Wall Street opened modestly, with major indices posting slight gains. The S&P 500 is up around 0.2 %, the Nasdaq by 0.1 %, and the Dow Jones gains nearly 0.5 %. The U.S. stock market maintains a positive sentiment following yesterday’s close, when indices mostly finished higher and the Dow Jones reached a new record closing level, reflecting ongoing accumulation and the relative strength of the largest companies, particularly in the technology sector, which is rebounding after earlier declines.

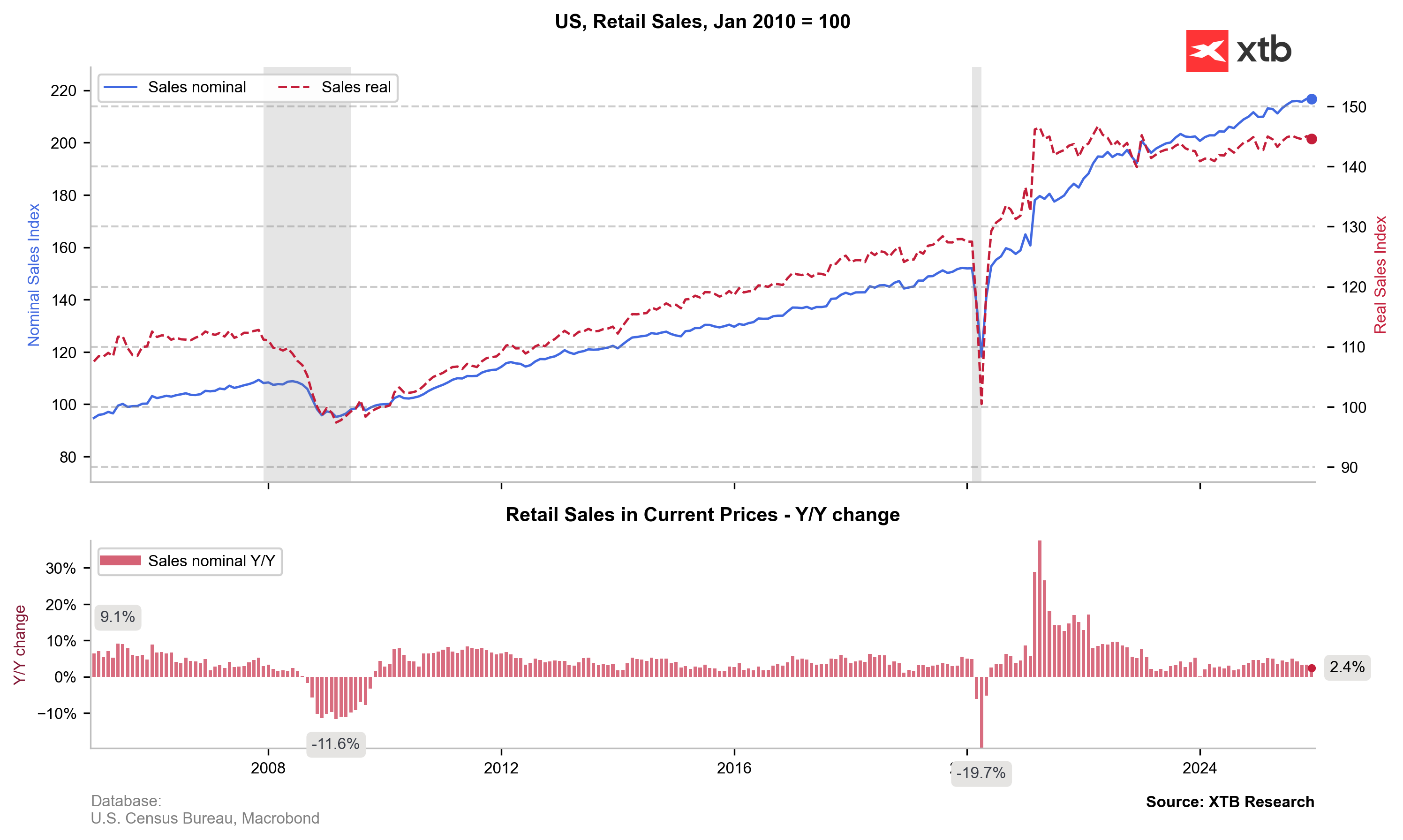

From a macroeconomic perspective, U.S. retail sales data for December have just been released, showing a significant miss versus expectations. Month-to-month sales remained flat, and the “core” component, which excludes auto sales, also showed no growth. This suggests a potential slowdown in consumer spending, which could limit economic momentum and reduce demand-driven inflationary pressure. At the same time, labor costs are rising but at a slower pace than expected, further mitigating the risk of excessive price growth. The weak consumer data, combined with current readings, indicate that inflation may continue to decline, increasing the likelihood that the Federal Reserve will adopt a more dovish stance, with potential interest rate cuts in the future.

Source: XTB Research

Futures on the US500 (S&P 500) are slightly higher in today’s session. Positive sentiment in the technology sector supports valuations, despite weaker-than-expected retail sales data. Slower consumer spending could increase the chances of a more accommodative Fed policy, which further helps sustain the positive market mood.

Source: xStation5

Company News:

Alphabet (GOOGL.US) raised 20 billion USD through a corporate bond offering to fund its artificial intelligence business expansion. The bonds, issued with varying maturities, attracted massive investor interest exceeding 100 billion USD. The proceeds will support investments in data centers and AI technologies, with capital expenditures expected to reach up to 185 billion USD in 2026. Additionally, reports indicate the company is considering issuing 100-year bonds denominated in British pounds.

S&P Global (SPGI.US) shares dropped sharply after the release of Q4 results and 2026 guidance, disappointing investors. The stock is down around 7 % following guidance for earnings per share that came in below analysts’ consensus, even though quarterly revenues slightly increased. The weaker-than-expected earnings and revenue growth for the year raise concerns about the pace of growth and the company’s ability to maintain its previous momentum.

Datadog (DDOG.US) shares are rising following Q4 2025 results, as the company beat revenue and earnings expectations. Datadog reported revenue growth of roughly 29 % year-over-year to 953 million USD, with adjusted EPS of 0.59 USD, exceeding analyst forecasts. The company also provided Q1 2026 revenue guidance above market expectations, further boosting investor sentiment. Although projected Q1 earnings per share are slightly below consensus, strong results and positive revenue prospects support Datadog’s stock performance.

Spotify (SPOT.US) shares are up after Q4 2025 results and forward guidance exceeded market expectations. The company reported strong growth in monthly active users (MAU) and premium subscribers, translating into higher revenue and improved profitability. Spotify also issued Q1 2026 guidance, projecting continued user growth and solid financial performance, which was positively received by investors and lifted the stock.

Coca‑Cola (KO.US) shares are declining following Q4 2025 results. While earnings per share slightly beat estimates, revenue came in below expectations, and the moderate sales forecast for 2026 adds pressure on the company.

Source: xStation5

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.