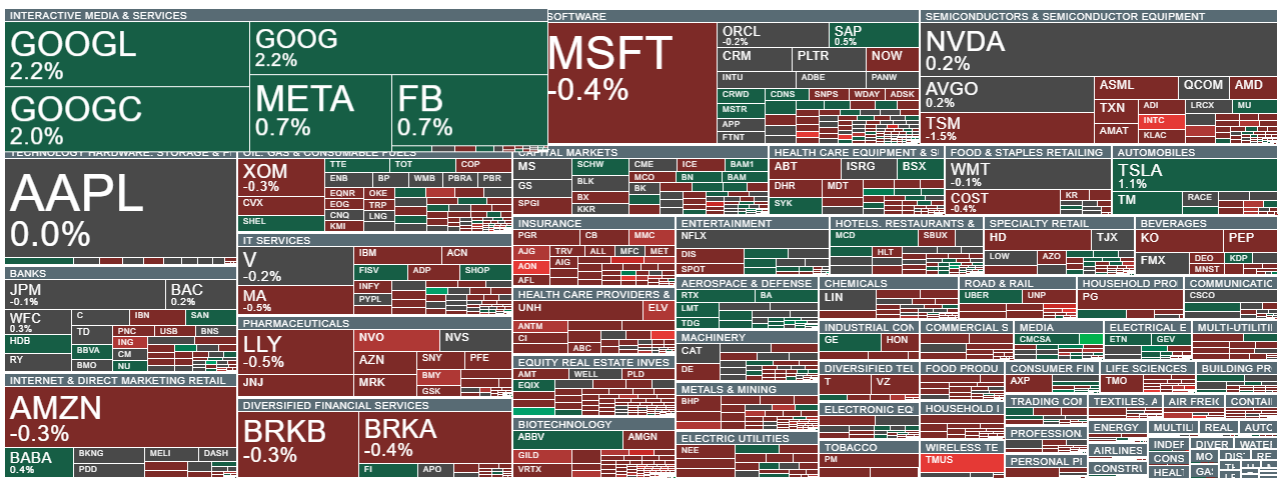

Sentiments among U.S. stock indexes are mixed today. The US100 is struggling to return to gains, while the US30 is down over 0.4%. Among Big Tech companies, Alphabet (GOOGL.US) and Tesla (TSLA.US) shares are recording the strongest gains.

- China has announced it will lower tariffs on some American goods currently subject to 125% duties.

- Final UoM sentiments came in higher than expected; 1 year inflation expectations slightly higher but still at very high 6.5% level

- Shares of UnitedHealth (UNH.US), a DJIA giant, are falling another 2.5%, hitting multi-year lows.

- Intel shares are down over 8% after disappointing financial results. Strong results from Alphabet (GOOGL.US) were not enough to lift broad market sentiment.

Among large U.S. companies, the biggest decliners include Intel, AON, Novo Nordisk, and T-Mobile US. Gains in the tech sector are being driven primarily by Alphabet (GOOGL.US).

Source: xStation5

Company News

• Schlumberger NV:

SLB missed analysts' profit estimates for the first quarter, as a slowdown in demand for oilfield equipment and services in Latin America weighed on its international business.

- "The industry may experience a shift in priorities driven by changes in the global economy, fluctuating commodity prices, and evolving tariffs — all of which could impact upstream investment and demand for our products and services," said SLB CEO Olivier Le Peuch.

- International revenue fell 5% to $6.73 billion in Q1. The company, formerly known as Schlumberger, reported adjusted earnings of 72 cents per share, slightly below analysts' estimates of 74 cents.

• Skechers USA Inc:

The footwear maker withdrew its full-year forecast on Thursday amid economic uncertainty caused by the Trump administration's unpredictable trade policies, sending shares lower in after-hours trading.

- Production in China accounts for nearly 38% of Skechers' U.S. sales, according to a Bank of America note dated April 9.

