This is a mega week for financial markets. There is the much-anticipated rate cut from the ECB, the latest reading on payrolls in the US, the Mexican election result, Nvidia’s new AI chip announcement, and Opec+’s latest decision on oil production cuts.

Shein moves step closer to London IPO listing

Last week, the S&P 500 managed to eke out a small gain, however, European markets and the Nasdaq 100 all posted losses for the week. IPO buzz could be in the air at the start of this week, as Chinese clothing giant Shein is expected to file its prospectus to float in London this week. The question for UK traders is will this lift the spirits of the FTSE 100, after the index fell 0.77% last week. If this does happen this week, then it would take London a step closer to being Shein’s IPO destination. While this filing does not indicate when its IPO would take place, it could be in the next few months, with Autumn seen as a likely date. The company is expected to be valued at £50bn, which would put it in the top 15 UK listed companies by market cap, and it would be the second largest UK listing in history.

Tech dominates once more

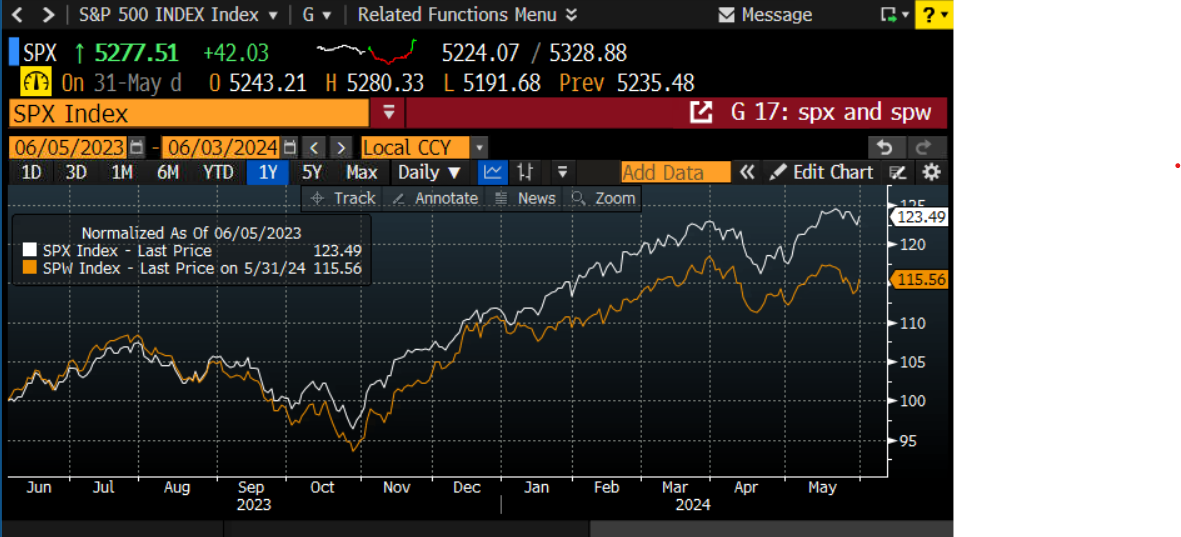

Stock markets in May once more saw the dominance of tech, albeit tech beyond the Magnificent 7. While Nvidia was one of the top three performers last month, HP and Qualcomm were also in the top 10 performers for May. The gap between the market cap weighted S&P 500 and the equal-weighted S&P 500 has widened in May, suggesting that the big tech firms could be the key drivers for markets in the coming weeks. This is a theme that we will continue to watch.

Chart 1: S&P 500 (white line) and Equal-weighted S&P 500 (orange line)

Source: XTB and Bloomberg

Will the ECB deliver a hawkish cut?

