-

US stock markets to open sharply lower as virus concerns mount

-

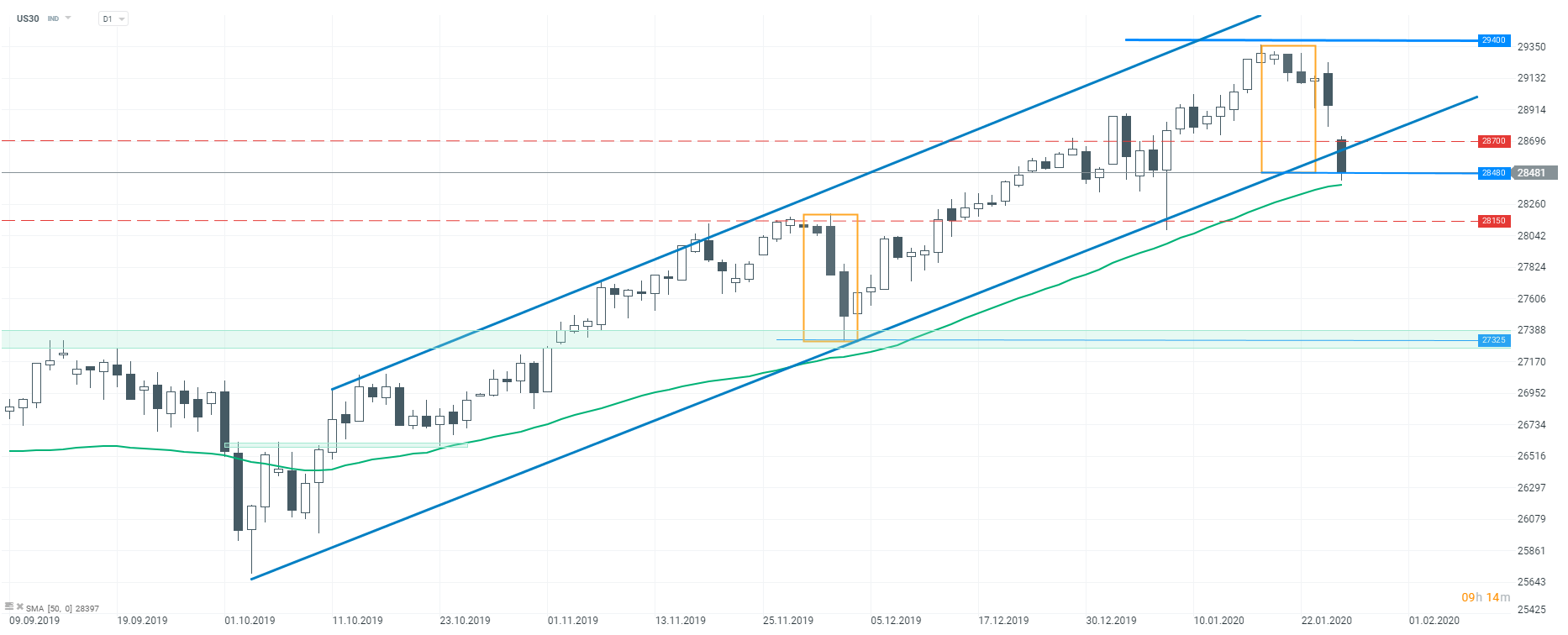

Dow Jones (US30) breaks below the lower limit of the upward channel

-

One of Boeing (BA.US) jets crashed in Afghanistan, 83 people on board

US stock markets are expected to start the week much lower with S&P 500 futures pointing to a 1.5% drop at the open. Coronavirus remains the main market theme and is unlikely to be dethroned anytime soon, unless a cure is found. US airlines may trade under pressure today just like their European peers due to demand concerns. Elsewhere, Boeing will be on the watch after one of its jets crashed in Afghanistan.

Dow Jones (US30) futures are taking a massive dive lower ahead of today’s session open. The US index is plunges below the lower limit of the upward channel and is testing the lower limit of the Overbalance structure at press time (28480 pts). Should it break lower, the 50-session moving average (green line, 28395 pts) could be the next target. Source: xStation5

Dow Jones (US30) futures are taking a massive dive lower ahead of today’s session open. The US index is plunges below the lower limit of the upward channel and is testing the lower limit of the Overbalance structure at press time (28480 pts). Should it break lower, the 50-session moving average (green line, 28395 pts) could be the next target. Source: xStation5

Boeing (BA.US) may be on the watch today due to two major events. The first one happened over the weekend and it was a successful first flight of its new 777-X jet. However, the second and probably more important factor driving the planemaker's shares today will be a crash in Afghanistan. Earlier today one of Boeing-made passenger jets carrying 83 persons crashed in Afgan province of Ghazni. The reason behind the crash is unknown so far.

Starbucks (SBUX.US) decided to close all of its shops in Chinese Hubei province. Spreading of the coronavirus is the reason behind the action.

