-

Major Wall Street indice opened lower

-

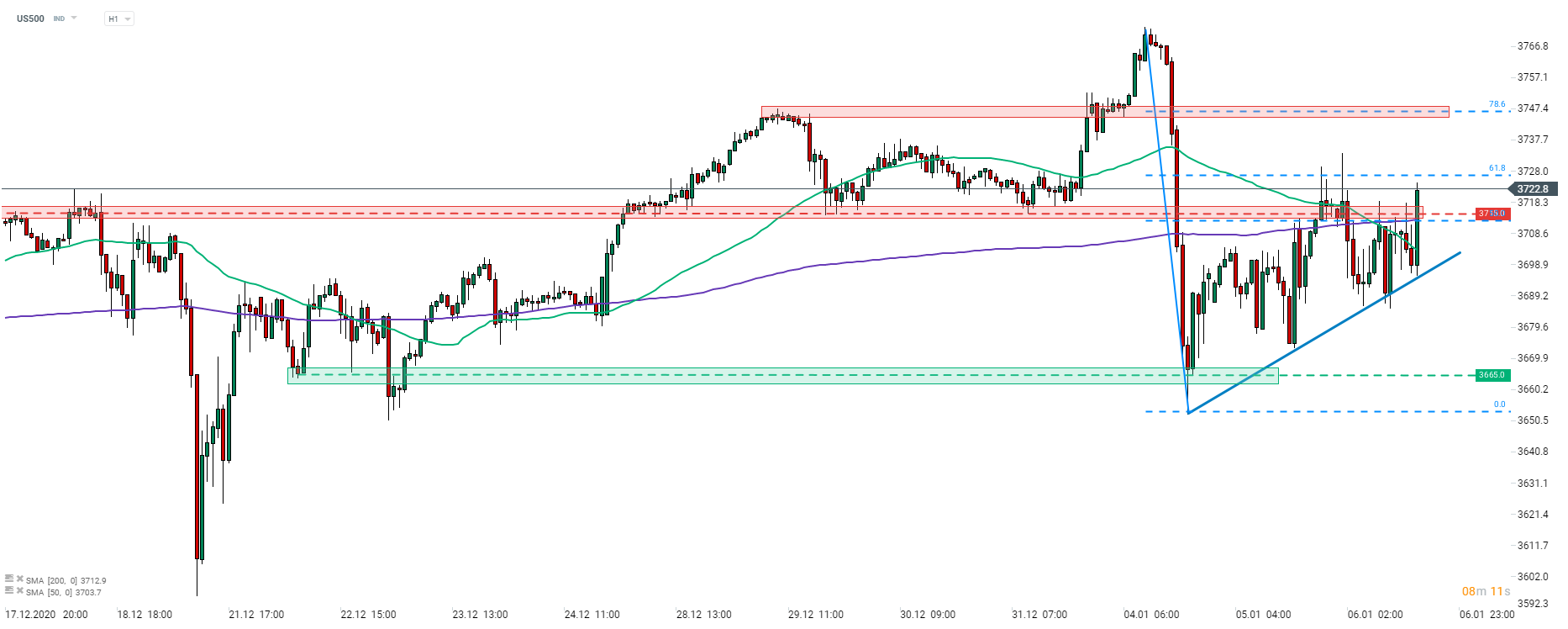

US500 catches a bid after session launch and breaks above 3,715 pts

-

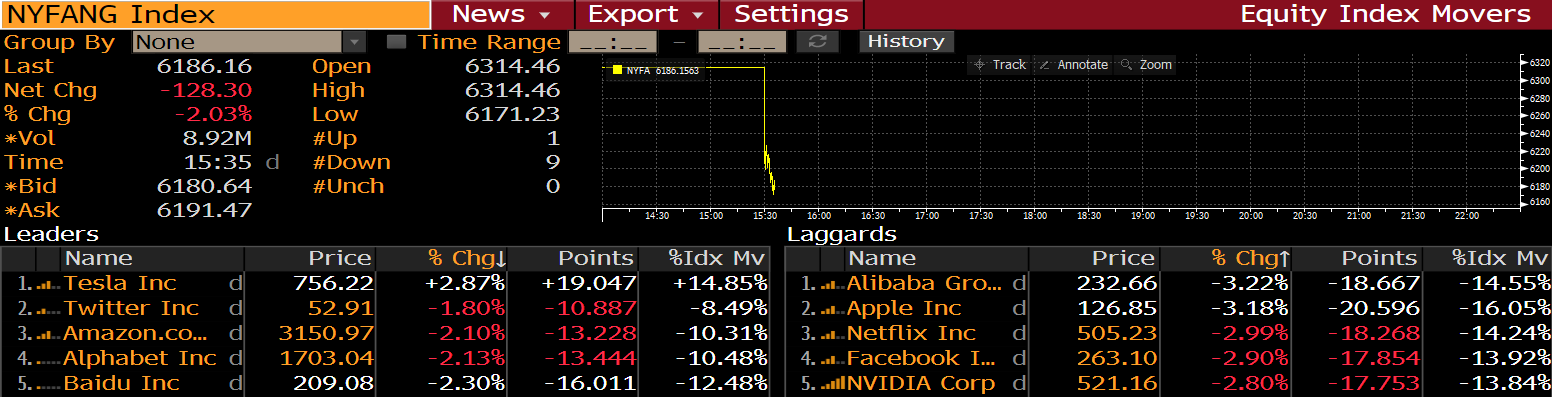

Big Tech struggles amid expected Democrat win in Georgia run-offs

Major stock market indices from Wall Street launched today's trading lower with Nasdaq (US100) opening around 1% below yesterday's close. Small-cap Russell 2000 (US2000) is outperformer as it gains over 1%. Divergence comes after news outlets pointed out that Democrats are set to win 2 seats in the Senate run-off in Georgia, an outcome that would give them control over the Senate. In such a scenario, Democrats would have control over Congress and the White House and will be able to proceed with a big infrastructure spending plan as well as speed up antitrust cases against Big Tech.

ADP data data showed 123k jobs decline in the US employment in December has been largely overlooked by the markets. FOMC minutes release at 7:00 pm GMT also has a scope to be non-event as highlights of the December's meeting - economic projections and dot-chart - has been released along with a monetary policy decision.

Following struggles throughout the European trading, US500 caught a bid following Wall Street cash open. The index is making a break above the resistance zone at 3,715 pts at press time. The first resistance to watch can be found at 61.8% retracement of a recent drop, that is also marked with yesterday's high. In case bulls manage to break above it, upward move could extend towards 78.6% retracement near 3,745 pts. Source: xStation5

