The Federal Reserve left fed funds rate at 0-0.25% and bond-buying at a $120 billion monthly pace. Still, the central bank said the economy has made progress toward employment and inflation goals and that if progress continues broadly as expected, a moderation in the pace of asset purchases may soon be warranted. The Fed also signalled interest rate increases may follow more quickly than expected, with 9 of 18 policymakers projecting borrowing costs will need to rise in 2022.

We will hear more from Powell at 7:30 pm BST during his press conference.

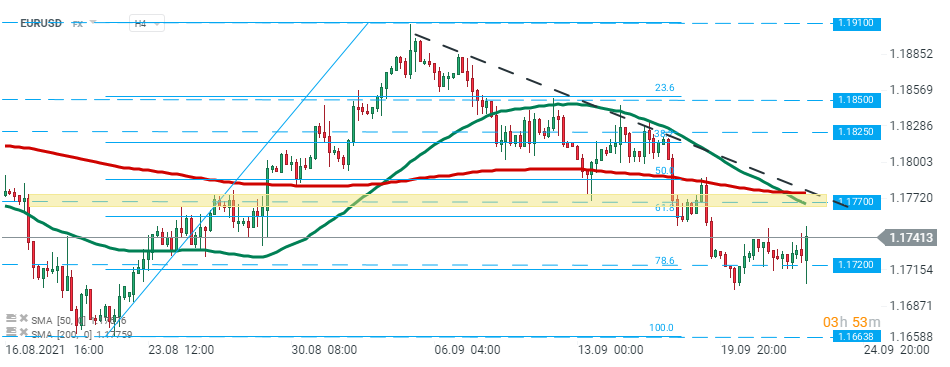

EURUSD bounced off the 1.1720 support after Fed decision and is heading towards major resistance level at 1.1770. Source:xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.