Summary:

-

Canadian core retail sales rise more than forecast

-

Latest core inflation figures also rise

-

USDCAD holds key support at 1.2885

The Canadian dollar has received a short term boost this afternoon with the latest consumer spending figures beating forecasts sending the Loonie higher against most of its peers, although these initial gains were since pared somewhat. In M/M terms the headline retail sales figure rose by 0.3% as expected, marking a comeback from the 0.2% drop last time out. But it was the core figure which delivered the best bit of news with a rise of 0.9% M/M above the 0.6% expected and further above the -0.1% seen last time out. There could be some seasonality at play here however, with the year-on-year figures not looking quite so positive and the core reading here is substantially below the headline.

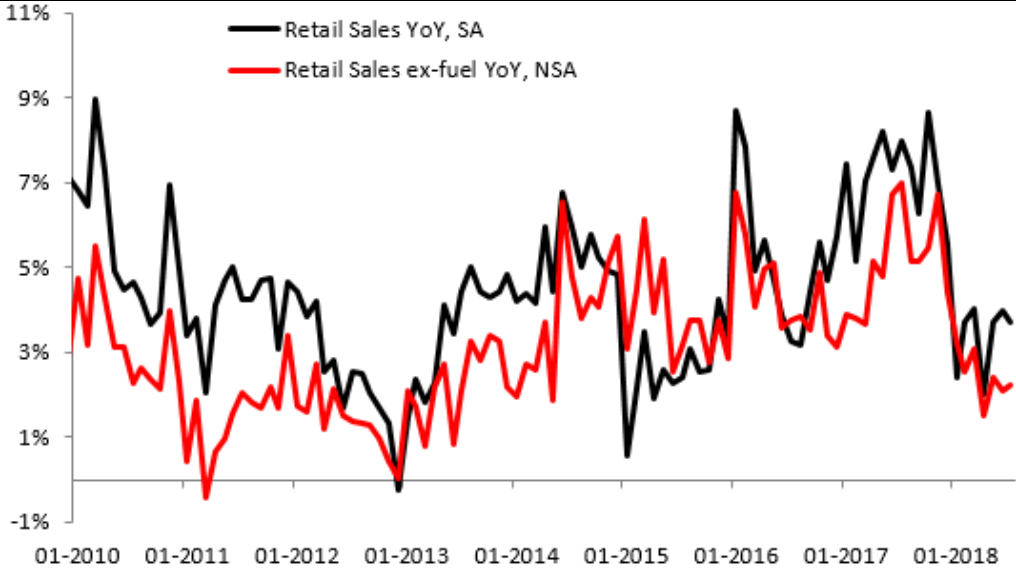

The bigger picture for Canadian retail sales isn’t so good however, with the core reading opening up a notable divergence with the headline. The former is also close to its lowest level in several years. Source: XTB Macrobond

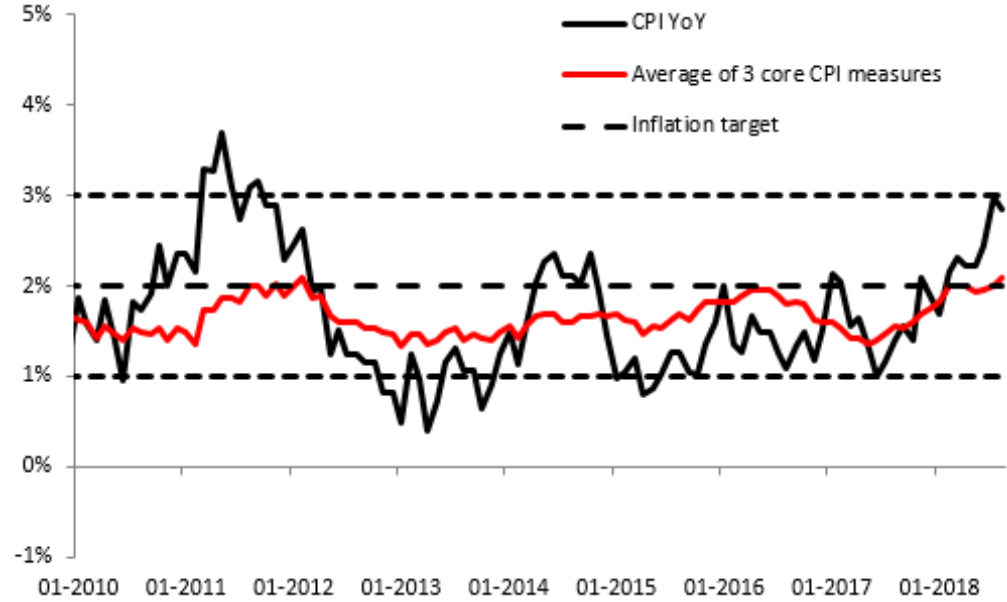

At the same time as the retail sales data was released we also got the most recent inflation figures with the overall picture a little positive for CAD. . In Y/Y terms the CPI fell to 2.8% as expected after the prior reading showed a huge jump of 3.0% - the largest since 2011. The core figures were all marginal beats with the common, median and trimmed beating by 0.1% to come in at 2.0%, 2.1% and 2.2% respectively.

Headline inflation pulled back from a 7-year high in the last month but the average of the 3 core measures increased again and in now above the 2.0% mid-point of the inflation target. Source: XTB Macrobond

Headline inflation pulled back from a 7-year high in the last month but the average of the 3 core measures increased again and in now above the 2.0% mid-point of the inflation target. Source: XTB Macrobond

USDCAD has respected the 1.2885 level once more despite the slightly positive Canadian data. This could now be viewed as key support. Source: xStation

USDCAD has respected the 1.2885 level once more despite the slightly positive Canadian data. This could now be viewed as key support. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.