- Wall Street indices open mixed

- US30 breaks above 40,000 pts mark

- Deere & Co drops after lowering full-year profit outlook

Wall Street indices launched today's cash session more or less flat - S&P 500 gained 0.1% at session launch, Nasdaq traded flat and small-cap Russell 2000 dropped 0.2%. Disappointing housing market and industrial production data from the United States released earlier today failed to trigger any major market moves. There is a number of speeches from Fed members scheduled for today, which may help move the markets should central bankers touch on the topic of yesterday's inflation data.

Source: xStation5

Source: xStation5

Dow Jones (US30) was the best performing major Wall Street index at launch of cash session today but has erased gains since. The move higher was to a huge extent driven by Walmart, which surges 6% after earnings release. Taking a look at US30 chart at H4 interval, we can see that the index trades above the psychological 40,000 pts mark and has almost fully erased downward correction from the first half of April 2024. The near-term resistance zone to watch can be found in the 40,300 pts area and is marked with all-time highs.

Company News

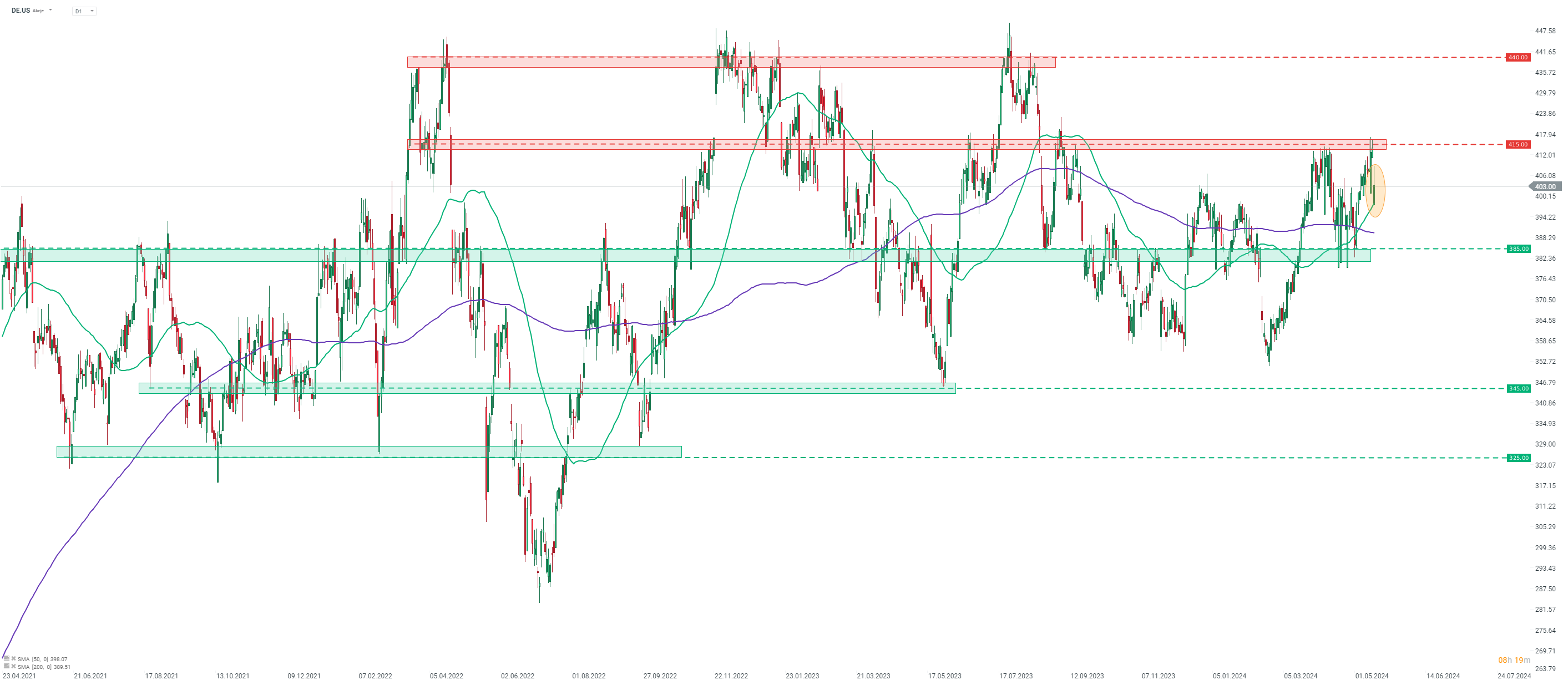

Deere & Co (DE.US) is pulling back following release of fiscal-Q2 2024 results. Company reported 15% YoY drop in net sales to $13.61 billion (exp. $13.20 billion). Net sales were year-over-year lower in each of three major segments - Production & Precision Agriculture, Small Agriculture & Turf and Construction & Forestry. However, only sales in Small Agriculture & Turf segment missed expectations. Company reported net income of $2.37 billion, higher than $2.16 billion expected but 17% lower than a year ago. However, what determined market's reaction was full-year net income forecast - Deere lowered full-year profit outlook from $7.50-7.75 billion to $7.00 billion (exp. $7.53 billion).

Palo Alto Networks (PANW.US) gains after the company announced a partnership with IBM. Aim of the partnership is to deliver AI-powered security offerings to customers. Palo Alto Networks will become IBM's preferred cybersecurity partner in network and cloud. As part of the agreement, Palo Alto Networks agreed to acquire IBM's QRadar SaaS assets. Transaction is expected to close by the end of September 2024.

Chubb (CB.US), US insurer, rallies at a double-digit pace today. The gain was triggered by an announcement from Berkshire Hathaway, an investment conglomerate run by legendary investor Warren Buffett. Berkshire Hathaway unveiled a $6.7 billion stake in Chubb.

Analysts' actions

- Coupang (CPNG.US) upgraded to 'buy' at UBS. Price target set at $26.00

Deere & Co (DE.US) drops after issuing a disappointing full-year net income outlook. Stock launched today's cash trading with an around-4% bearish price gap. However, stock found support at the 50-session moving average (green line) and has recovered a big part of initial drop already. Source: xStation5

Deere & Co (DE.US) drops after issuing a disappointing full-year net income outlook. Stock launched today's cash trading with an around-4% bearish price gap. However, stock found support at the 50-session moving average (green line) and has recovered a big part of initial drop already. Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Middle East conflict ramps up a gear as energy price spike rips through markets

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.