The main stock indices in the U.S. are opening Wednesday’s session on a positive note, driven by stronger-than-expected August producer price inflation (PPI) data. The reading came in significantly better than initial forecasts. The market had anticipated a 3.3% year-over-year increase in PPI inflation, whereas the official data showed a rise of only 2.6% year-over-year.

Producer price inflation in the U.S. for August 2025 was clearly below expectations. The annual PPI rate stood at 2.6%, down from 3.3% the previous month. On a monthly basis, PPI decreased by 0.1%, contrary to the expected 0.3% increase, following an earlier 0.7% surge.

Increasingly, it appears that both today’s PPI report and recent U.S. labor market data—including revisions to new job figures and visible slowing in employment growth—will play a key role in shaping the Federal Reserve’s future monetary policy path. In recent weeks, there have been clear signs that the U.S. labor market is losing momentum and inflationary pressure is gradually easing. As a result, financial markets are almost unanimously convinced that the Fed will decide on its first interest rate cut as soon as this month.

Moreover, investor expectations are becoming more “dovish.” The likelihood of a scenario involving at least three rate cuts by the end of 2025 is rising. Market participants seem to assume that the Fed may have fewer reasons to maintain restrictive monetary policy, especially if upcoming data—particularly the forthcoming CPI inflation reading—confirm the disinflationary trend. This development is boosting positive sentiment in equity and bond markets, supporting not only stock index gains but also pressure on yields of U.S. Treasury securities to decline.

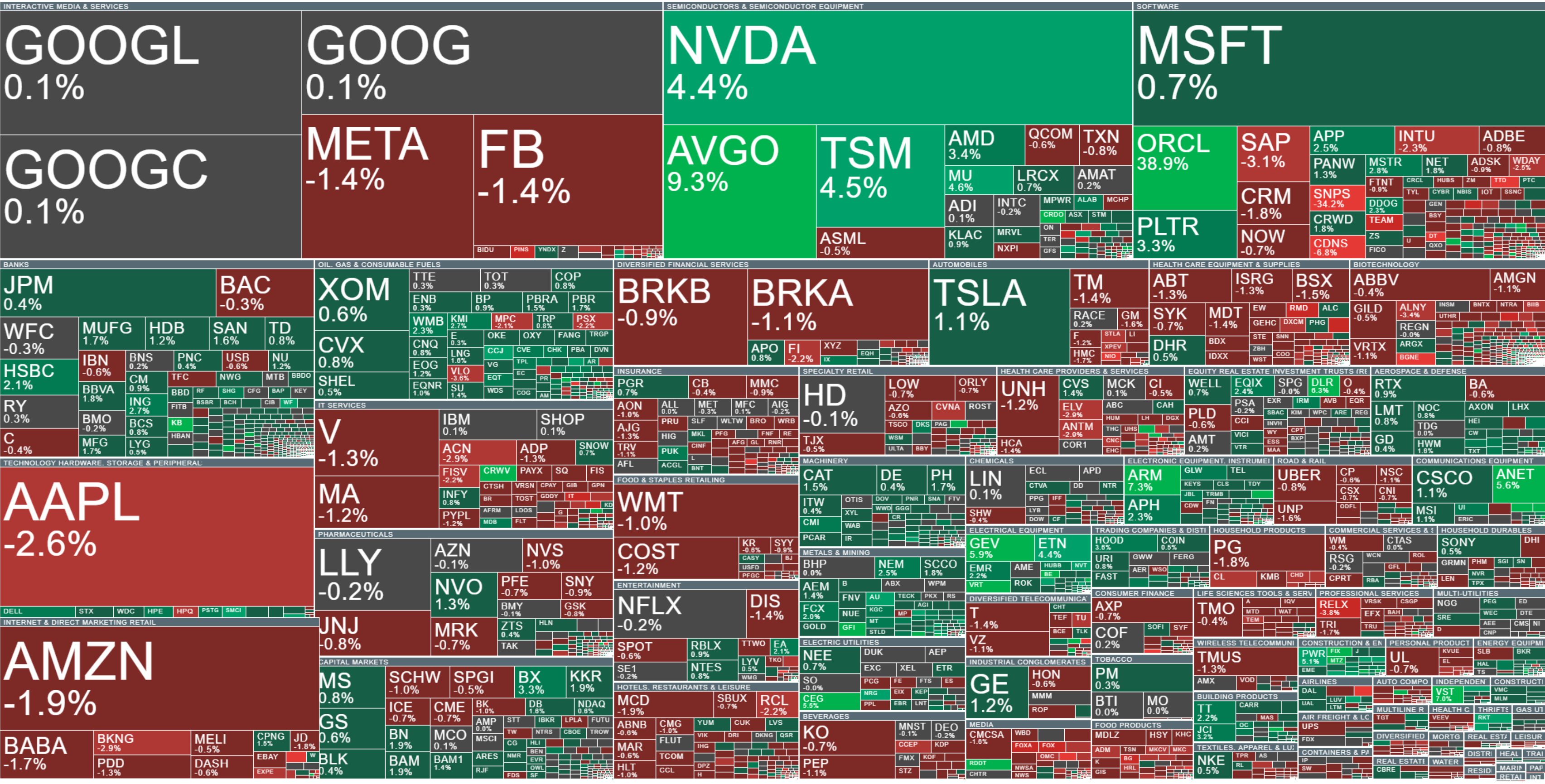

Volatility of U.S.-Listed Stocks

Source: xStation5

US100 (H1 Interval)

It is evident that the market has received today’s inflation news very positively. Nasdaq 100 futures are trading well above key moving averages (EMA 25, EMA 50, and EMA 100), indicating strong bullish sentiment. The current movement continues the upward trend following an earlier rebound, with investors anticipating further market strengthening. Such behavior suggests the market is confident in the positive impact of the inflation data and expects the upward trend to continue.

Source: xStation5

Company News:

Oracle (ORCL.US) shares soared 39% after reporting results for the first quarter of fiscal 2025. Revenues reached $14.9 billion, marking a 12% increase compared to the previous year. Earnings per share (EPS) came in at $1.47, slightly below analysts’ expectations. However, a key factor driving the stock’s rise was the significant increase in backlog (Remaining Performance Obligations, RPO), which reached $455 billion—a 359% increase year-over-year. This growth results from signing four multibillion-dollar contracts with clients such as OpenAI, Meta, NVIDIA, and AMD. Oracle plans further cloud infrastructure expansion, investing $35 billion in data center development this year. Forecasts indicate a 77% increase in cloud infrastructure revenues for the current fiscal year, potentially reaching $144 billion by 2029.

Asset Entities Inc. (ASST.US) is up about 30% following the announcement of a merger with Strive Asset Management. The company specializes in social marketing on platforms like Discord and TikTok. The merger will create the first publicly traded company focused on Bitcoin investments. The deal will enable rapid capital raising for further cryptocurrency purchases and the implementation of innovative, tax-efficient financial strategies for investors.

NIO (NIO.US) fell 9.4% after announcing a $1 billion share offering. The company plans to offer 181.8 million shares at $5.50 each. Although the funds are intended for research and development of electric vehicle technology and corporate purposes, investors reacted negatively to the dilution of shares. The market is now awaiting the conclusion of the offering, scheduled for early October 2025, along with further details on the use of the proceeds.

Gossamer Bio (GOSS.US) rose about 9% after UBS initiated coverage with a “Buy” rating and a target price of $19. Analysts highlight the undervalued potential of the company’s clinical portfolio and foresee share price appreciation in the short to medium term. The company focuses on developing seralutynib for pulmonary hypertension, with PROSERA trial results expected in February 2026.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.