Summary:

-

Canadian employment change: 11.2k vs 15.0k expected

-

Unemployment rate falls to 5.8% average earnings miss (Y/Y +1.9% vs 2.3% exp)

-

CAD dropping lower in reaction

At the same time as the US jobs report is released, the Canadian equivalent is also announced, and given that the Lion’s share of attention is south of the border, it’s easy to overlook some good trading opportunities on this. The employment change for October in Canada came in at +11.2k vs +15.0k expected, marking a pretty large drop on the prior print of 63.3k. The composition of the jobs was better however, with full-time roles increasing by 33.9k (20k exp, prior -16.9k) and part time falling by 22.6k (-4.1k exp, +80.2k prior).

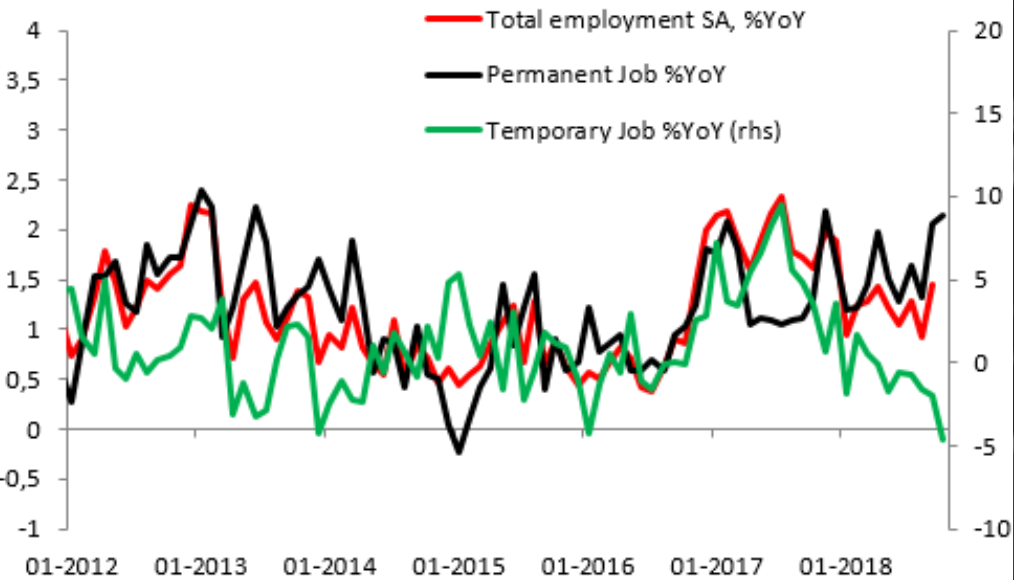

Total employment rose by a little less than expected in the latest release but the composition of the roles improved with permanent jobs rising and temporary ones falling. Source: XTB Macrobond

While the employment component of the report is pretty good the best part arguably came from the unemployment rate which dipped to 5.8% from 5.9% previously. This had been expected to remain at 5.9%. This is the join lowest level this year and marks a second consecutive drop after this metric hit a 2018 peak of 6.0% in the September release. Having said that this good news was more than outweighed by the wage figures and this has caused the Canadian dollar to fall back since the release.

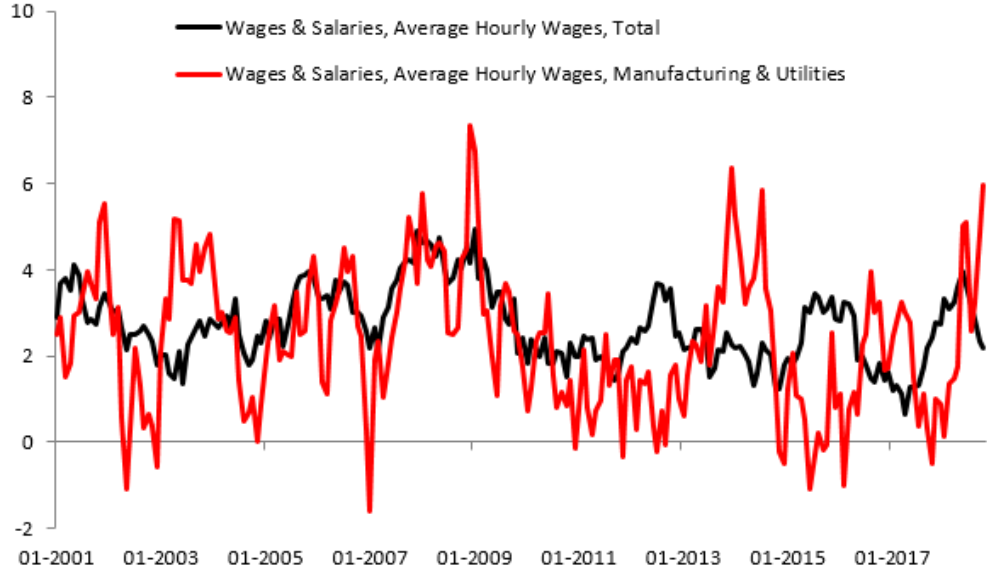

Average hourly earnings had been expected to rise by 2.3% y/y after a reading of 2.2% last time out, but there was a pretty big miss here, with a reading of 1.9%. If we look at just the manufacturing and utilities numbers there was more bright news, but on the whole it seems a little negative for CAD.

Despite a pick up in the manufacturing and utilities sectors, wages dropped on the whole last month which came as a negative shock as they were predicted to rise. Source: XTB Macrobond

Overall the outlook for USDCAD is a little unclear at present with the pair showing no real clear direction. Last week a push lower after a hawkish hike from the BOC was met with buying but after breaking out of a falling channel going back to June the market has meandered somewhat. This Wednesday the price looked to make a push higher but was met with a firm rejection and a bearish engulfing candle yesterday. This heightens the importance of the resistance around 1.3170. Support may be found around the daily lows of 1.3050.

USDCAD has seen quite a lot of chop lately with a push higher on Wednesday met with a bearish engulfing candle yesterday. Today the market is rising after the US and Canadian jobs release with 1.3050 now possible support and 1.3170 resistance. Source: xStation

USDCAD has seen quite a lot of chop lately with a push higher on Wednesday met with a bearish engulfing candle yesterday. Today the market is rising after the US and Canadian jobs release with 1.3050 now possible support and 1.3170 resistance. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.