- US markets are set to open slightly higher on the opening bell on Friday

- US dollar appreciates at the end of the week

- Michigan report ahead

- Cryptocurrencies extends bearish momentum

Indices open today slightly higher. Investors’ mood looks relatively calm as the markets continue to trade in a consolidation following the release of US CPI data on Thursday. The main path remains unchanged, indicating that major central banks are likely to pause their tightening cycle. The economic releases this week have not had a significant impact on this narrative.

The value of the dollar increases, with the EURUSD pair experiencing a decrease of 0.3% to reach 1.0885, as sellers cautiously explore levels below 1.0900. USD behaves even stronger in comparison to the New Zealand dollar with the NZDUSD pair trading almost 1.3% lower at 0.6222. NZD is the worst performing G10 currency after RBNZ lowered 1- and 2-year inflation expectations from 5.11 to 4.28% while 2-year expectations were lowered from 3.30 to 2.79%. This can be seen as a dovish move as lower inflation expectations suggest that RBNZ is progressing in its fight against inflation and may not need to raise rates too much.

The NZDUSD currency pair is currently trading at 0.6226 and is approaching a support level at 0.61880. If the price fails to break below the support level, we could see a potential reversal or a consolidation phase in the near term. Traders should closely monitor the price action for any signs of a rejection or a bullish reversal pattern.

At 03:00 PM BST, the Preliminary University of Michigan Consumer Sentiment index will be announced, with a forecast of 63.0, slightly lower than the previous reading of 63.5. This report provides insights into consumer confidence and sentiment, which can impact spending and economic activity. Investors will look for clues about the current state of the US economy. Particularly interested data will be the Inflation Expectations 1-year forecast. Last month, it was reported at 4.6%. Monitoring these expectations is important as they can influence future monetary policy decisions. Question still remains whether this data will confirm yesterday’s release of lower CPI figures.

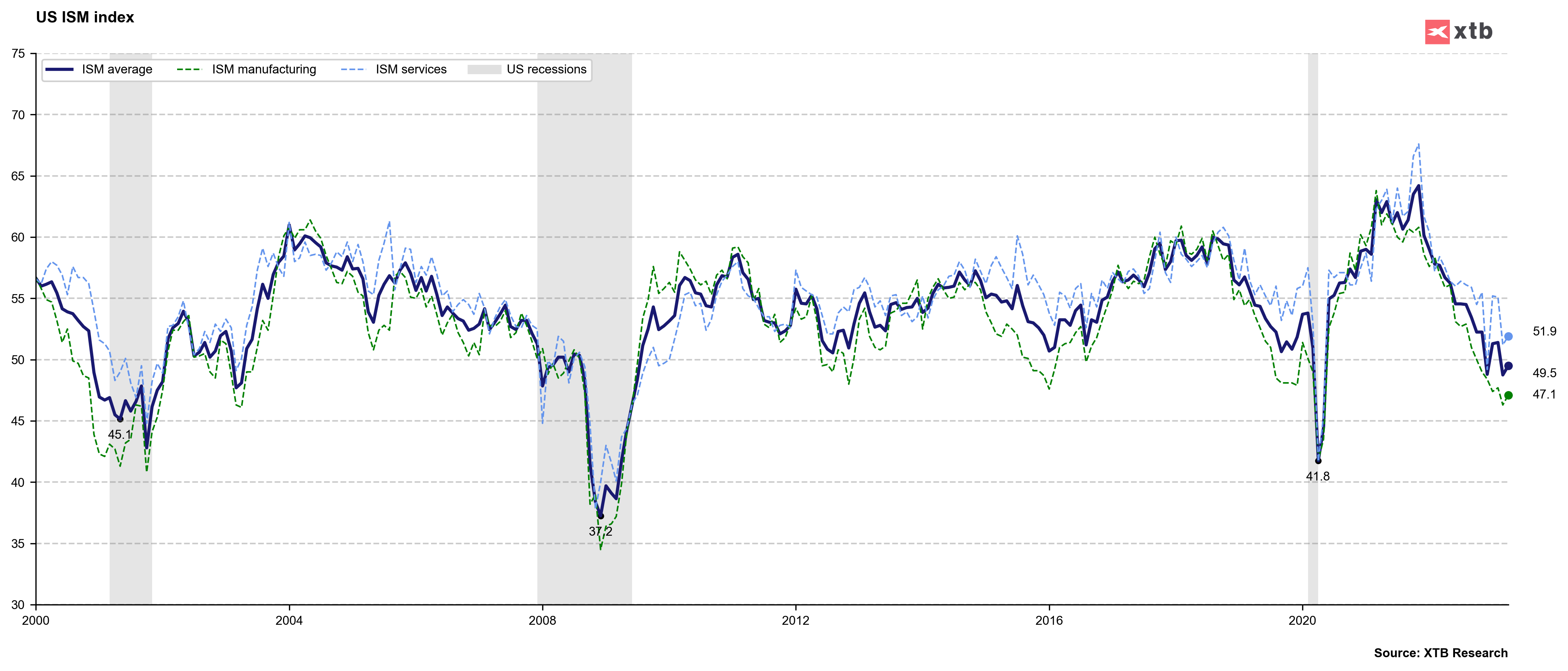

Regional activity indicators compared to the ISM index

Regional activity indicators compared to the ISM index

US500 is set to open slightly higher today at 4,156 points. The price consolidates between the 4,100 and 4,200 point range. The index remains within a downward channel, indicating a bear market.

Company News:

-

Richemont (CFR.CH), a luxury goods conglomerate, exceeded expectations with strong sales driven by high demand for jewelry and watches from Chinese consumers. This outstanding performance propelled the company's shares to reach their highest recorded levels.

-

Petroleo Brasileiro (PNR.US) - Brazil's state-run oil company, announced a 14.4% decline in net profit for the first quarter. The decrease was primarily due to lower oil prices. Despite this decline, the company's results surpassed analysts' expectations, as stated in their official statement.

-

Gen Digital (GEN.US), formerly known as NortonLifeLock Inc, projected lower-than-anticipated revenue for the first quarter. The decline was attributed to customers reducing spending on cybersecurity products amid higher borrowing rates and persistent inflation. The company expects first-quarter revenue to range between $940 million and $950 million, falling short of Wall Street's estimated $954.2 million. However, their fourth-quarter revenue experienced a 32% growth, reaching $947 million, which exceeded analysts' average projection of $940.1 million.

-

News Corp (NWS.US) - the media conglomerate on Thursday beat Wall Street estimates for third-quarter profit, helped by a string of cost-cut measures and strong subscription growth across its professional data and news platforms. News Corp said it expects to achieve at least $160 million in annualized savings from its previously announced 5% reduction in workforce, or about 1,250 employees.

-

Cryptocurrency markets keep crushing as the bearish momentum extends. BTC is currently trading at 26.4k, which is around 20% lower from this year's highs. Top news today:

- The New York State legislature is considering a bill that would permit the use of stablecoins, cryptocurrencies pegged to the US dollar, as a legal method of paying bail for defendants

- Former SEC official John Reed Stark has urged US financial regulators to prohibit crypto-related firms from offering Tether (USDT) stablecoins, warning that the USDT issuer may be vulnerable to collapse

- Franklin Templeton, a company managing over $1.4 trillion in assets, plans to launch a second blockchain fund, as disclosed in documents filed with the SEC. The fund will require a minimum investment of $100,000

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.