Summary:

- Wall Street to open higher boosted by US-Mexico trade truce

- Merger Monday legend lives on with the announcement of another two big deals

- Insys Therapeutics (INSY.US) files for bankruptcy protection as the first drugmaker involved in US opioid crisis

The US stocks are eyeing a green opening on the first trading day of the new week. Sentiment is buoyed by upbeat news from the US-Mexico trade front. Namely, it all turns out that no tariffs on the Mexican goods will be levied as an agreement was reached. Let us recall that Mexico pledged to take action in order to limit the amount of illegal migrants crossing the US-Mexico border and obliged to buying more US agricultural products. Now the Mexican legislative body needs to approve the agreement. While this should not be much of a problem, Donald Trump decided to warn Mexico in advance that a failure to get the deal through the parliament lead to reinstatement of tariffs. With that hurdle out of the way, markets’ focus will return to US-China trade spat.

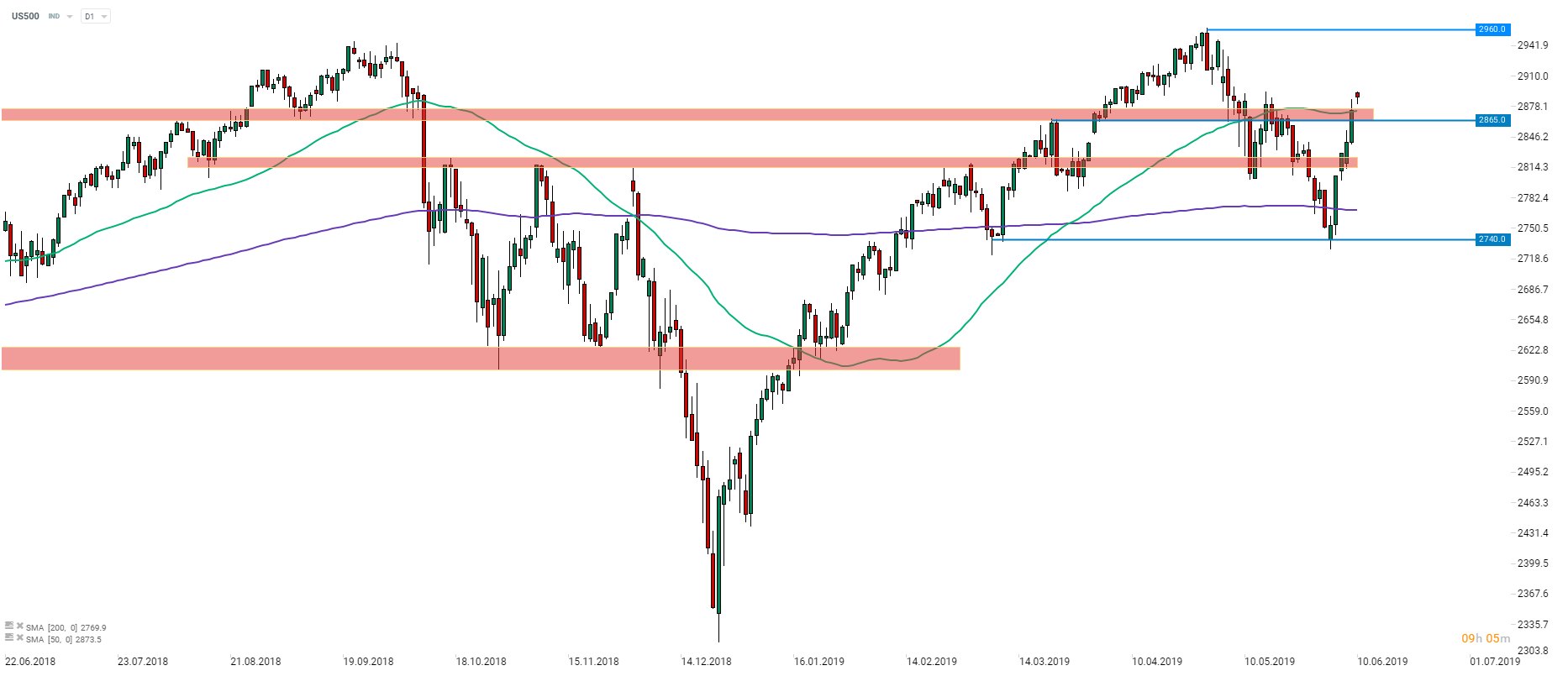

S&P 500 futures (US500) launched the week with a quite big upward price gap. The index is trading above the resistance zone (2865-2875) and above the 50-session moving average (green line). Note that in case the upbeat moods prevail the first resistance level to watch is being marked by the all-time high in the 2960 area. Source: xStation5

S&P 500 futures (US500) launched the week with a quite big upward price gap. The index is trading above the resistance zone (2865-2875) and above the 50-session moving average (green line). Note that in case the upbeat moods prevail the first resistance level to watch is being marked by the all-time high in the 2960 area. Source: xStation5

Merger Monday is quite a common saying on Wall Street as numerous deals are being announced on the first day of the week. This year was a perfect example with Worldpay’s takeover by Fidelity National and Infineon’s merger with Cypress being both announced on Mondays. Out of all deals announced this year close to 30% was announced on Mondays’ and the current week started with 2 big M&A announcement. United Technologies (UTX.US) will merge with Raytheon (RTN.US) in an all-stock merger creating the second largest US aerospace & defense company while Salesforce (CRM.US) said it will merge with Tableau Software (also in an all-stock merger). So far deals worth close to $1.3 trillion were announced this year.

