Market expectations suggest that investors will be offered a strong NFP report for January later today, following solid data released for December. December's report not only showed an over-200k jobs gain, but also a drop in the unemployment rate to 3.7%. On the other hand, there were also some negative factors, and it should be said that January's data is often confusing. Will a negative surprise in today's data raise concerns over the US economy and boost chances for a March rate cut?

Market expectations

Consensus among economists is for a 180k increase in US employment in January, what may be seen as a high reading given risk factors present. Bloomberg Intelligence suggests that 160k gain is more likely. Data for December showed a job growth of 216k.

- Market expects a negative revision to November and December employment data, what may cause the report to be seen as a negative

- Weather, benchmark adjustments, population revision and other seasonal adjustments may have a negative impact on January's reading

- San Francisco Fed estimates that good weather in December may have boosted employment by as much as 90k, while low temperatures in January may have a negative impact of around 25k

- Market consensus suggests a rebound in unemployment rate back to 3.8%, amid slowdown in hiring and increased participation

- Wage growth is also seen slowing to 0.3% MoM in January, down from 0.4% MoM reported in December

- According to Bloomberg, seasonal factors may cause January's NFP data to be less credible, and investors should instead focus on 2022-2023 revisions

- If revisions are significant and show that labor market was not as robust as data hinted, it may cause Fed to act quicker on rate cuts

- There is even a slim chance of January's employment dropping, what would be the first employment drop since December 2022. Nevertheless, it will be driven by aforementioned seasonal factors and statistical error

- According to Powell, neutral jobs growth is around 100k per month. Any reading below that could boost odds for quicker rate cuts from Fed

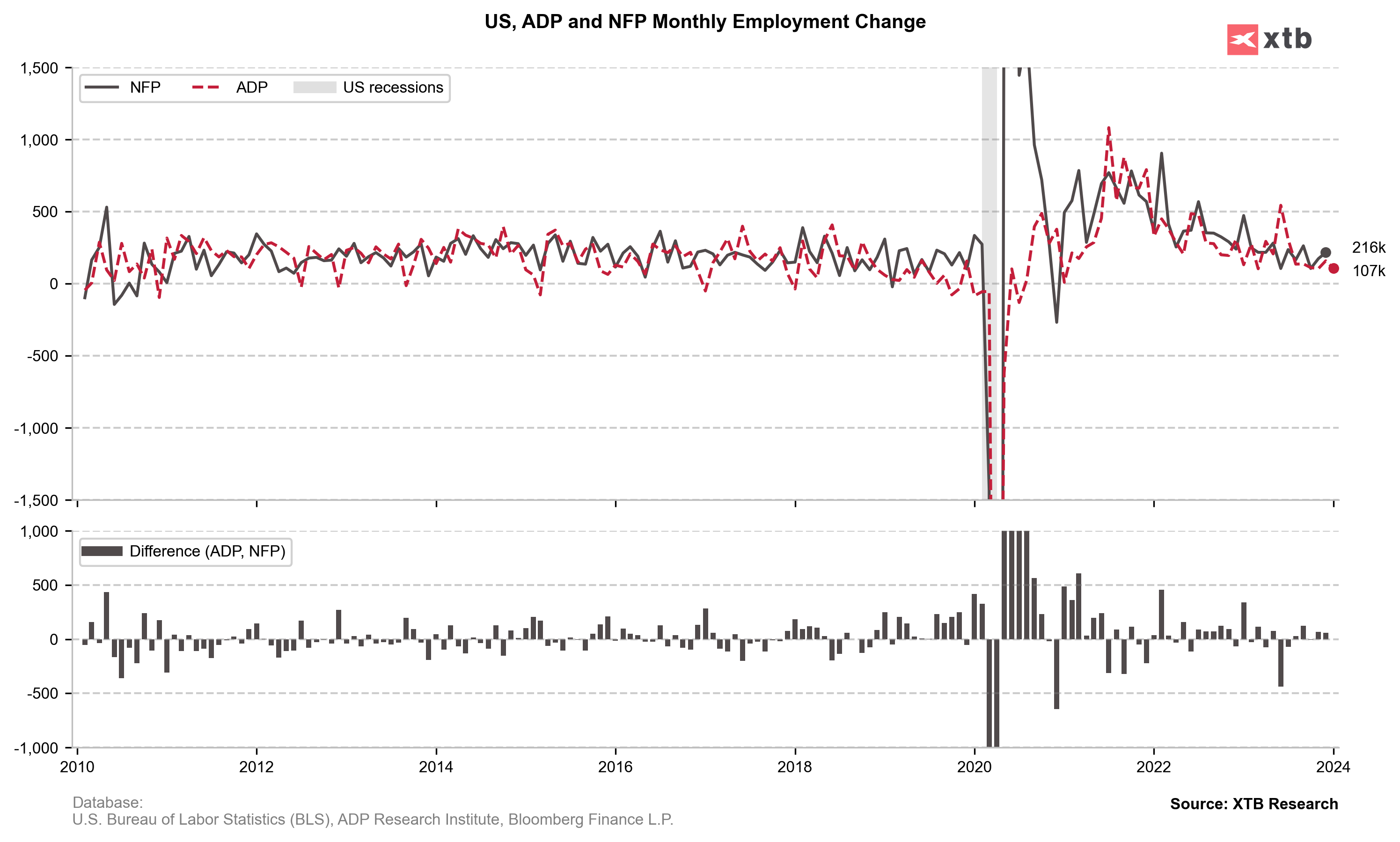

Poor ADP reading, rebound in jobless claims, low reading of manufacturing ISM Employment subindex as well as recent JOLTS drops (although December brought rebound) are factors that are hinting at possible weak January data. On the other hand, it should be said that ADP was a rather poor predictor of NFP readings in recent months, therefore one cannot rule out a positive surprise today. It looks like every reading above 150k can be seen as further tightening of the labour market.

