Release of the US jobs data for November is a key market event of the day. NFP report will be released at 1:30 pm GMT and is expected to show a bigger employment gain than in October. While monthly wage growth is seen accelerating more than in October, wage growth on an annual basis is expected to decelerate to 4.0% YoY. However, an already-released US labor market data for November suggests that we may have a disappointing NFP reading ahead.

What markets expects from today's NFP reading?

- Non-farm payrolls. Expected: 180k. Previous: 150k

- Private payrolls. Expected: 153k. Previous: 99k

- Unemployment rate. Expected: 3.9%. Previous: 3.9%

- Wage growth (annual). Expected: 4.0% YoY. Previous: 4.1% YoY

- Wage growth (monthly). Expected: 0.3% MoM. Previous: 0.2% MoM

Worrying signals from other jobs reports

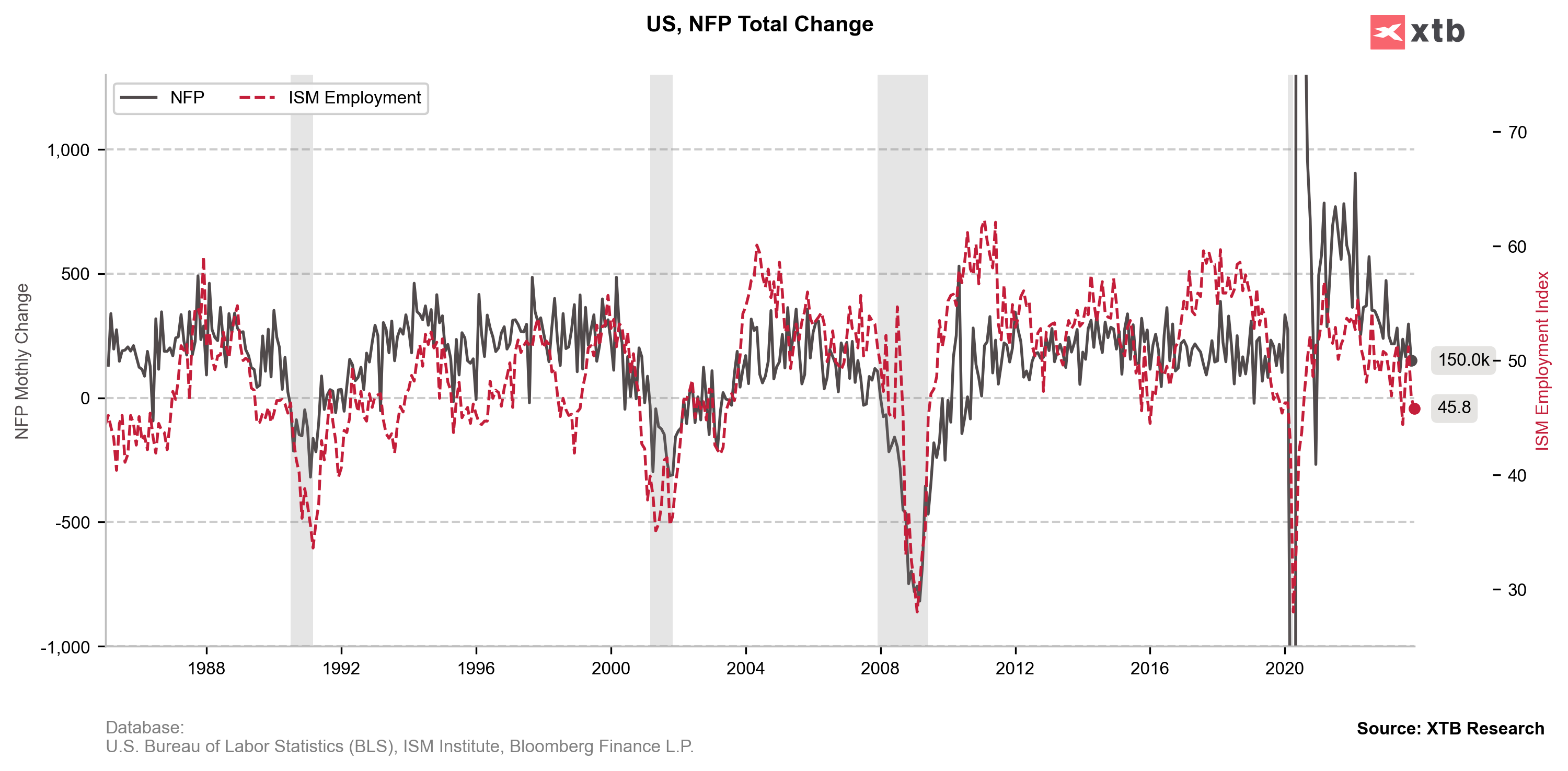

ADP report for November missed expectations and showed a 103k employment gain for the previous month. Moreover, data for October was revised lower from 113k to 106k. Also, employment subindices in services and manufacturing ISM reports for November both came in below expectations. Challenger report also hinted at more planned lay-offs than a month ago. However, it should be said that services ISM employment subindex improved compared to a previous reading and planned lay-offs are much smaller than they were in November 2022.

