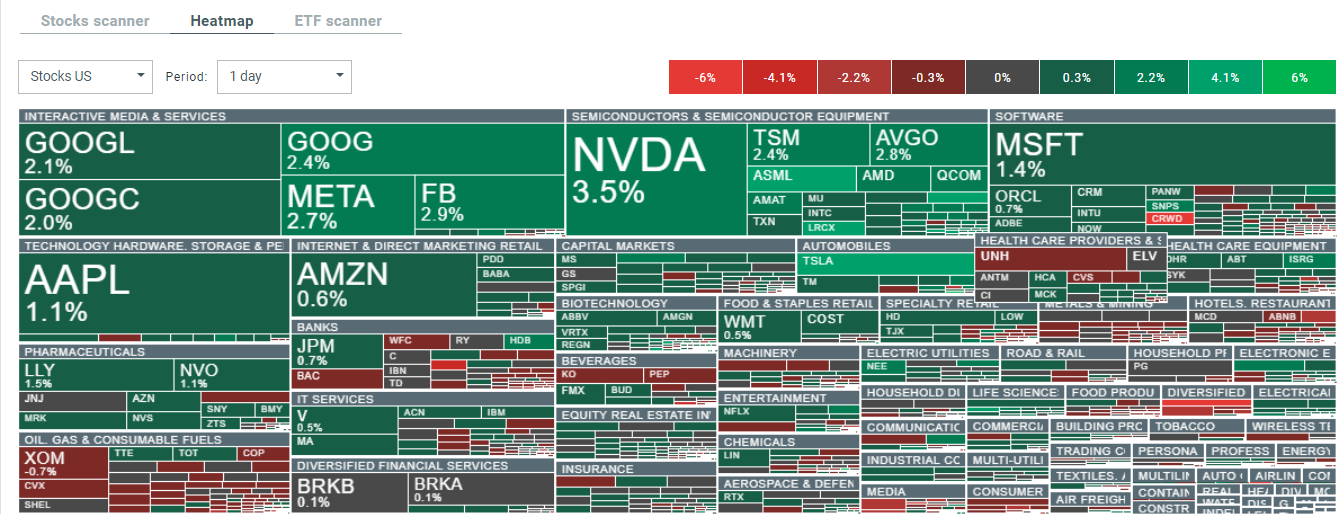

- Futures on the Nasdaq 100 (US100) are gaining nearly 1.2%. Technology stocks post gains on wave of semiconductor sector rebound

- Nvidia (NVDA.US) gains nearly 3%; the company is set to deliver advanced chips specifically tailored to the Chinese market

- Verizon (VZ.US) results push stock nearly 6% lower; shares test 200-session moving average

- Chicago Fed regional index well above analysts' forecasts (0.05 vs. -0.09 forecast and 0.18 previously)

Sentiment around U.S. stocks is decidedly positive today, with the biggest rebound seen in the semiconductor sector, whose gains also carry over to the 'return' of bolder buyers to the stocks of 'BigTech' companies, with Microsoft (MSFT.US) and Alphabet (GOOGL.US) posting gains of over 3% today. Ahead of tomorrow's earnings report, Tesla (TSLA.US) is also gaining over 3%. The resignation of Biden and the candidacy of Kamala Harris, from the Democratic Party, has translated into a higher valuation of the Democrats' win in the election, although according to the polls, Donald Trump has consistently held by far the dominant odds of victory.

According to the latest press reports, Nvidia will begin working with Chinese company Inspur, one of China's major parts and semiconductor distributors. The companies will work together to market and widely distribute the chip, which will tentatively be named “B20.” Deliveries are scheduled to begin in the second quarter of 2025, according to anonymous Reuters sources. The market may read such a scenario as a potential additional source of revenue for Nvidia and an expected not overly drastic U.S. tariff policy, in the years to come. Nvidia has been reducing its chip sales to China in recent quarters, also due to tariffs and technology transfer restrictions.

