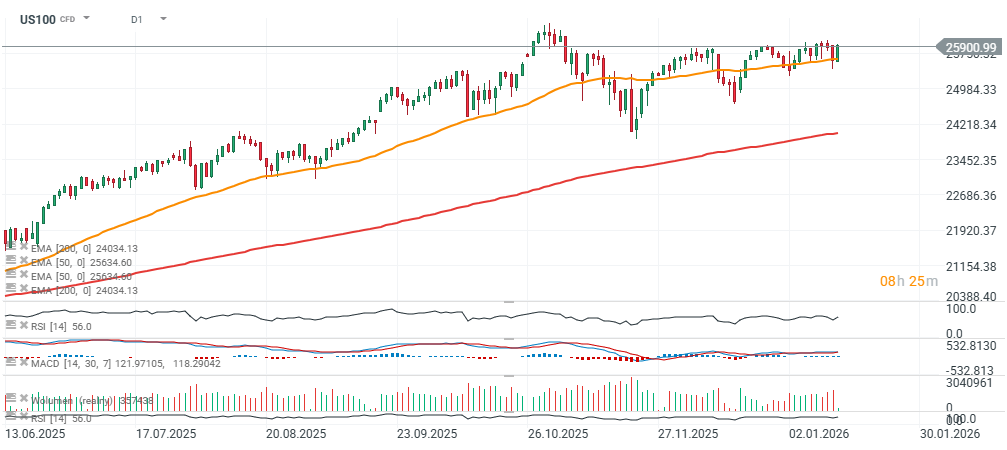

US indices are opening higher today, with Nasdaq 100, S&P 500, the Dow Jones Industrial Average and the Russell 2000 futures posting solid gains. Strong results from Taiwan’s AI chip heavyweight TSMC (TSM.US) have propelled tech stocks and set the “market optimism machine” in motion. Nasdaq (US100) futures are up more than 1% early in the US session.

Moves across the semiconductor segment are particularly strong - ranging from Europe’s ASML to US names such as Nvidia, AMD, Lam Research and KLA Corp (KLAC.US). KLA is seeing an outright impressive ~8% jump following an upgrade at Wells Fargo, driven by the 2nm roadmap and the high-performance computing (HPC) cycle.

Source: xStation5

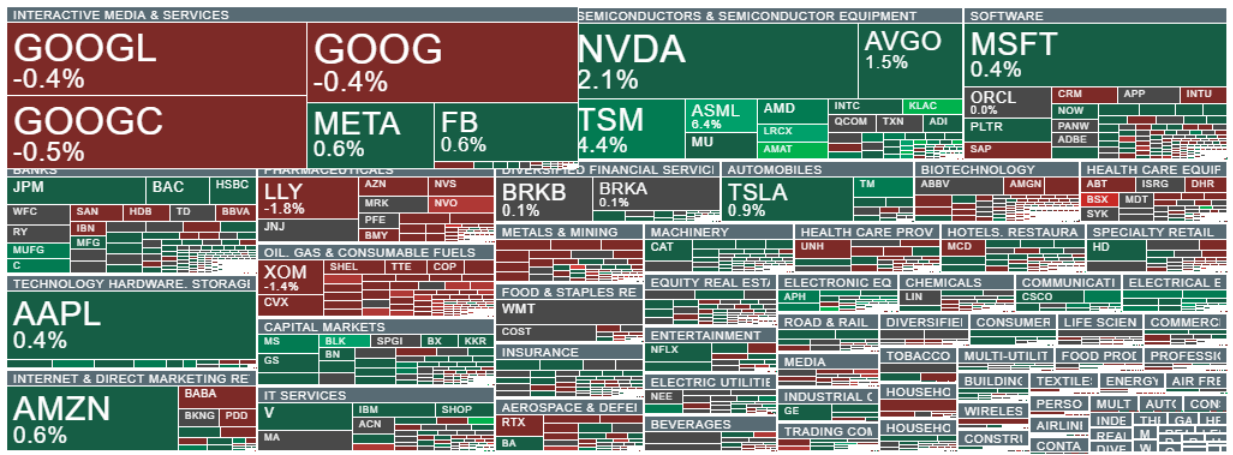

Semiconductor stocks and the financial sector are supporting today’s gains in equities. Source: xStation5

Company news

-

Nvidia sets the pace among the “Magnificent Seven” after TSMC’s strong earnings and outlook, driven by AI demand, Nvidia (NVDA) is up +2%, Amazon (AMZN) +1%, Tesla (TSLA) +0.5%, but Alphabet (GOOGL) lags, losing -0.5%. Microsoft and Apple shares are slightly higher.

- Amplitude (AMPL) rises 5.7% after Morgan Stanley upgraded the software company from equal-weight to overweight.

- Applied Materials (AMAT) gains 2.1% after Barclays also upgraded the stock from equal-weight to overweight. The name is also benefiting from a stronger demand backdrop after TSMC set a more ambitious 2026 capex target—read by the market as a sign of robust AI-related chip demand.

- Chip equipment names are clearly higher in US pre-market trading: Lam Research (LRCX) +8.2% and Teradyne (TER) +4.1%. The backdrop is similar—TSMC’s 2026 spending target came in above expectations, which investors interpret as confidence in the durability of the AI boom.

- Clearway Energy (CWEN) rallies 7.5% after announcing a package of power purchase agreements (PPAs) with Google for 1.17 GW in Missouri, Texas and West Virginia.