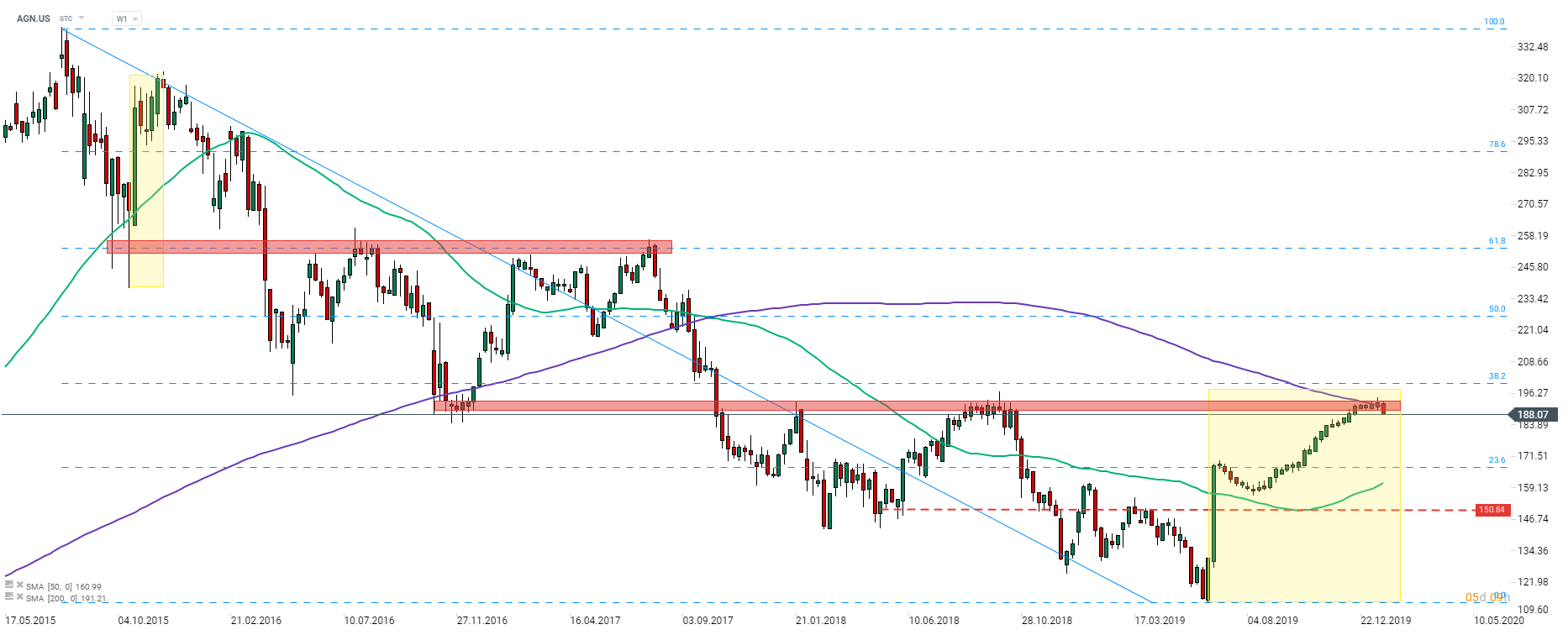

Shares of Boeing (BA.US) slumped from an all-time high after its 737-MAX jets were ground. Stock has not recovered yet and may have a hard time doing so in case it turns out that today’s crash was caused by technical issues. The stock climbed towards the resistance zone at 78.6% Fibo level of a steep upward move that pushed the stock to record highs. Source: xStation5

Shares of Boeing (BA.US) slumped from an all-time high after its 737-MAX jets were ground. Stock has not recovered yet and may have a hard time doing so in case it turns out that today’s crash was caused by technical issues. The stock climbed towards the resistance zone at 78.6% Fibo level of a steep upward move that pushed the stock to record highs. Source: xStation5

AbbVie (ABBV.US) decided to acquire Allergan (AGN.US) last year in a $63 billion deal. In order for the acquisition to go through, divestments are required. The two companies are one step closer to winning approval, thanks to Nestle and AstraZeneca. Nestle will buy “Zenpep” medication from Allergan while AstraZeneca will buy “Brazikumab” drug. However, financial terms of those deals have not been disclosed yet.

Traders should expect travel stocks, especially airlines, to underperform during today’s session as spreading of the coronavirus is likely to limit demand for tickets. Among biggest US airlines one can find United Airlines (UAL.US), Delta Air Lines (DAL.US), American Airlines (AAL.US) and Southwest (LUV.US).

Allergan (AGN.US) has been trading in a downward move since mid-2015. The stock found support at around $115 in mid-2019 and rallied afterwards as AbbVie announced acquisition plans. However, the stock has run into the resistance zone ranging above $190, that also coincides with 200-week moving average (purple line). On the other hand, in case the stock continues to run higher, traders should focus on $200 handle as the upper limit of the Overbalance structure can be found there. Source: xStation5

Allergan (AGN.US) has been trading in a downward move since mid-2015. The stock found support at around $115 in mid-2019 and rallied afterwards as AbbVie announced acquisition plans. However, the stock has run into the resistance zone ranging above $190, that also coincides with 200-week moving average (purple line). On the other hand, in case the stock continues to run higher, traders should focus on $200 handle as the upper limit of the Overbalance structure can be found there. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.