On the other hand, employment growth could get a boost as two major workers' strikes were resolved in November - United Auto Workers strike and Hollywood actors strike. It is estimated that end of those two strikes will provide an around-40k boost to employment growth.

Already released US labor market data for November

- Manufacturing ISM employment (November): 45.8 vs 47.6 expected (46.8 prior)

- Services ISM employment (November): 50.7 vs 51.4 expected (50.2 prior)

- ADP report (November): 103k vs 130k expected (106k previously)

- Challenger report (November): 45.51k vs 36.84k previously (-40.8% YoY)

Source: Bloomberg Finance LP, BLS, XTB

Source: Bloomberg Finance LP, BLS, XTB

Will today's data matter for the Fed?

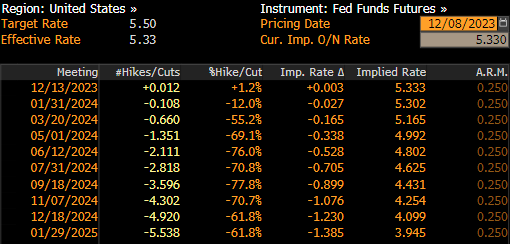

Jobs data always matter for the Fed as it pursues its dual-mandate of keeping inflation stable and achieving maximum sustainable employment. However, it is highly unlikely that today's print will have any impact on FOMC rate decision scheduled for Wednesday next week. Expectations for NFP data suggest further cooling of the US labor market and slowdown in wage growth means that inflationary pressures ease. Such developments seem to confirm that further rate hikes are not needed anymore.

However, it does not mean that markets will look past today's release. Severity of jobs market cooling would likely impact market pricing for rate cuts next year. Should the report come in weaker-than-expected, markets may start pricing in rate cuts earlier. Right now, the first rate cut is fully priced in for May 2024 meeting, with pricing for March 2024 meeting showing an over-50% chance of a cut. Weak NFP data would boost dovish bets and it may weaken USD and boost equities. However, should the pricing get extremely dovish and suggest that rate cuts will begin already in Q1 2024, Fed may be forced to cool these expectations and push back against them at the next week's meeting.

Source: Bloomberg Finance LP

A look at the markets

EURUSD

Main currency pair has been sliding recently as USD regained some of its shine. EURUSD tested 1.0750 support zone this week but failed to break below it, and an upward correction was launched. However, this correction failed to break above the upper limit of market geometry or paint a higher high, and the technical outlook remains bearish. However, a strong NFP print may be needed to maintain the downtrend. Source: xStation5

Main currency pair has been sliding recently as USD regained some of its shine. EURUSD tested 1.0750 support zone this week but failed to break below it, and an upward correction was launched. However, this correction failed to break above the upper limit of market geometry or paint a higher high, and the technical outlook remains bearish. However, a strong NFP print may be needed to maintain the downtrend. Source: xStation5

US100

Recent upward move on Nasdaq-100 futures (US100) was halted at the 16,035 pts swing area earlier this week. The index has been trading in a tight range between 16,000 pts support and 16,035 pts resistance since. NFP report today may provide fuel for a breakout, with weak NFP report being equity-positive due to increased likelihood of rate cuts starting earlier. Source: xStation5

Recent upward move on Nasdaq-100 futures (US100) was halted at the 16,035 pts swing area earlier this week. The index has been trading in a tight range between 16,000 pts support and 16,035 pts resistance since. NFP report today may provide fuel for a breakout, with weak NFP report being equity-positive due to increased likelihood of rate cuts starting earlier. Source: xStation5

GOLD

GOLD spiked to all-time highs at the start of this week's trading but has since erased all those gains and pulled back below the $2,070 price zone. Pullback was halted at the $2,000-2,010 support zone, at least for now. Post-NFP moves on GOLD will be driven by USD, with a weak jobs data having potential to weaken USD and boost precious metals. Source: xStation5

GOLD spiked to all-time highs at the start of this week's trading but has since erased all those gains and pulled back below the $2,070 price zone. Pullback was halted at the $2,000-2,010 support zone, at least for now. Post-NFP moves on GOLD will be driven by USD, with a weak jobs data having potential to weaken USD and boost precious metals. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.