Source: xStation5

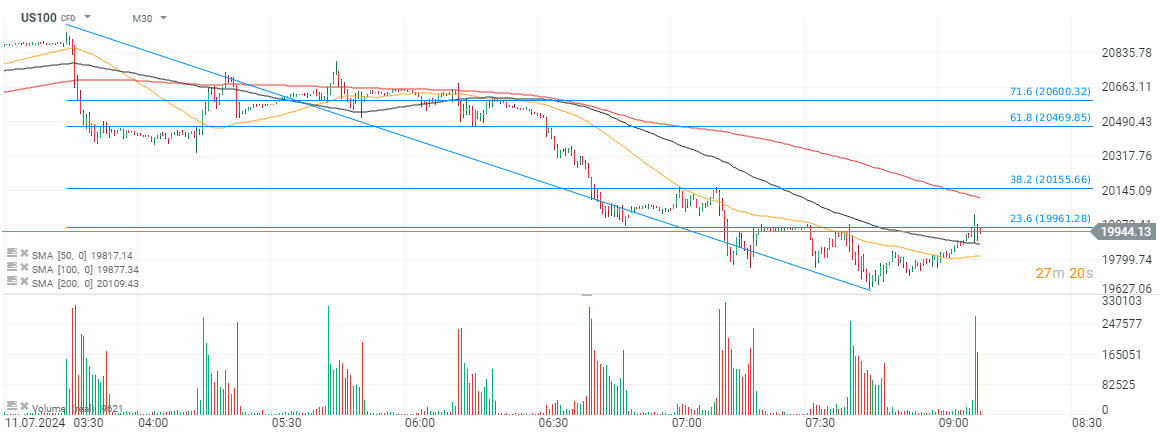

US100 (M30)

We are seeing a return of buying volume, in Nasdaq 100 (US100) contracts, but looking at the last few sessions, we see a distribution scenario materializing. The contracts retreated after reaching resistance at the 20,000-point level, where stronger supply volume became active, but are still trading above the SMA100 and SMA50 momentum averages.

Source: xStation5

Weaker results for Verizon

Telecommunications company Verizon is a member of the Dow Jones Industrial Average (DJIA) index and was one of the largest companies to report financial results for the second quarter of the year today. Expected revenues fell short of expectations, and earnings per share came in line with Wall Street's forecast; the stock is losing about 6.5% today.

- Verizon reported second-quarter revenue of $32.8 billion (0.8% year-on-year increase) versus more than $33 billion expected, and earnings per share (EPS) of $1.15 (down from $1.23 in Q2 2023). Verizon's net Q2 earnings were $4.7 billion vs. $4.8 billion forecast, but adjusted EBITDA rose to $12.3 billion vs. $12 billion in Q2 2023.

- Verizon had a total of 11.5 million broadband subscribers in Q2 (up 17.2% year-on-year, service revenue up 3.5% year-on-year, and fixed wireless grew 70% year-on-year, generating 514 million in revenue

- However, the market sees no significant catalysts to support the company's business in the near term, and the company's cautious full-year outlook itself supports such a scenario.

- Verizon maintained its expected 2024 revenue and projected full-year earnings per share between $4.5 and $4.70 versus $4.58 expectations, suggesting that the company may not meet market estimates this year.

- The company is targeting 2 to 3.5% year-on-year growth in revenue from the sale of equipment and distribution of wireless services. The company's CEO, Vestberg assessed that the company sees upward momentum and intends to secure a winning position in the market, but the market does not perceive this scenario either as certain, and the expansion of the company's business seems to be quite slow, compared to other large US companies.

Verizon Communications (VZ.US) chart, D1 interval

Verizon shares are down nearly 7% today, following a somewhat disappointing second quarter and very cautious forecasts. The stock is testing the long-term 200-session moving average (SMA200) today, and is approaching the bottom of the last trading range, where the stock has been since early 2024. A breakout below the SMA200 will potentially indicate a possible trend reversal, the strength of which is being tested today.

Source: xStation5

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

Zions Bancorp rebound after sharp US regional bank stocks sell-off 📈

DE40: European markets decline due to concerns about the U.S. banking sector

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.