The new week started with the strength of the US dollar against major currencies, while yields continue to rise and US indices are under pressure once again. On the other hand, the FED continues to ignore the current situation.

Looking at eur/usd on a 4-hour time frame chart, we can see that the price has broken below the corrective channel and has made a new relative low and the bearish pressure remains in the euro.

However, also we can look at RSI that is showing signs of oversold in the short term and could justify a correction of the recent bearish momentum. In addition, the chart below shows that USD is losing is losing strength in the short term and may reinforce the possibility of a EUR / USD recovery.

Eur/usd, timeframe 4H. Source: xStation

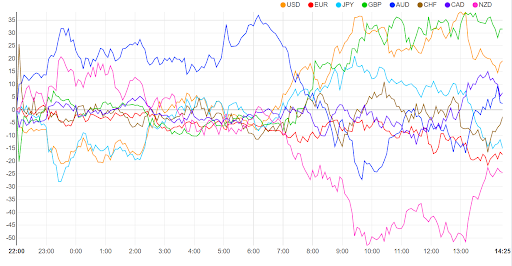

As we can see in the chart below, USD and GBP have the best performance, while NZD and EUR have the worst performance.

Source: currency-strength.com

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.