Summary:

-

US benchmarks still near record highs; confidence remains strong

-

PTJ warns of stock crash on Warren victory

-

Google shares start lower after results

The week started with a bang for US indices with the US500 and US100 both chalking up new all-time highs as the markets extended their recent run higher. Since then the trade has been fairly mixed on the whole but there’s still very little for bears to go on with the markets holding not far from their recent peaks.

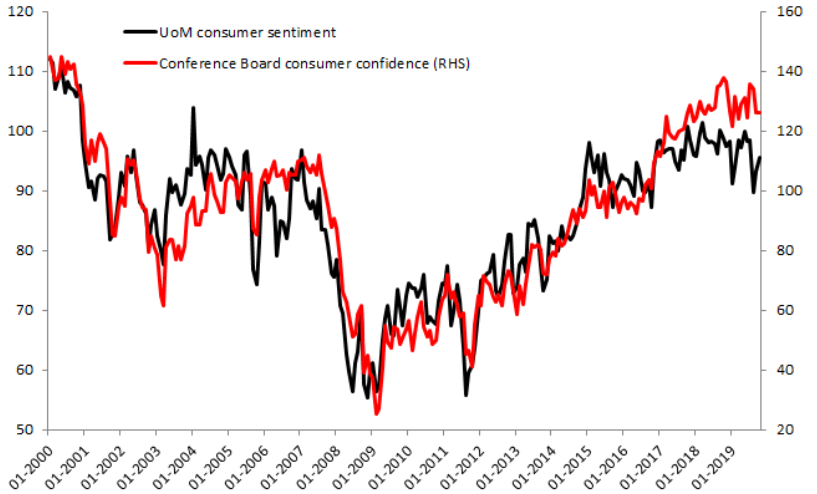

On the data front the latest CB consumer confidence has come in a little lower than expected, but when a sizable upwards revision to the prior is taken into account the overall feeling is still one of strength. For the current month the reading of 125.9 missed the 128.2 consensus forecast, with the prior now standing at 126.3 after 125.1 originally.

The consumer in the US remains fairly upbeat according to the latest conference board data, and both this metric and the Uni Mich equivalent are not far from their highest levels since 2000. Source: XTB Macrobond

It’s still early to get too drawn into next year’s US elections but given the wild swing seen back in 2016 there will no doubt be heightened expectations going into the vote. Incumbent Donald Trump is expected to face a vote on impeachment in the House of Representatives this week and throughout his tenure politics have never strayed far from investors’ minds. Looking ahead to next year billionaire Paul Tudor Jones has joined hedge fund managers Rob Citrone and Jeff Vinik in warning of the adverse impact an Elizabeth Warren presidency could have for stocks. The hedge fund legend warned that the S&P500 will drop 25% if the Democratic senator wins the 2020 election, due to concerns over the proposed wealth tax.

Warren, who advocates for a 2% tax on America’s richest families, “Medicare for all” and new regulations on private equity, is stoking fear on Wall Street as she’s gained momentum in a huge field of candidates for the Democratic nomination. Macro hedge fund manager Citrone, who runs the $2.5 billion Discovery Capital Management, said last week that she could send the market down 10% and 20% if she’s leading the way into the February primaries.

On the earnings front, Google parent company Alphabet are the most noteworthy today with the quarterly results coming in a little worse than expected. A steady rise in online advertising sales was overshadowed by increased costs and poor performance in some of their long-held company investments:

-

Revenue: $40.5B vs $40.3B exp

-

EPS: $10.12 vs $12.28 exp

Shares have begun lower by around 2% this afternoon but have still gained approximately 25% this year - comparable to the broader technology market.

The US100 has dipped a little today, with shares in Google weighing on the market. However, price is still not far from Monday’s all-time high of 8126. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.