Crude oil fell this week to the lowest levels since mid-February. Price fell around 30.0% from March high, when the market was concerned that Russia may halt oil transfers. It seems that the oil market has stabilized significantly from this time, although at this point we are dealing not only with supply concerns, but most of all about the demand, which may react negatively to a potential economic slowdown. Crude oil has been moving below $ 100 a barrel for two weeks. Will the current situation prevail? Or maybe in the autumn the prices will resume an upward rally?

The biggest concerns surround China!

China is currently the biggest unknown when it comes to global oil demand. Despite the strong increase in oil imports from Russia, oil processing in China is at its lowest since March 2020. Private refineries in China operate at only 62% and if covid restrictions return, processing may fall to the levels from March and February.

Private refineries in China process less and less oil. A drop in processing capacity to 60% will point to weakening demand. Source: Bloomberg

Private refineries in China process less and less oil. A drop in processing capacity to 60% will point to weakening demand. Source: Bloomberg

Demand in the US doesn't look bad, but ...

Many comments emerged in recent weeks regarding the weakness of US demand. In fact, the implied demand was lower in the beginning of the summer, although this was also associated with extremely high gasoline prices. But when the price per gallon has dropped by as much as one dollar, fuel demand rebounded. On the other hand, the Fed may continue to move towards a stronger slowdown, which will also lower US demand.

US implied gasoline demand returned above the 5-year average, but for the year as a whole, consumption was weaker. Source: Bloomberg

US implied gasoline demand returned above the 5-year average, but for the year as a whole, consumption was weaker. Source: Bloomberg

The physical market is no longer as tight as it was before

The crack spread, i.e. the difference between the price of the product and oil, has dropped significantly, although it remains around $ 40 per barrel. On the other hand, the spread between the nearest Brent oil contracts has dropped significantly (from $ 4 below $ 1), showing that temporary demand has weakened. The forward curve has flattened considerably, although it is still in the contango area. A marked flattening suggests that oil demand is beginning to decline.

Crack spread and COCO spread show that physical demand has decreased significantly. Source: Bloomberg

Crack spread and COCO spread show that physical demand has decreased significantly. Source: Bloomberg

The forward curve flattened significantly. Source: Bloomberg

The forward curve flattened significantly. Source: Bloomberg

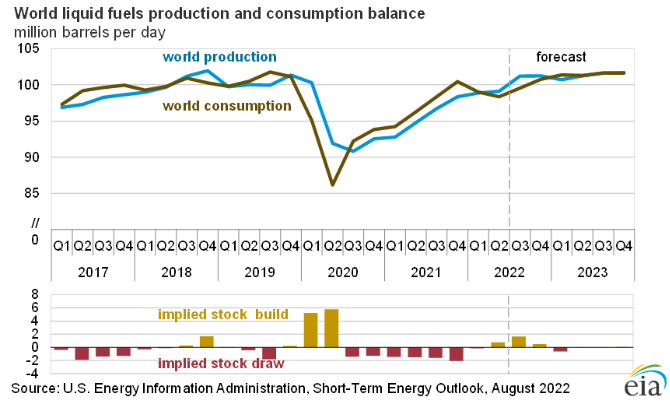

EIA and Bloomberg expect oversupply in the second half of the year

Production growth from OPEC + is limited, but production from the United States and even Russia is increasing. With limited demand due to the economic slowdown, the market may face oversupply in the second half of the year!

Bloomberg and EIA points out that implied stock build may reach 0.5-1 million barrels per day per quarter. Source: EIA

Bloomberg and EIA points out that implied stock build may reach 0.5-1 million barrels per day per quarter. Source: EIA

However, the demand does not necessarily have to be weak!