Following struggles throughout the European trading, US500 caught a bid following Wall Street cash open. The index is making a break above the resistance zone at 3,715 pts at press time. The first resistance to watch can be found at 61.8% retracement of a recent drop, that is also marked with yesterday's high. In case bulls manage to break above it, upward move could extend towards 78.6% retracement near 3,745 pts. Source: xStation5

Company News

Expected win of Democrats in Georgia Senate run-offs is boosting sectors, who are seen benefiting from Democrat agenda. This includes renewable energy companies as well as stock operating in the cannabis sector. Small-caps are rallying thanks to increased odds for passage of Biden's infrastructure plan as well as bigger stimulus. On the other hand, Big Tech companies can be found among losers.

UnitedHealth (UNH.US) agreed to acquire Change Healthcare (CHNG.US) in an all-cash deal. Acquisition is valued at $25.75 per share, marking a premium of more than 40% over yesterday's closing price. Deal is valued at $7.8 billion, or around $13 billion including debt. Change Healthcare will be combined with UnitedHealth's OptumInsight unit. Acquisition is expected to close in the second half of 2021.

Carnival Cruise Line, a division of Carnival Corp (CCL.US), said that it is informing its customers that it is cancelling cruises from US homeports through March.

Big Tech companies for NYFANG index are struggling at the beginning of Wall Street session. Source: Bloomberg

Big Tech companies for NYFANG index are struggling at the beginning of Wall Street session. Source: Bloomberg

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.