Summary:

-

US indices firmly higher ahead of Wall St. open

-

Large gaps higher after Trump-Xi trade truce

-

US500 back near 2814-2824 resistance region

It’s been a great start to the week for stock market bulls with large gains seen in many indices following a positive meeting over the weekend between US president Trump and his Chinese counterpart Xi. The markets have reacted positively to this apparent de-escalation and as we begin the month of December, bulls are growing in confidence once more and targeting a run higher into year-end.

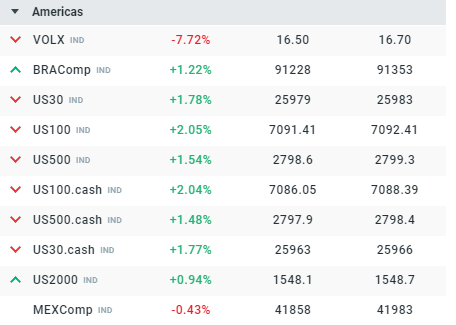

There’s been sizable gains in US indices with gains of more than 1% seen in all the major benchmarks. The US100 is the biggest gainer and higher by over 2% on the day. Source: xStation

There’s been sizable gains in US indices with gains of more than 1% seen in all the major benchmarks. The US100 is the biggest gainer and higher by over 2% on the day. Source: xStation

Due to the fact that the news broke after a Saturday night dinner between the two world leaders, the markets were closed and as a result we’ve seen large gaps higher when they re-opened. The US500 began almost 50 points higher after ending at 2756 on Friday night and the market now seems to have cleanly broken the prior resistance zone from 2744-2756 which could be seen as support going forward. Looking to the upside 2814-2824 has proved a hurdle too far for longs on two separate occasions in recent months and how price reacts here now will likely prove key. A clean break above here and the outlook looks increasingly positive with all-time highs of 2946 then only around 120 points, or approximately 4% away. Alternatively a failure to breach this level once more would put a ceiling on the latest rally and if bears can push price below 2744 then they will regain control of the tape.

The US500 has retested prior resistance around 2814-2824 after a large gap higher following the Trump-Xi truce. How price reacts here could well determine how we trade into year-end. Source: xStation

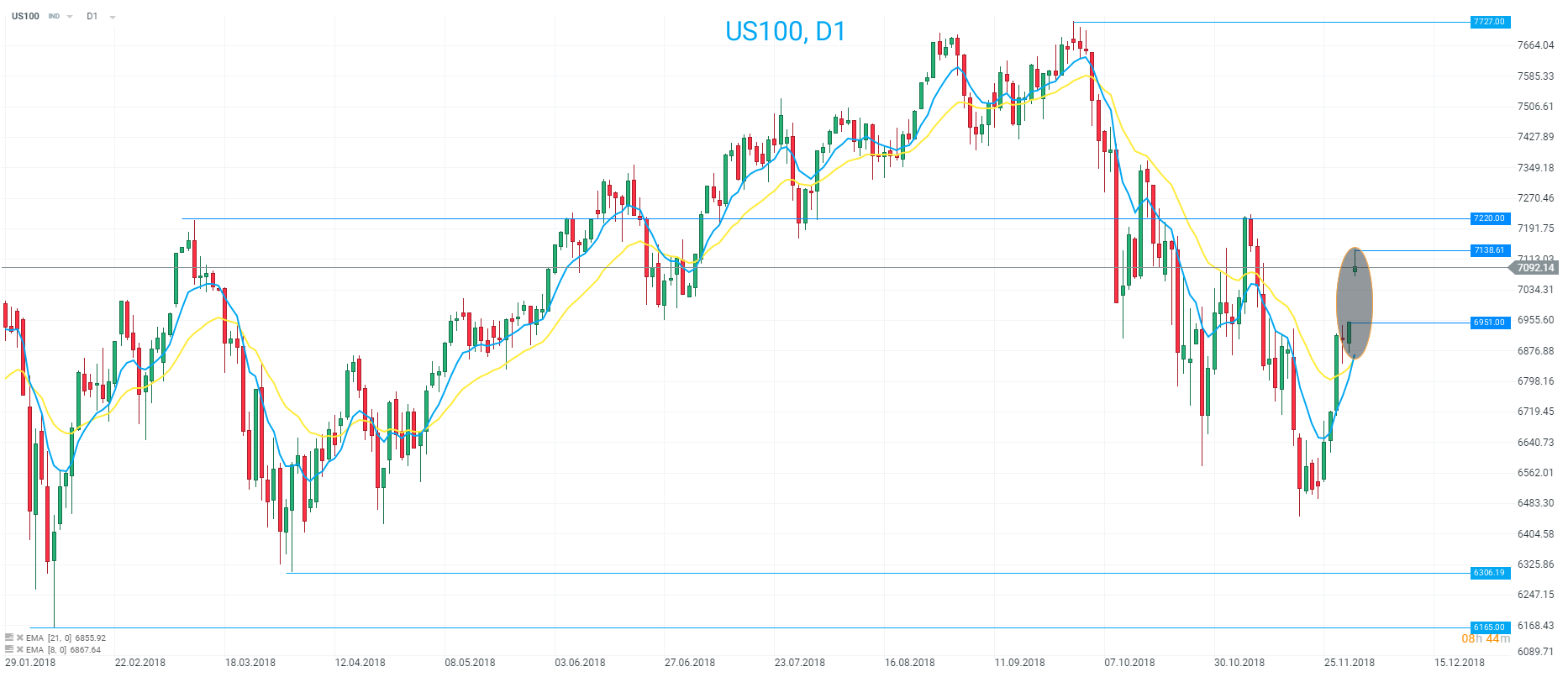

Looking at the US100 and the market could be on the verge of a bullish EMA cross, with the 8 period not far from the 21. Should this print then the trend could be viewed as having turned higher and the sell-off from the September high of 7727 would then be seen as potentially over. Price would have to get above the prior high of 7220 to negate the series of lower highs whilst last week closing level of 6951 is possible support if the gap fills.