- Skechers also missed first-quarter sales expectations, reporting a 7.1% rise compared to the 7.9% growth expected.

- Sales in China fell about 16% in the quarter ending March 31, a steeper decline than the 11.5% drop in the previous three-month period.

• T-Mobile US Inc:

The U.S. telecom carrier added fewer new wireless subscribers in Q1 2025 than the market expected, as competitors ramped up promotions in an increasingly saturated U.S. market, leading to a drop in the company's shares after hours.

- The report highlighted intensifying competition, where operators attract customers with price locks and bundled offers while economic uncertainty grows due to tariffs.

- T-Mobile added 495,000 monthly bill-paying subscribers in the first three months of 2025 — more than AT&T — while Verizon lost subscribers during the period after warning about the impact of "off-season promotions."

- Still, the result fell short of FactSet’s estimate of 506,400 additions.

- The company raised its 2025 adjusted EBITDA guidance to a range of $33.2 billion to $33.7 billion, up from the previous forecast of $33.1 billion to $33.6 billion.

- T-Mobile's revenue in Q1 rose 6.6% to $20.89 billion, beating expectations of $20.62 billion, according to LSEG data.

• Verisign Inc:

The internet services company reported a 4.7% rise in first-quarter revenue on Thursday, driven by continued demand for domain registrations as businesses expanded their online presence. Warren Buffett increased his stake in Verisign in Q4 2024.

- Verisign reported revenue of $402.3 million compared to $384.3 million a year earlier.

- It manages the domain-name registries for two of the world's most valuable domains — .com and .net — and operates two of the 13 global internet root servers.

- Net income rose to $199.3 million, or $2.10 per share, from $194.1 million, or $1.92 per share, a year earlier.

- Verisign processed 10.1 million new .com and .net domain registrations in Q1, up from 9.5 million a year earlier.

Intel extends losses

The chipmaker forecast second-quarter revenue and profit below Wall Street estimates, casting a shadow over the first financial results under the leadership of new CEO Lip-Bu Tan amid an ongoing trade war.

- In efforts to restructure and cut costs, Intel also announced it is lowering its adjusted operating expense target to approximately $17 billion in 2025, down from the previously stated goal of $17.5 billion, and is targeting $16 billion in 2026.

- The company expects revenue between $11.2 billion and $12.4 billion for the quarter ending in June, compared with analysts' average estimate of $12.82 billion.

- Intel's first-quarter revenue remained flat at $12.67 billion, exceeding the $12.30 billion estimate.

- The company projects that second-quarter adjusted earnings per share will be near zero, compared to prior expectations of 6 cents per share.

Intel Stock Chart (INTC.US)

Intel shares are falling below $20 today, marking an 8% sell-off. The stock failed to break above the 23.6% Fibonacci retracement of the last downward wave and twice failed to hold above the 200-day EMA, signaling a return to a downward trend. Strong support is seen between $18 and $19.50.

Source: xStation5

Changes in Analysts' Recommendations

• Alphabet Inc: Wells Fargo raises the target price to $175 from $167 after impressive first-quarter results driven by advertising growth.

• Comcast Corp: Oppenheimer lowers the target price to $38 from $55, as the cable provider reported weak broadband subscriber performance due to high prices.

• Intel Corp: JPMorgan lowers the target price to $20 from $23 after the chipmaker downgraded its second-quarter revenue outlook.

• PepsiCo Inc: Piper Sandler lowers the target price to $160 from $167, citing potential tariff pressures on North American beverage concentrate imports and the Frito-Lay North America division.

• Procter & Gamble Co: TD Cowen lowers the target price to $175 from $189 after the consumer goods company cut its sales and EPS forecasts for FY25 amid uncertainty about consumer spending and tariff-related costs.

Meta drops 8% despite strong revenue growth 🔎

EURUSD falls below 1.16 after Fed 💵

BREAKING: Fed cuts interest rates and will end QT on December 1st 📌

Upcoming Meta earnings: will the AI transformation be well received by the market? 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.