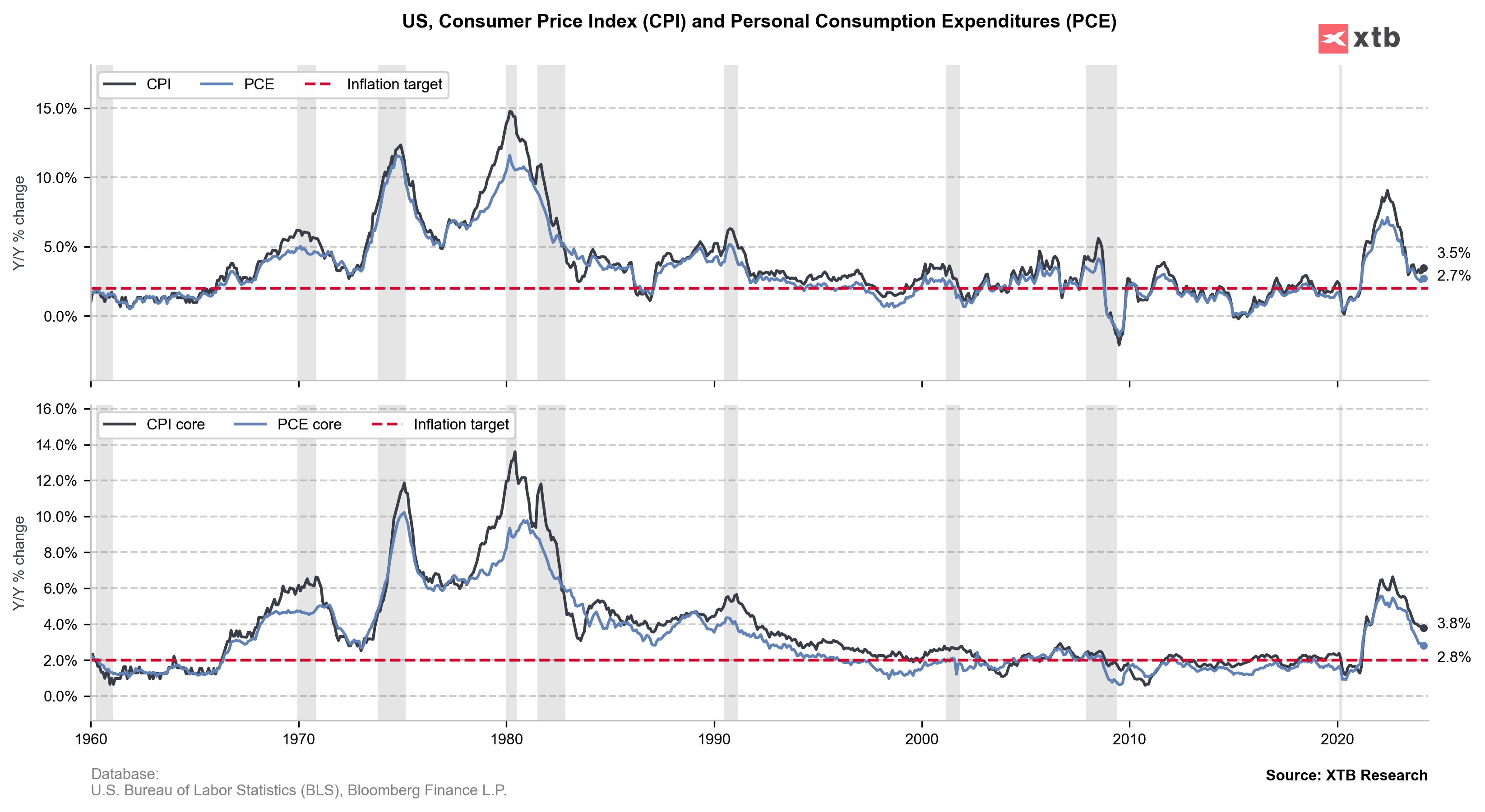

Markets are waiting for a key macro release of the week - US CPI report for April scheduled for 1:30 pm BST today. The report will be closely watched as inflation is now a key factor in Fed's decision-making process. However, recent data from the US economy has been rather hawkish. Let's take a quick look at what markets and economists expect from today's release!