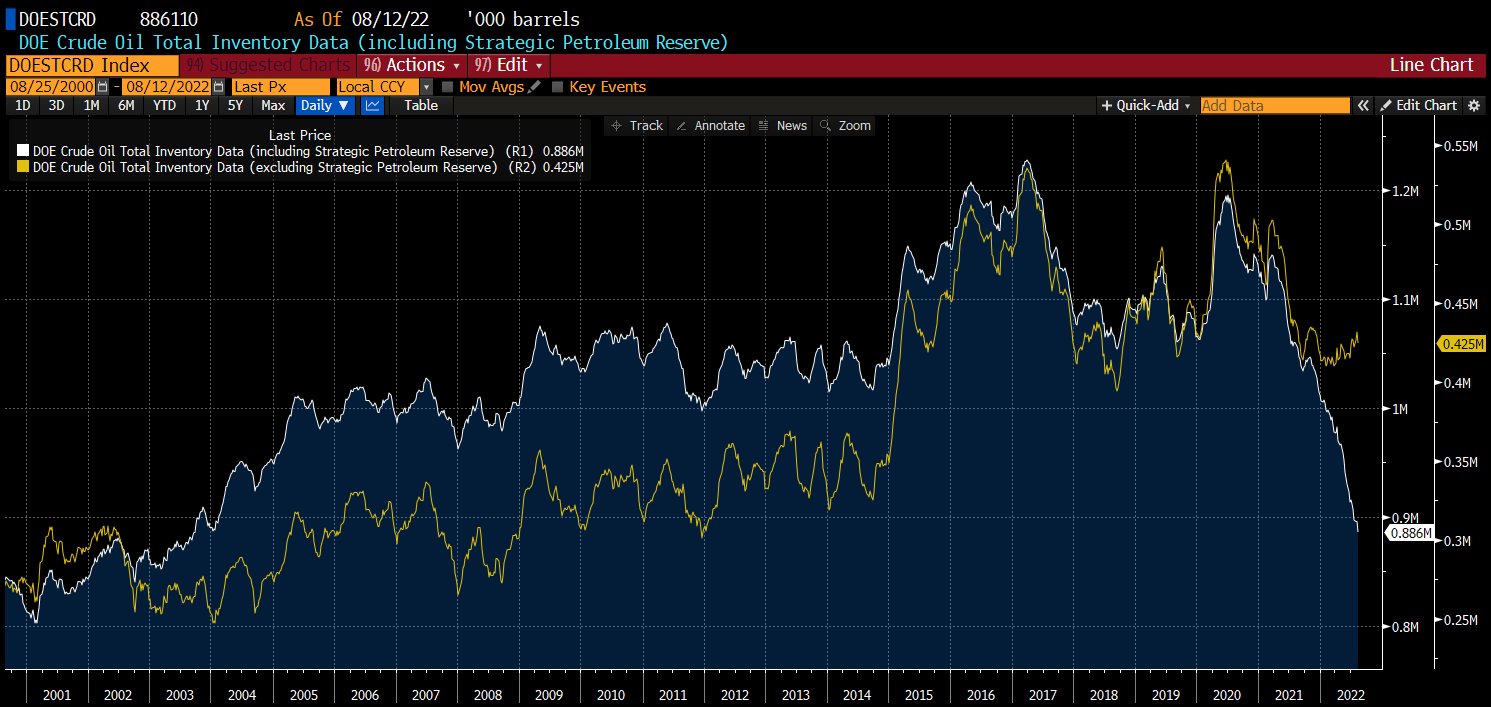

In the autumn and winter period, a decrease in demand is possible, but it may be offset by an increase in the consumption of oil in relation to gas. Many countries that have oil-fired power plants decide to restart their operations, as the price of gas in the equivalent of a barrel of oil is even 2-3 times higher, including the costs associated with emission permits. The so-called Gas-to-oil switching could generate as much as 1-5 million barrels per day of additional demand. In addition, it's worth remembering that from October onwards, the US is likely to stop releasing strategic oil reserves, which have fallen to their lowest levels in nearly 20 years! Without an additional 1 million barrels per day, commercial stockpiles may fell very sharply, which could lead to higher prices at the end of the year!

Inventories, including strategic reserves, fell by 120 million barrels since the beginning of the year! Source: Bloomberg

Inventories, including strategic reserves, fell by 120 million barrels since the beginning of the year! Source: Bloomberg

What's next with prices?

Growing concerns about a potential slowdown or even a recession, problems in China could lead to oversupply on the market, which could push oil prices to even lower lows. On the other hand, it seems that the post-covid uptrend should be maintained. This is why the price should not fall below $ 85 a barrel. At the same time, rising demand and uncertainty regarding supply may push the price above $100 per barrel. However there is a chance that price will enter consolidation period around this level, as was the case in 2011-2014

Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.