Comparison of ADP and NFP readings. Source: Bloomberg Finance LP, XTB

Comparison of ADP and NFP readings. Source: Bloomberg Finance LP, XTB

How will markets react?

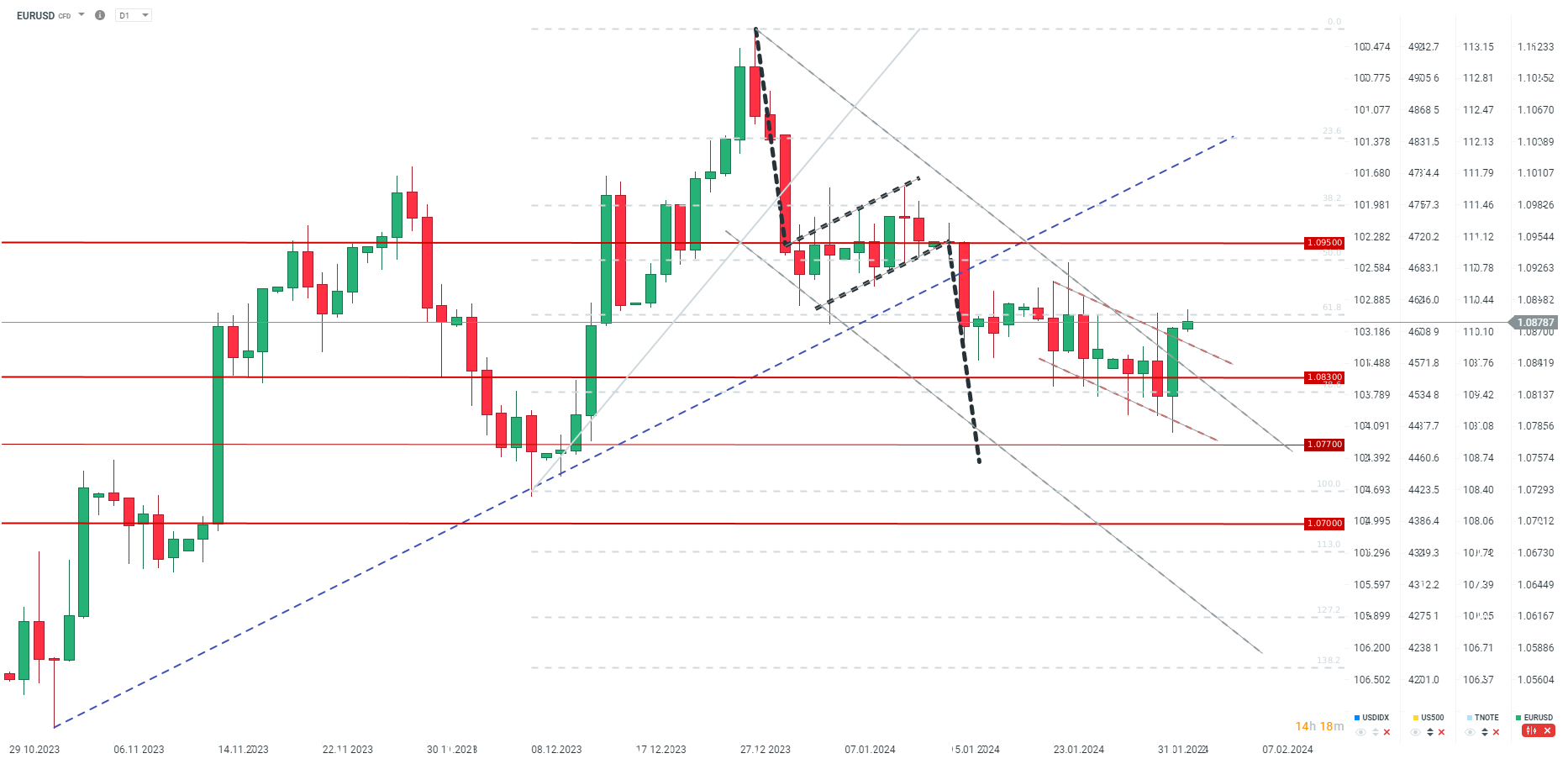

EURUSD broke above the main and short-term bearish channels. The pair is reacting to demand zone above 1.08 mark, but at the same time a strong supply side reaction could be spotted in the 1.0890-1.0900 area. Should NFP disappoint, there is a chance for the pair to end the week on a positive note and break out of the downtrend sequence. On the other hand, if NFP report comes in strong and support USD, a test of the 1.0800-1.0830 area will be key. A break below this area could pave the way for a drop towards local lows from the beginning of December.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.