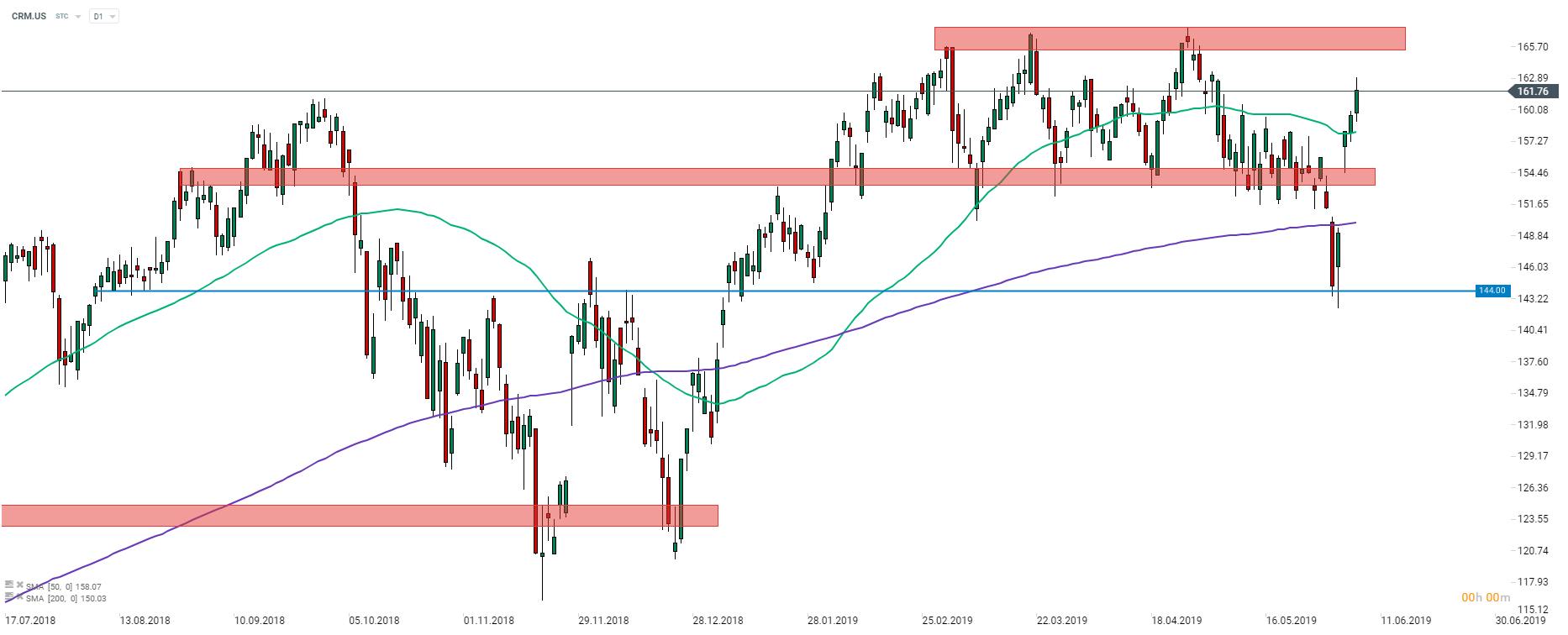

Salesforce (CRM.US) has been trading within a range since the beginning February 2019. Following a false break lower in the previous the stock surged and climbed back into the trading range. The stock may become more volatile, especially at the beginning of the session, as investors will digest Tableau Software merger news. Source: xStation5

Salesforce (CRM.US) has been trading within a range since the beginning February 2019. Following a false break lower in the previous the stock surged and climbed back into the trading range. The stock may become more volatile, especially at the beginning of the session, as investors will digest Tableau Software merger news. Source: xStation5

Insys Therapeutics (INSY.US), the US manufacturer behind Subsys opioid drug, has filed for Chapter 11 bankruptcy protection today. The company and its fentanyl-based drug are said to be one of the causes of the ongoing US opioid crisis. One may label the move surprising given that Insys settled with the US Justice Department last week. Nevertheless, legal expenses related to numerous claims that the company is responsible for the opioid crisis have pushed the company into the financial distress so hard that it saw no other way than filing for bankruptcy. A key point to note is that Insys is the first drugmaker to collapse under accusations of being responsible for the opioid crisis.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.