Summary:

- US dollar rallies in the morning registering the largest gains against NZD and NOK

- The White House and the US Congress have struck a deal to increase a debt ceiling

- RBNZ takes a look at unconventional monetary policy options at hand

Higher across the board

The US dollar is by far the strongest major currency in early European trading, and as a result the EURUSD is already trading below the key level of 1.12. The largest gains are seen against the Norwegian krone as well as the New Zealand dollar. In case of the former we may talk about an impact coming from oil prices which have stopped rising of late. In turn, the NZ dollar seems to be under pressure after Bloomberg reported some RBNZ-related headlines (we write about this topic further in this analysis). As far as the latest revelations are concerned, one needs to mention a deal struck between the White House and the US Congress to increase the so-called debt ceiling until the middle of 2021. It needs to be confirmed by both the House (it has to do so before July 26 when a six-week recess starts) and the Senate which could put it to a vote as late as next week. However, expectations suggest that the higher debt ceiling will become law and it if happens, it would mean that the next budgetary stand-off would arise after presidential elections scheduled for next year. Undoubtedly, this is a big advantage for Donald Trump who will be running for his second term in office.

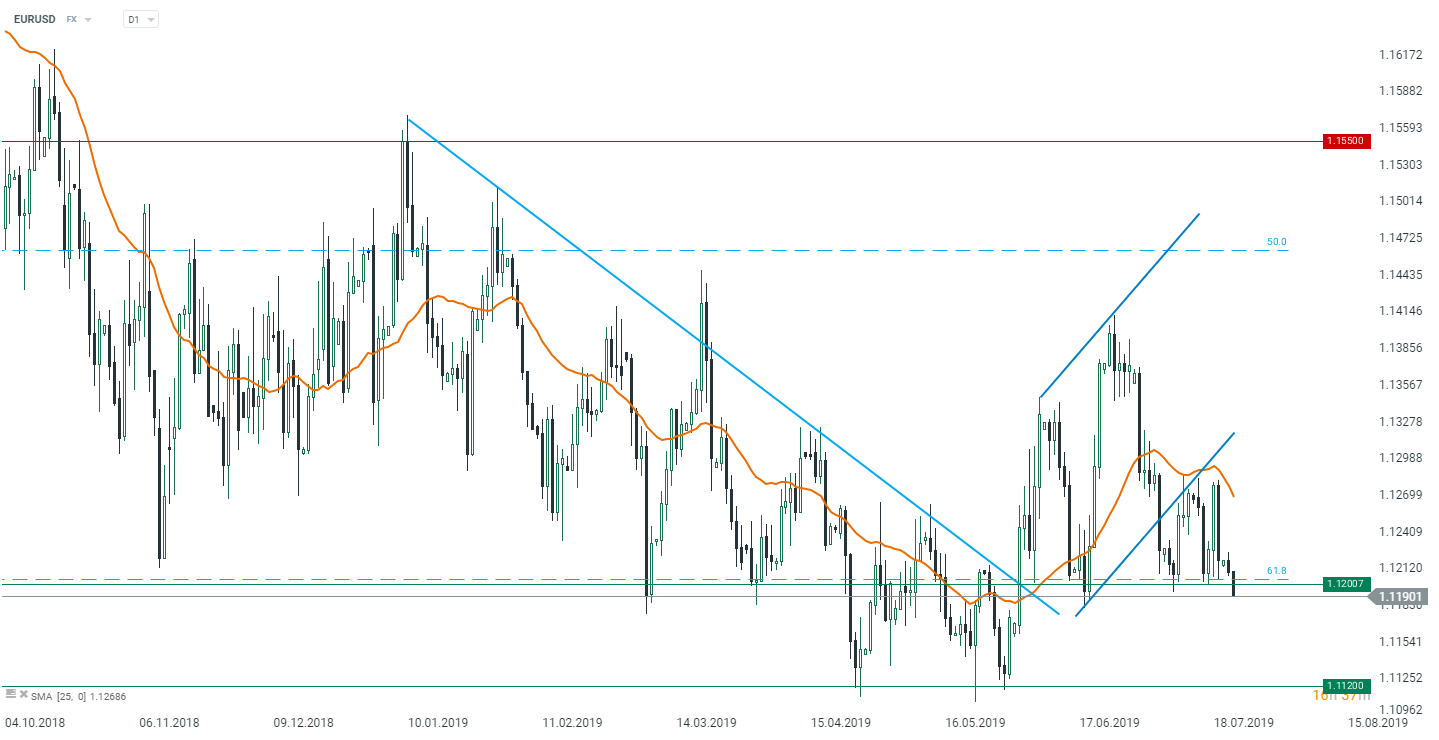

The EURUSD is trading below its crucial place at 1.12 and from a pure technical viewpoint one could suppose that the pair may be heading lower. On the other hand, one cannot forget about the upcoming ECB meeting which may rattle both the euro and Europen stocks and bonds. Looking at the chart above one may conclude that 1.112 seems to be a so-called line in the sand. Ultimately, the greenback could also come under downward pressure relatively soon after the Federal Reserve begins rate cuts. Source: xStation5

The EURUSD is trading below its crucial place at 1.12 and from a pure technical viewpoint one could suppose that the pair may be heading lower. On the other hand, one cannot forget about the upcoming ECB meeting which may rattle both the euro and Europen stocks and bonds. Looking at the chart above one may conclude that 1.112 seems to be a so-called line in the sand. Ultimately, the greenback could also come under downward pressure relatively soon after the Federal Reserve begins rate cuts. Source: xStation5

RBNZ looks at unconventional measures

According to a Bloomberg article, the Reserve Bank of New Zealand is taking another look at its strategy for unconventional monetary policy. “This year the Reserve Bank has begun scoping a project to refresh our unconventional monetary policy strategy and implementation. This is at a very early stage,” the RBNZ said in response to an Official Information Act request regarding work on non-standard policy measures submitted by Bloomberg. Here, it is worth referring to a paper on unconventional policy released by the RBNZ last year where some signals regarding so-called quantitative easing occurred. Hence, in theory the New Zealand central bank could begin purchasing either government or corporate bonds, a move aimed at lowering long-term rates. So far, we have not been offered more details on this kind of topics as the RBNZ declined to elaborate on the response it sent to Bloomberg. Either way, the NZ dollar remains under selling pressure this morning being 0.4% down against the US dollar.

The NZ dollar is retreating following the report brought by Bloomberg. The first technical support might be found in the vicinity of the blue trend line. Source: xStation5

The NZ dollar is retreating following the report brought by Bloomberg. The first technical support might be found in the vicinity of the blue trend line. Source: xStation5

In the other news:

-

BoJ’s Kuroda reiterated on Monday that the Bank of Japan would persistently continue with powerful monetary easing to maintain momentum towards achieving its 2% goal

-

US negotiators are set to visit Beijing next week for face-to-face trade talks, according to South China Morning Post

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.