- Wall Street begins the session with declines – the main indices open in the red

- A day with speeches from FOMC members – the market awaits Jerome Powell's speech, followed by Bailey, Walley, and Collins. Bowman did not provide new signals.

- Weak sentiment in the cryptocurrency market pulls down related stocks

- Rare earth metals continue to rise, investors view them as hedging assets amid trade tensions.

- The US government remains shut down, the administrative paralysis continues

- Mixed results from banks and retail chains

- Wall Street begins the session with declines – the main indices open in the red

- A day with speeches from FOMC members – the market awaits Jerome Powell's speech, followed by Bailey, Walley, and Collins. Bowman did not provide new signals.

- Weak sentiment in the cryptocurrency market pulls down related stocks

- Rare earth metals continue to rise, investors view them as hedging assets amid trade tensions.

- The US government remains shut down, the administrative paralysis continues

- Mixed results from banks and retail chains

Today's session on Wall Street clearly begins under the influence of sellers. Futures contracts on the Nasdaq 100 index were losing nearly 1% before the opening, signaling a nervous start to the day. After yesterday's gains, the American market may be entering a correction phase. The US100 contracts are losing the most. Dow and S&P500 are down about 1%, while Russel 2000 is performing the best, sliding down by about 0.6%.

At the start of trading, the main indices open with clear declines, reflecting growing tensions on many fronts. Investors are reacting to the escalation of the trade war with China. Additionally, the worsening situation in the financial system, with increasing volatility in the debt market and liquidity concerns, intensifies the selling pressure. All this is compounded by the ongoing federal government shutdown, which has been destabilizing the situation for several days and testing the market's resilience to risk.

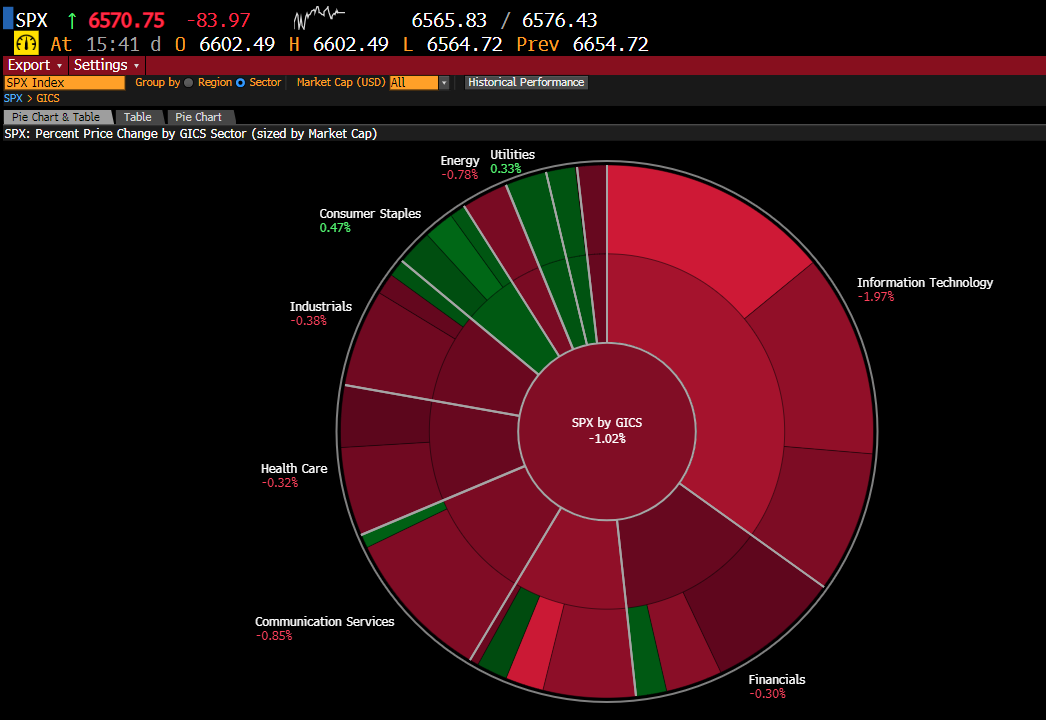

Source: Bloomberg Finance

The declines are most affecting the IT sector and related industries. Following them, the financial sector is falling the most. Slightly better, but still in the negative, are healthcare and the broadly defined industry. Retailers can boast a slight increase.