There is a 95% chance that the ECB will cut interest rates this Thursday. The market expects a 25bp rate cut on Thursday, however, it’s what comes next that matters more for financial markets and for the euro, in particular. There is currently a 51% chance of another cut in September and a 45% chance of a further cut in December, with the market currently expecting Eurozone rates to be 3.35% by year end. We do not expect Christine Lagarde to confirm further rate cuts, however, she may say that the bar is high for a rate cut in July, and instead suggest that a September cut could be possible, but only if inflation starts to retreat in the coming months. The ECB Staff forecasts are also released at this meeting. The Inflation rate rose in the currency bloc last month, to 2.6% from 2.5%, which does not give the ECB much wiggle room to signal a series of rate cuts at this week’s meeting. The focus will be on the Staff inflation forecasts. Analysts expect no change in these forecasts, but if the recent upgrade to wage growth and the uptick in May inflation data does push up the Staff forecasts then expect the market to rapidly recalibrate Eurozone rate cut expectations. If there is a surprise upgrade to the Staff inflation forecasts, then Thursday could see a ‘hawkish cut’ from the ECB, which may limit euro downside. EUR/USD was lower by 0.25% last week, and this pair has traded in a tight range between $1.0800 and $1.0900 in recent weeks. A hawkish cut from the ECB could nudge this pair above the top of its recent range back towards $1.10, the high from January. It is also worth noting that at the same time that the ECB is set to cut rates, the German 10 Year bond yield is at its highest level since November last year. This suggests that the bond market does not see a prolonged cutting cycle from the ECB, and instead sees a hawkish cut.

UK: the first political debate in focus

It's fairly quiet for the UK, with the focus on politics. The first leaders’ debate will take place on Tuesday evening, The latest polls suggest that Labour still have a big lead over the Tories, with the BBC’s poll tracker predicting Labour will win 45% of the vote, with the Conservatives in second place with 24% of the vote. As we have mentioned, we think that a narrowing of the Labour lead, or signs of a hung parliament are likely to have the most impact on UK asset prices, especially the pound, which is historically sensitive to unexpected political outcomes.

Mixed messages from US labour market data

US economic data comes thick and fast this week, with the May ISM services and manufacturing surveys, the latest Jolts jobs report and the payrolls data at the end of the week. The market is expecting an uptick in the payrolls for last month. The labour market is expected to have created 190k jobs last month, compared with 175k in April. However, the market is expecting the unemployment rate to stay steady at 3.9%, although a number of analysts expect it to pick up to 4%. If the unemployment rate does tick up, then it could be a sign that the US labour market is not as tight as some think, which could lead to a further recalibration in rate expectations and even some dollar weakness as we move towards the weekend.

Opec and the oil price

Opec + surprised the market when it announced its decision on production quotas on Sunday. While it will extend cuts for some key Opec members like Saudi Arabia and Russia well into 2025, it will also start to roll back some measures as soon as October, which is earlier than the market had expected. This could add an extra 750,000 per day of oil to the market by the start of 2025. The plan is that the roughly 2 million barrels of daily production cuts by Opec will be extended into Q3 but will then be phased out over a 12-month period. This move is designed to appease nations including Russia and the UAE, who have bene vocal in their criticism of Opec cuts. However, the big question now is whether or not this is enough to stem the decline in the oil price?

A mixture of fears about the global economic outlook now that interest rates have been pushed back, alongside concerns about China’s growth has seen the price of Brent crude fall nearly $9 per barrel since late April. The latest news from Opec may not stem this decline and could be seen as being bearish for the oil price, since the production cuts will be phased out next year. WTI and Brent crude both fell approx. 1% on Friday, WTI is below $77 per barrel, and Brent crude could test the $80 a barrel mark at the start of this week.

Nvidia in focus as the innovation machine strikes again

Nvidia was also in the news at the weekend, as it announced the next generation of its AI processors, which surprised the market since the last new product announcement was only 3 months ago. It announced the new Rubin chip, which will replace the Blackwell, which hasn’t even been shipped yet, and is set to come into production in 2026. The company also said that it is moving to a 1-year ‘rhythm’ of building new AI platforms, so expect more Apple-like product launches from Nvidia in the years to come. This move towards a speedier innovation cycle is designed to solidify Nvidia’s position as the leader in the AI chip business. It is also trying to move into the CPU business, a market dominated by Intel and AMD, and also into the AI PC business. Nvidia’s share price rose 5% last week and was up more than 28% in May after unveiling mega earnings for last quarter. Nvidia’s products are must-haves when it comes to the AI infrastructure build-out, thus it is hard to see how the stock price won’t react positively to this news this week. It could also hurt some of Nvidia’s competitors such as Intel and AMD.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Join NFP Live Now

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.