What market expects?

Market expectations for today's reading are pointing to a slowdown in headline and core annual CPI measures. Headline gauge is seen slowing from 3.5 to 3.4% YoY, while core measure is expected to drop from 3.8 to 3.6% YoY. A slowdown would be welcome and would support dovish bets in money markets. However, it should be noted that every CPI reading release since the beginning of 2024 has surprised to the upside so far.

Range of economists' estimates in Bloomberg survey is 3.2-3.5% for the headline CPI print and 3.5-3.8% for the core CPI print. This means that none of the more than 40 economists surveyed expects an acceleration, what is a welcome development following two months of acceleration in February and April. Nevertheless, this also means that market reaction in case of an unexpected acceleration can be significant.

US, CPI inflation report for April

- Headline (annual). Expected: 3.4% YoY. Previous: 3.5% YoY

- Headline (monthly). Expected: 0.4% MoM. Previous: 0.4% MoM

- Core (annual). Expected: 3.6% YoY. Previous: 3.8% YoY

- Core (monthly). Expected: 0.3% MoM. Previous: 0.4% MoM

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

What other reports tell us about US inflation?

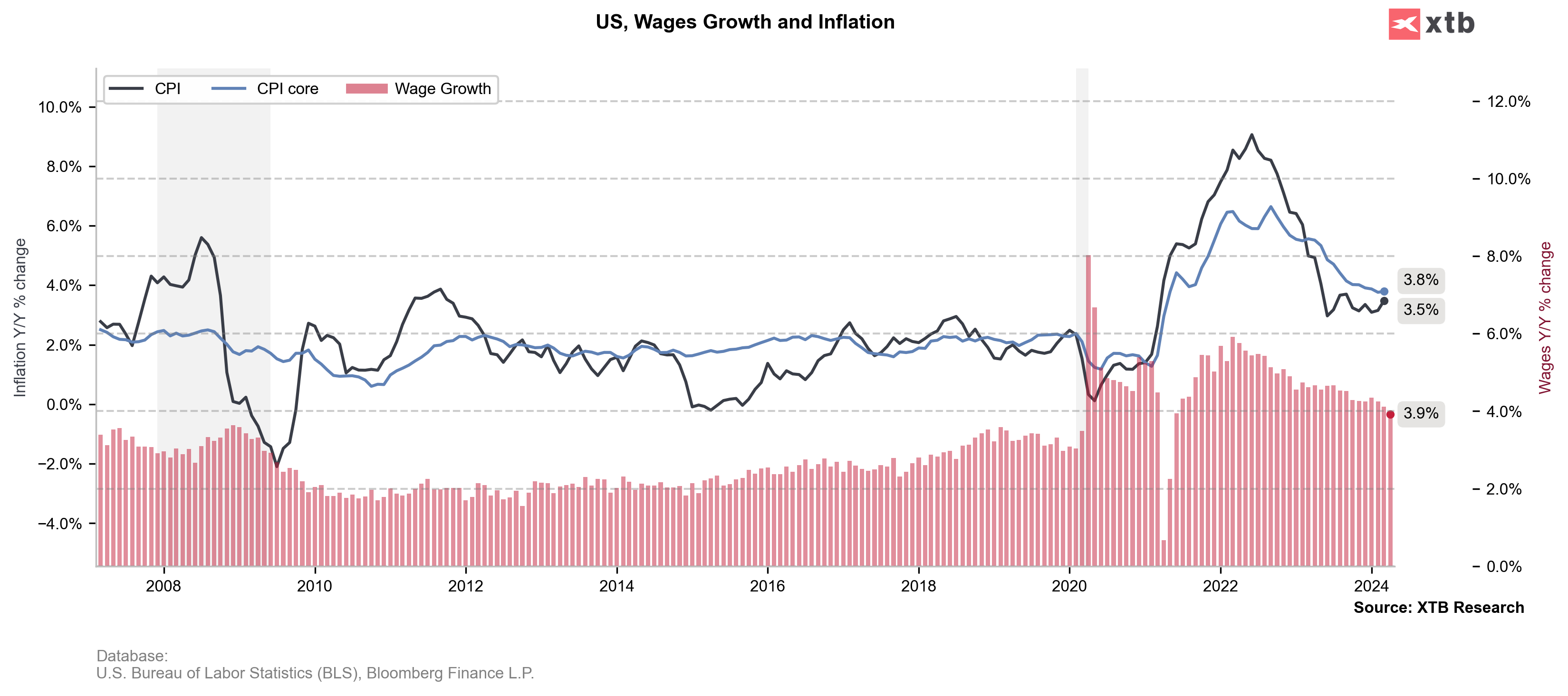

Recent data from the United States seems to support the view of inflation remaining an argument against rather than in favor of rate cuts. PPI inflation report for April released yesterday, came in more or less in-line with market expectations, although beat in monthly data was a surprise. However, much higher-than-expected readings of ISM price subindices as well as pick-up in University of Michigan inflation expectations are clearly hawkish. On the other hand, a further slowdown in wage growth could help cool services inflation.

- US headline PPI inflation accelerated from 1.8% to 2.2% YoY in April, in-line with market expectations. Monthly inflation came in at 0.5% MoM, higher than 0.3% MoM expected by economists

- US core PPI inflation accelerated from 2.1% to 2.4% YoY in April, also in-line with market expectations. However, monthly core PPI came in at 0.5% MoM and also exceeded economists' expectations (0.2% MoM)

- Manufacturing ISM Prices subindex jumped from 55.8 to 60.9 in April (exp. 55.5)

- Non-manufacturing ISM Prices subindex jumped from 53.4 to 59.2 (exp. 55.0)

- Average hourly earnings growth slowed from 4.1 to 3.9% YoY (exp. 4.0% YoY). On a monthly basis, earnings growth reached 0.2% MoM (exp. 0.3% MoM)

