Futures on Chicago wheat (WHEAT) at the CBOT are down nearly 1% today ahead of the release of updated supply, demand, and ending stocks projections in the USDA WASDE report, scheduled for 6:00 p.m. CET. Wheat prices continue to face pressure from cheaper Russian exports, where the reduction of the export tax to zero has translated into even lower FOB values. The move was likely intended to allow Russian exporters to push prices down further and secure contracts across markets in the Middle East, Africa, and Asia. Notably, Argentina’s Javier Milei has also decided to reduce export taxes on wheat, introducing yet another highly competitive player to the global agricultural market.

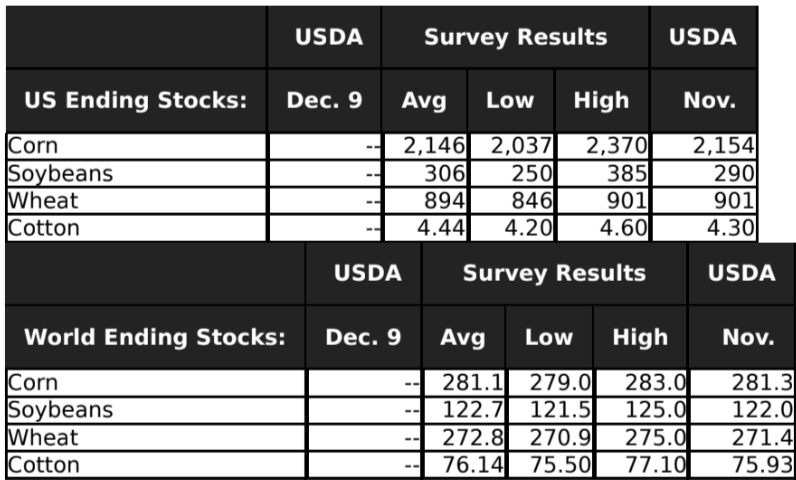

Expected WASDE figures

Source: Bloomberg Finance L.P.

Key Facts

-

Wheat from the Black Sea region remains the primary benchmark for global pricing. Russian 12.5% protein wheat continues to outcompete Ukrainian 11.5%, with both origins trading within a narrow range, though Russia maintains a clear pricing advantage.

-

Declines in Chicago SRW and Kansas HRW (March) futures reflect a market lacking a clear catalyst and still weighed down by global supply pressure, primarily from Russia.

-

French milling wheat weakened again, highlighting soft EU demand and ongoing export challenges due to aggressive Black Sea pricing.

-

Demand in Southeast Asia is beginning to recover, with private buyers in the Philippines reportedly purchasing several cargoes of feed wheat. The Pacific Basin continues to absorb supply despite volatility in freight markets.

-

In Australia, APW and ASW prices strengthened as the Australian dollar gained value.

-

Russian export offers for January–February shipment remain exceptionally competitive at 229–233 USD/t FOB, and the export tax cut to zero further solidifies Russia’s role as the global “market maker.”

-

In the EU’s Black Sea region (e.g., Constanța), prices remain stable, but liquidity is extremely thin.

-

Protein premiums across Europe (France, Germany, Poland, Baltic states) remain virtually unchanged, reflecting a calm physical market with no upward pressure on higher-quality wheat. Export premiums in the U.S. Gulf remain stable as well, both for Chicago and Kansas classes.

WHEAT (D1 interval)

The chart shows weakening sentiment in the wheat market, with prices struggling to hold within a narrow 530–450 range since November 21. A breakdown below 530 could open the door to a deeper decline, while a move above 545 would increase the likelihood of a test of local highs around 560.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.