- Wall Street is set to open higher on the last day of the week

- Mixed sentiment after contrary signals from labor market data

- MongoDB shares rally after Q1 results

Wall Street is set to open higher on Friday following the approval of a debt-limit deal. Futures for the US500 are traded at 4,268 points with +0.7% change, US100 0.2% to 14,520 points.

The agreement to raise the government's debt limit and implement spending cuts removed the threat of default that had unsettled markets the previous week. While the debt deal provided relief, investors are now focusing on whether the economy will enter a recession before inflation subsides enough to convince the Federal Reserve to pause its rate hikes. Recent data showing fewer unemployment benefit applications and stronger-than-expected job growth has added to the uncertainty. The hope is that the Fed may delay or reduce further rate hikes if upward pressure on prices eases.

In May, the US labor market presented mixed signals as nonfarm payrolls increased and unemployment rate rose, leading to speculation about a pause in interest-rate hikes by the Federal Reserve. Payrolls showed a broad-based advance, particularly in professional and business services, government, and healthcare sectors. The rise in payrolls caused Treasury yields to jump. However, the surge in the unemployment rate and the number of jobless individuals raised concerns about the longevity of labor demand. The report may support the Fed's decision to pause rate hikes temporarily, allowing them to assess the effects of previous hikes. Fed officials are expected to closely examine the upcoming consumer price index data before their June meeting.

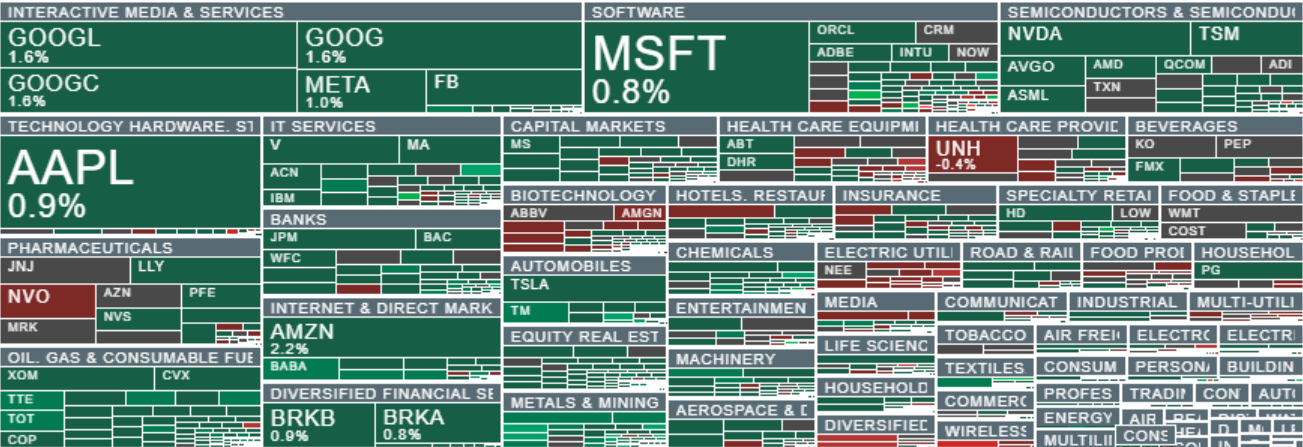

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Alphabet (GOOGL.US) and Microsoft (MSFT.US). Source: xStation5

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Alphabet (GOOGL.US) and Microsoft (MSFT.US). Source: xStation5

The US500 index is currently trading at 4268 points gaining 0.7% today. The price has broken above the bear market channel, indicated by the blue lines, which suggests a positive development. Additionally, the presence of two large green candles indicates a strong upward movement. The next significant resistance level to watch is at 4300 points. On the downside, if the bullish momentum weakens, there is a support line at 4200 points. Traders should closely monitor the price action around these levels to gauge the strength of the ongoing trend.

Company News:

- Asana (ASAN.US) shares are up 1.8% after the software company reported first-quarter revenue that was slightly better than expected. Morgan Stanley also touted the company’s billings, margins, and “strong positioning to deliver compelling AI capabilities” as positives.

- MongoDB (MDB.US) shares are soaring 34% with analysts positive on the database software company after it reported first-quarter results that beat expectations and raised its full-year forecast. Citi says the outlook “could signal a faster recovery in the consumption trends of the business, potentially driven by GenAI tailwinds.”

- Samsara Inc. (IOT.US) shares are up 19% after the software company boosted its total revenue guidance for the full year. It also reported first-quarter revenue that was higher than analyst expectations.

- PagerDuty (PD.US) shares fall 12% after the company saw a worsening of the spending environment in 1Q. That resulted in a cut to the fiscal 2024 outlook, but guidance looks achievable, according to Morgan Stanley.

- Dell Technologies (DELL.US) published sales outlook indicating that a recovery may take a bit longer than expected as it continues to struggle to sell PCs, particularly to consumers.

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.