US100 could be on the verge of printing a bullish 8/21 EMA cross on D1 and the downtrend seen from the September high could we close to coming to an end. Source: xStation

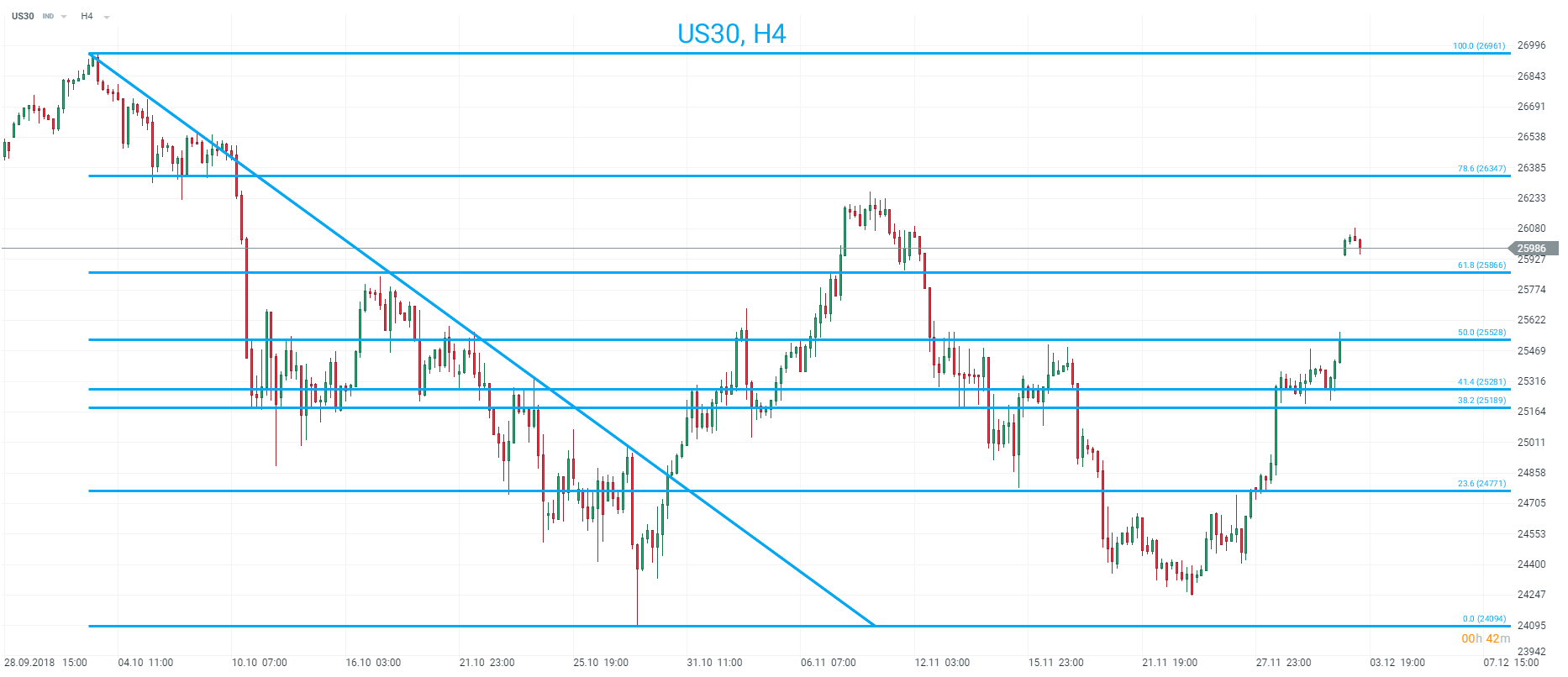

The US30 may be lagging a little behind the gains seen in the US100 today but overall the market has held up better than it’s more tech-related peer of late. Looking at fib retracements from the September high the market has now jumped back above the 61.8% at 25866 and this could be seen as offering possible support. If price falls below there then the 50% fib at 25528 is a potentially key level and unless the market falls below there then the outlook remains positive. The 78.6% at 26347 seems like the last bastion of resistance for shorts if the markets builds on recent gains and if they can’t halt a rally there then a move back to 26961 is on tap.

The US30 has retraced back above the 61.8% of the drop at 25866 and is looking to reclaim the rest of the lost territory in the sessions ahead. Source: xStation

The US30 has retraced back above the 61.8% of the drop at 25866 and is looking to reclaim the rest of the lost territory in the sessions ahead. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.