- Coinbase (COIN) slips 1.1% after the US Senate Banking Committee postponed a debate on crypto market structure, while Coinbase withdrew support for a bill proposal concerning caps on stablecoin rewards.

- Disc Medicine (IRON) drops 7.1% after reports that the FDA delayed its review of an experimental treatment for a rare blood disorder that was part of an accelerated voucher program (per Reuters).

- Goldman Sachs (GS) gains 2.3% after its quarterly report: 4Q FICC and trading revenues beat the average analyst estimate.

- Millicom (TIGO) rises 3% after UBS upgraded the stock from neutral to buy, citing an attractive valuation and potential benefits from consolidation, which could support growth and cash returns.

- Morgan Stanley (MS) falls 1% despite posting 4Q wealth management revenues above consensus—investors appear to have taken a cooler view of other parts of the report.

- Penumbra (PEN) jumps 13% after Boston Scientific agreed to acquire the company in a cash-and-stock deal valuing it at around $14.5bn.

- Samsara (IOT) is up 2.6% in pre-market trading after BNP Paribas upgraded the stock to outperform from neutral, pointing to stronger demand.

- Sandisk (SNDK) gains 4.1% after Benchmark raised its price target to $450 from $260. Analysts note that even after the strong rally, “the story still holds” and rests on several solid pillars.

- Southwest Gas Holdings (SWX) rises 1.4% after Citi upgraded the stock from neutral to buy, citing an acceleration in EPS growth.

- Talen Energy (TLN) jumps 11% after signing agreements to purchase three gas-fired power plants from Energy Capital Partners for $3.45bn. The deal increases its generation capacity portfolio by roughly 2.6 GW.

BlackRock hits new records

Shares of BlackRock, the world’s largest asset manager, are up 2.2% after earnings. Adjusted EPS and net inflows came in well above market expectations. BlackRock reached a new all-time scale record, with assets under management (AUM) rising to $14.04 trillion—highlighting how strongly the firm “rides the market’s current” when asset valuations climb.

The AUM surge was driven largely by the 4Q equity rally, fueled by:

-

AI enthusiasm

-

easing rate pressure

-

relatively stable US economic growth

Results beat Wall Street expectations, and the market reaction was swift: BlackRock shares were up about +2.5% in pre-market trading, suggesting investors welcomed both the revenue scale and the quality of inflows. Revenue increased to $7.0bn from $5.68bn y/y, beating the analyst consensus of $6.69bn. For BlackRock, that matters because most revenues are calculated as a percentage of AUM—so rising assets act like operating leverage. EPS clearly beat forecasts: $13.16 versus expectations around $12.21. For investors, that signals revenue growth is translating into net results more efficiently than the market assumed.

- Adjusted net income rose to $2.18bn from $1.87bn a year earlier, pointing to a strong profitability quarter despite rising cost pressure.

- Costs rose sharply: $5.35bn vs $3.6bn y/y—putting a key issue on the radar going forward. At this scale, investments in growth and expansion can be “expensive,” and the market will watch closely whether higher spending delivers durable payoffs.

- Equity product inflows were essentially flat y/y: $126.05bn vs $126.57bn a year earlier. That may look like “no fireworks,” but at this scale, stability itself is a strong signal.

- Fixed-income inflows were very strong: $83.77bn in the quarter, which Reuters links to a more dovish Fed stance and a cooling labor market. This is important—it shows BlackRock is benefiting from investors rotating back into bonds.

- Total long-term net inflows came in at roughly $267.8bn, with ETFs once again the main locomotive. This is the key point: BlackRock is effectively “wired” to win when capital returns to passive, low-cost strategies.

The company also posted record annual net inflows of $698.26bn, reinforcing the picture of BlackRock as the biggest capital-gathering machine in the world.

ETFs: low fees, massive scale

ETFs remain the core engine of BlackRock’s organic growth, even if the unit economics carry lower margins. The mechanism is simple: lower fees are offset by enormous scale and the iShares network effect.

The passive trend isn’t slowing. Investors continue to look for low-cost diversification, and the “ETF as a default investment product” narrative is only getting stronger over time.

Performance fees: the market is paying for results again

Performance fees jumped 67% to $754m, suggesting the firm benefited not only from rising AUM and base fees but also from strong performance in strategies that include success-fee components.

Notably, this marks another strong quarter in this line item—performance fees were up around 33% in 3Q. It adds an “extra layer” of revenue that isn’t always repeatable, but can be highly profitable.

“Private market play”: BlackRock wants higher-margin revenues

BlackRock is increasingly diversifying toward higher-fee products, which makes sense given the intensifying fee competition in ETFs.

The firm is leaning more heavily into:

-

private markets

-

real estate

-

infrastructure

-

AI-linked assets (data centers, energy infrastructure)

This direction is margin-accretive because private assets typically generate higher fees than ETFs. In other words, BlackRock is trying to build a “higher-end dining room” next to a very large—but lower-margin—“ETF cafeteria.” Private market inflows were $12.71bn in the quarter. The scale is still nowhere near ETFs, but the trend is clear: the company is steadily building a second pillar. The target is ambitious: $400bn of cumulative fundraising by 2030. That suggests BlackRock sees private markets not as an add-on, but as a future major source of margins and more stable revenues. A particularly interesting move is its plan to integrate private assets into retirement programs—potentially opening up a huge pool of long-term capital.

BlackRock shares (D1 interval)

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.