- University of Michigan 1-year inflation expectations jumped from 3.2% to 3.5% in May (exp. 3.2%), while 5-year inflation expectations climbed from 3.0 to 3.1% (exp. 3.1%)

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

What today's reading means for Fed?

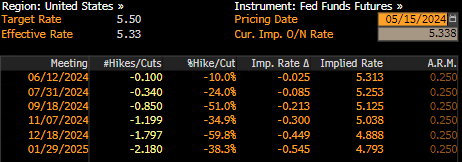

The first Fed rate cut looks to be getting more and more distant. While as recently as a few months ago, money markets saw a rate cut in June as not only likely, but almost certain. However, US data that has been reported since the beginning of 2024 has been stubbornly hawkish - economic growth and labour market remained strong, and inflation continues to run above Fed's target.

Moreover, this week's comments from Fed Chair Powell further hint that the June rate cut is a wishful thinking. Powell acknowledged that recent data did not encourage confidence that inflation is on the path towards a target, and that his confidence in inflation slowing is not as high as it was earlier this year.

Having said that, even a dovish surprise in today's data is unlikely to encourage Fed to cut rates in the first half of this year. It could help guide market expectations towards September as the timing of the first cut. Still, a further confirmation would be likely needed in the coming months to make Fed confident enough that inflation is returning to target and that time for rate cuts has come. Currently, money markets see an around-50% just of Fed delivering the first rate cut in September.

Money markets are seeing just a 50% chance of Fed cutting rates on September meeting. Source: Bloomberg Finance LP, XTB Research

USD weakens ahead of CPI release

US dollar is likely to experience a volatility jump following release of US CPI data for April. It should also be noted that US retail sales data for April will be released simultaneously at 1:30 pm BST, and it will also influence market reaction. USD is pulling back today, and is the worst performing G10 currency at press time. Taking a look at USDJPY chart at H1 interval, we can see that the pair has halted recent upward move and pulled back to the 23.6% retracement of the upward impulse launched on May 3, 2024. A hawkish surprise in the data, especially an unexpected inflation acceleration, could help revive the upward move and push the pair above 156.75 area.

Source: xStation5

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.