Financial markets appear to be completely ignoring the risk of a recession in the U.S. economy. The prevailing belief is that a soft landing is not only the most likely outcome but, in fact, the only viable path forward given the current macroeconomic environment.

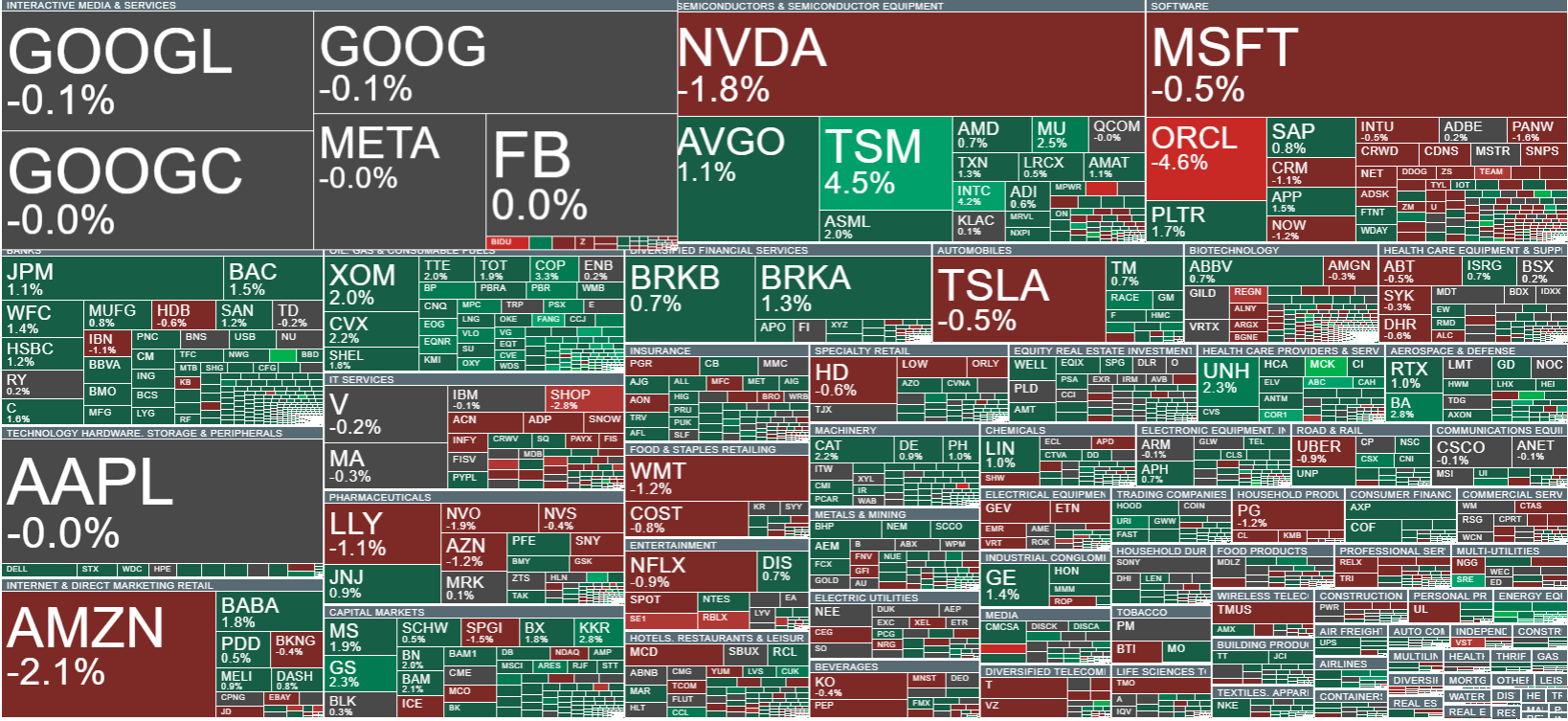

Investor optimism is further fueled by record-breaking levels on major U.S. stock indices, which are hitting new all-time highs almost daily. The tech rally shows no signs of slowing down — in fact, it seems to be accelerating, driven by growing interest in artificial intelligence, data infrastructure, and advanced semiconductor production. An increasing number of companies are announcing multimillion-dollar investments in technology, ranging from data center construction to the implementation of AI-based solutions. This trend continues to support bullish market sentiment and dampens fears of a potential economic slowdown.

The focal point for investors today is the speech by Federal Reserve Chair Jerome Powell. His tone and any hints about the future direction of monetary policy may play a decisive role in determining the short-term path of the markets. Any mention of recession risks or the need to maintain higher interest rates could trigger a correction, while a more dovish stance will likely be interpreted as confirmation of the ongoing upward trend.

US500 (H1 Timeframe)

Futures on the S&P 500 index (US500) are posting modest gains in early trading, holding near record highs. Despite the prevailing optimism and strong upward momentum, investors are exercising caution ahead of today's highly anticipated speech by Fed Chair Jerome Powell. His remarks will be critical in shaping expectations for future monetary policy and the near-term behavior of equity markets.

Source: xStation5

Company News

Boeing (BA.US) shares are up about 3%, trading near $216, following reports that the U.S. and China are in the final stages of negotiations on a major aircraft order for Boeing. Although details regarding the number and model of aircraft have not been disclosed, the potential deal could significantly impact the company’s financial performance. The news has improved investor sentiment, boosting the stock ahead of the market open.

ACM Research (ACMR.US) shares are surging over 6% to $38.50 after the announcement that the company will be added to the S&P SmallCap 600 Index, replacing WK Kellogg Co., which is expected to be acquired by the Ferrero Group pending deal closure. Inclusion in the index is likely to raise ACM Research’s visibility among institutional investors, potentially increasing liquidity and attractiveness to small-cap-focused funds.

Firefly Aerospace (FLY.US) shares are down approximately 10% following the release of the company’s first earnings report as a publicly traded entity. Despite strong revenue growth and a $1.1 billion order backlog, investors remain concerned about high operating losses and a rapid burn rate of available cash.

Kenvue (KVUE.US) shares are up around 4% in early trading, despite warnings issued by the Trump administration regarding the use of Tylenol (paracetamol) during pregnancy. Authorities suggested a potential link between the drug and an increased risk of autism in children, sparking significant concern among both investors and consumers. Nonetheless, the stock has rebounded slightly, although it remains down over 25% in the past six months — largely due to ongoing reports about possible connections between Tylenol use and developmental issues.

Arista Networks closes 2025 with record results!

AI scare trade broadens out as we wait for key inflation update

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.