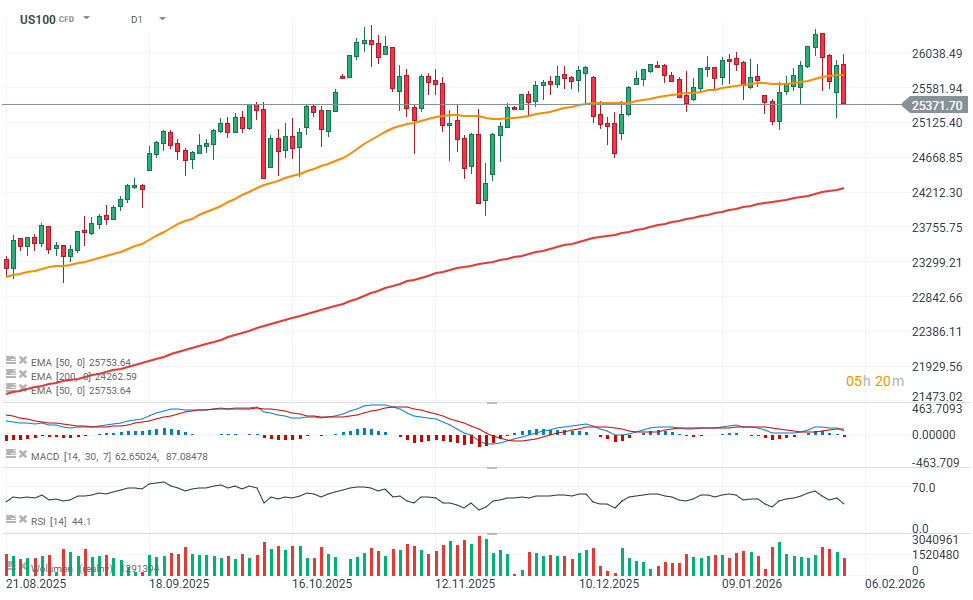

U.S. technology stocks are having a very weak session today, with Nasdaq 100 futures (US100) sliding to around 25,370 points, down nearly 2% on the day. The drop is being driven mainly by an accelerating sell-off across the tech sector, where Nvidia and Microsoft are both down more than 3%. However, today not only BigTech stocks are bleeding, but broader IT & Software stocks are seeing 'systematic selling' with potentially institutions realizing profits or exiting big trades. The downside impulse was further amplified by reports that an Iranian Shahed drone was shot down by an F-35 fighter near the USS Abraham Lincoln carrier strike group. The prospect of higher oil prices could undermine market hopes for Fed rate cuts later this year.

Source: xStation5

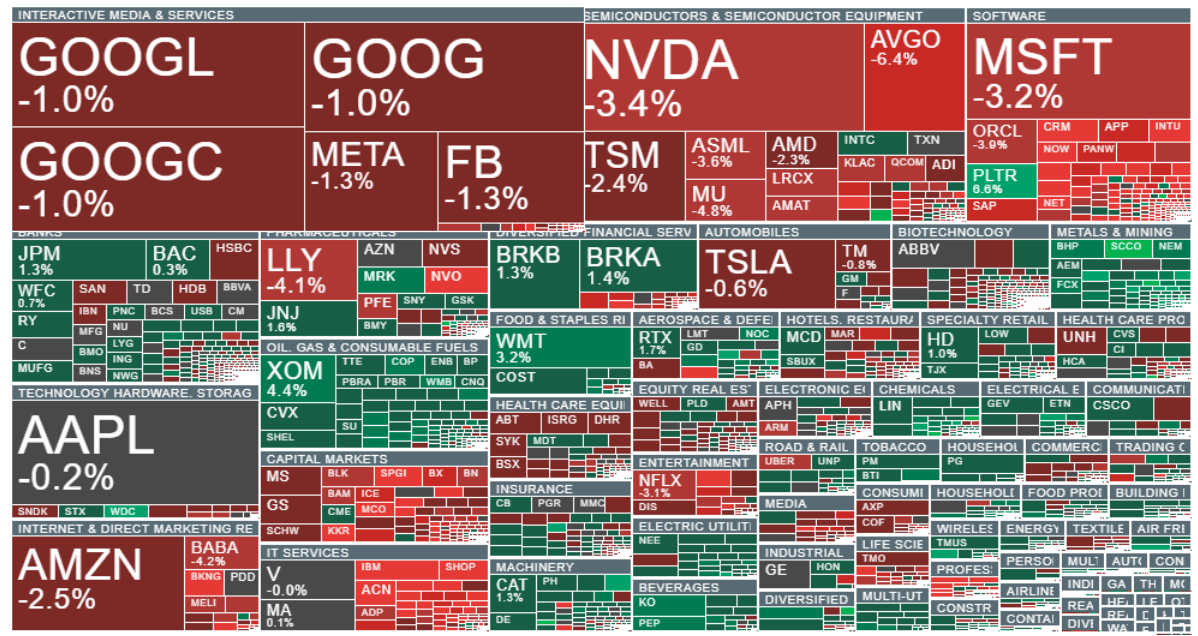

Broadcom shares are down more than 6%, while major software names are also taking heavy losses, including Intuit, ServiceNow, Salesforce, and NetApp. The sharp declines across IT have ultimately spilled over into semiconductors and memory suppliers, with Micron falling nearly 5%. Eli Lilly and Novo Nordisk are also down more than 4%. In contrast, stocks tied to precious metals, oil and gas, as well as banks and the defense sector, are holding up notably better.

Source: xStation5

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

US stocks sell off on Nvidia’s good news, as traders wait for results of key UK election

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

📉US100 loses 2%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.