Summary:

-

USD index rises close to 2018 peak

-

The greenback is set for a solid month of gains

-

US consumer confidence comes in at highest since 2000

It’s looking like another day of solid gains for the US dollar, with the buck rising against most of its peers. After falling to the low 93s back in mid-September a trade weighted index of the US dollar has been in a steady grind higher, with the market now closing in on its 2018 peak set back in August. Should there be a green close today then 4 of the past 5 days will have seen an appreciation in the buck and given the strong fundamental growth and employment figures from the US of late, as well as the fairly marked divergence in monetary policy it’s not hard to justify these gains.

The USD index is looking for another day of gains and is back near its YTD peak of 96.87 after a steady move higher in recent weeks. Source: xStation

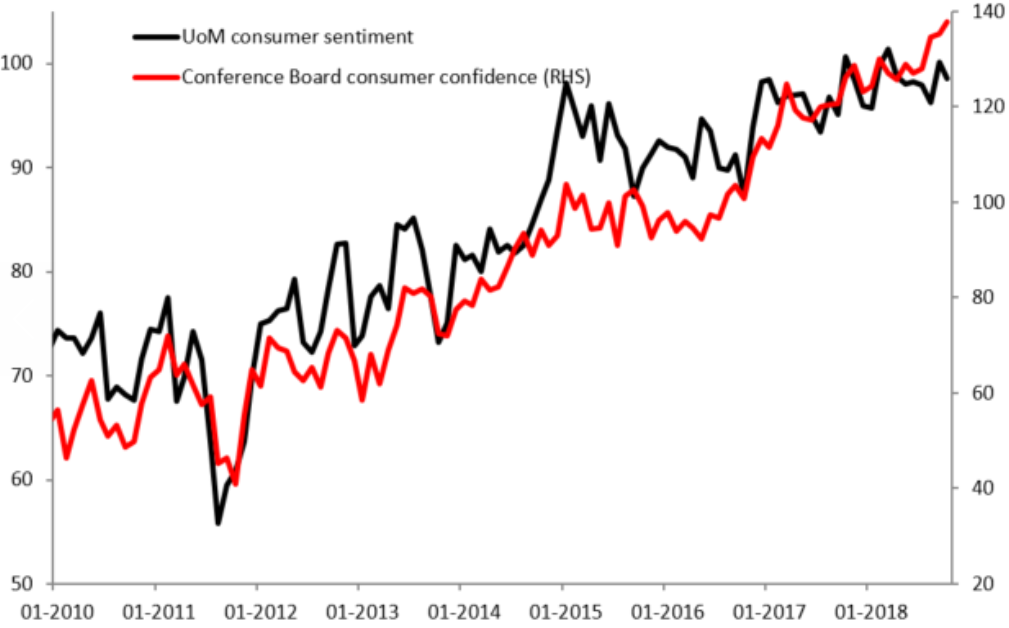

This afternoon the only data of note for the USD was the Conference Board consumer confidence figure which surprised to the upside in printing its highest reading since 2000. The number of 137.9 was comfortably above the 135.9 expected, but it should be noted that this was only a 18-year high because the prior reading of 138.4 was revised lower to 135.3. Another consideration which should be made is that while this data is for the month of October, the survey was concluded by the 18th and therefore was before a large chunk of the selling seen in the stock market.

The latest strong consumer sentiment reading from the CB extends the run higher seen for much of this decade and is more pleasing given the recent pullback in the Uni Mich equivalent. Source: XTB Macrobond

One of the most interesting USD pairs at present is the USDJPY which has broken above the 38.2% fib today. The market ran into some resistance at the 50% fib of 112.95 but as long as price doesn’t move back below 112.58 then further gains are possible with the 61.8% fib at 113.33. Source: xStation

One of the most interesting USD pairs at present is the USDJPY which has broken above the 38.2% fib today. The market ran into some resistance at the 50% fib of 112.95 but as long as price doesn’t move back below 112.58 then further gains are possible with the 61.8% fib at 113.33. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.