Macroeconomic Data:

Due to the administrative paralysis, macroeconomic data is still not being published, which limits investors' ability to assess the economy's condition.

The market's attention is therefore drawn to the speeches of FOMC members. Michelle Bowman has already finished her speech, adding nothing new beyond what the market had already priced in.

Later in the day, investors are waiting for Jerome Powell's speech, which may set the tone for the entire week.

After him, Andrew Bailey, Susan Walley, and Austan Collins will also speak. Each of these speeches may impact short-term sentiments and expectations regarding Fed policy.

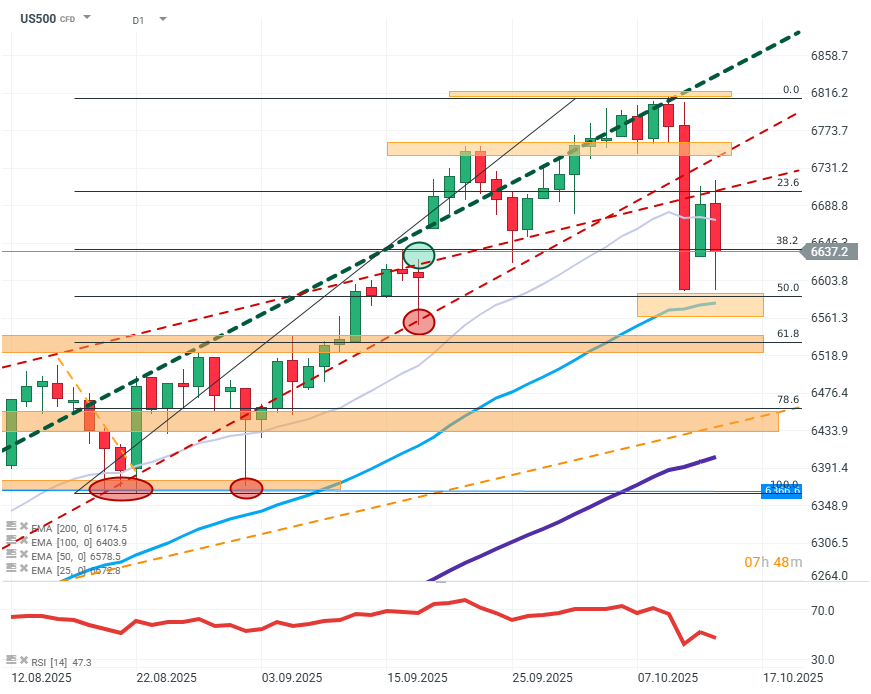

US500 (D1)

Source: Xstation5

The price on the index, without corrections, broke both growth channel limits, the EMA25 average, and the FIBO 23.6 level. The declines were only stopped around the EMA100 and FIBO 50 level. Currently, the rate is between FIBO 38.2 and 50 levels. Maintaining resistance is essential to avoid deepening the correction towards the 6500 level. However, if buyers want to regain initiative, it is necessary to overcome the FIBO 38.2 level.

Company News:

- Companies related to cryptocurrencies are in a difficult situation. The retreat from peaks and worsening sentiment is affecting most companies associated with crypto trading. Coinbase (COIN.US) loses 4% at the opening.

- Companies related to the mining and processing of rare earth metals continue to rise in recent days on the wave of Chinese restrictions and the escalation of trade tensions. MP Materials (MP.US) rises over 3% before the opening.

- Polaris (PII.US), a manufacturer of light vehicles, rises over 10% at the opening after announcing the "spin-off" of its Indian division.

- Navitas Semiconductors (NVTS.US) — rises 24% after revealing their new chip for Nvidia.

- Wells Fargo (WFC.US) — rises over 2% at the opening after publishing a good third-quarter report. The bank raised key indicators and announced business expansion following recent regulatory easing.

- Domino's Pizza (DPZ.US) — The company rises over 2% at the opening after publishing results in which the restaurant chain could boast sales growth above analyst consensus.

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.