- Jackson Hole Economic Policy Symposium begins this Thursday

- Powell's speech on Friday a key event

- No clarity on September's decision yet, more data to come

- Hawkish hold looks to be the base case scenario

- A look at EURUSD, US500 and GOLD

The annual Jackson Hole Economic Policy Symposium, hosted by the Federal Reserve, will be held this week from Thursday, August 24 to Saturday, August 26. The event is always watched closely as it was used in the past to hint at major policy changes. The main theme of this year's Jackson Hole Symposium is 'Structural Shifts in the Global Economy'. While there will be a number of central bankers and economists speaking at the event, markets are waiting primarily for a speech from Fed Chair Powell on Friday.

Attention on Powell's speech

As is usually the case, the full agenda of the Jackson Hole Symposium will not be released until just before the launch of the event (Thursday, 1:00 pm BST). However, timing of the most important part of the event has been already unveiled - Fed Chair Powell will deliver his speech on Friday, August 25 at 10:05 am ET (3:05 pm BST). As we have already said in an introduction paragraph, speeches at Jackson Hole are sometimes used by Fed chairs to hint at major policy changes. Even if no such hints are offered, statements made during the speech often trigger large market moves. Such was the case a year ago when Powell triggered pullback in risk assets, stressing that in spite of economic challenges, inflation will be brought under control. S&P 500 (US500) plunged over 3% on August 26, 2022 after Powell delivered those remarks at the 2022 Symposium.

Fed Chair Powell triggered a sell-off on Wall Street with his Jackson Hole speech last year. Will it be the same this time? Source: xStation5

Fed Chair Powell triggered a sell-off on Wall Street with his Jackson Hole speech last year. Will it be the same this time? Source: xStation5

What to expect from Powell?

The real question is what to expect from Powell this time. It should be said that Fed looks to be on the right path to deliver Powell's promise - headline CPI came in at 3.2% YoY in July 2023, down from 8.5% YoY reported a year ago in July 2022. However, progress on core inflation is not as impressive as the core gauge dropped to 4.7% YoY in July 2023 from 5.9% YoY reported in July 2022. Having said that, the message Powell would attempt to send at Jackson Hole is - target was not achieved yet, rate hikes are still on the table and it is premature to think about cutting rates.

Fed did a good job bringing inflation down over the past year but headline and core gauges still remain above inflation target. Source: Bloomberg Finance LP, XTB Research

Fed did a good job bringing inflation down over the past year but headline and core gauges still remain above inflation target. Source: Bloomberg Finance LP, XTB Research

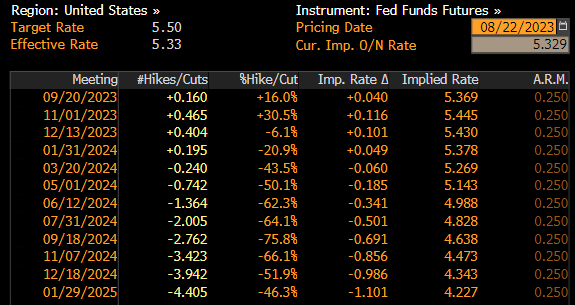

While money markets no longer believe the Fed will hike rates one more time before ending the cycle, saying that the time has come for rate cuts is a too far drawn conclusion. After all, recent data from the United States, like Q2 GDP or July's retail sales, was very strong and showed that demand in the US economy is strong. On top of that, the Atlanta Fed GDPNow model is now pointing to 5.8% GDP growth in Q3 2023. This is not a scenario where you would want to cut rates as it would likely fuel inflation. Also, with inflation still running above the target and risk of inflation re-accelerating by the end of the year due to base effects, conditions for a rate cut are simply not there yet.

Money markets do not see any more Fed rate hikes this year. Markets see rate cuts in Q2 2024. Source: Bloomberg Finance LP

Higher rates for longer?

Fed Chair Powell is unlikely to confirm that the rate hike cycle is over. After all, he has stressed at the last FOMC press conference that the September meeting is live and there is still some key data to be reported before the decision will be made. Some of those readings have been already released - like jobs data and CPI for July - but some are yet to be released - like jobs data and CPI for August.

CPI data for July showed a further progress in bringing inflation down while NFP report for July showed slightly weaker-than-expected jobs growth but also wage growth holding firm. This is not a mix that guarantees another rate hike and Powell will acknowledge it. While it is unsure whether the Fed will hike another time in September, it is sure that the end of the rate hike cycle is near and the real question is what's next.

Fed is more and more often stressing the need to see the full impact of already-delivered tightening. As the US economy remains strong this may lead to a situation where the Fed pauses rate hikes but does not immediately engage in cutting rates. As a result rates may stay at elevated levels for an extended period of time. Keeping rates 'higher for longer' looks to be the base case scenario. Such is the view of a growing number of financial institutions as well as outlook expressed by the vast majority of respondents in a recent Bloomberg survey.

Vast majority of respondents in the Bloomberg survey see 'hawkish hold' as the most expected message from Powell. Source: Bloomberg Finance LP

Vast majority of respondents in the Bloomberg survey see 'hawkish hold' as the most expected message from Powell. Source: Bloomberg Finance LP

How will markets react?

Reaction of the markets will, of course, depend on what Powell says. However, if he largely sticks to the narrative from the latest post-meeting press conference as expected, market reaction may be muted. Any hints that his stance on the September decision has become more clear since July's meeting would likely shape up market expectations and would trigger large market moves. Nevertheless, such an outcome seems highly unlikely and Powell is always careful not to steer markets when delivering speeches.

EURUSD

EURUSD has pulled back recently amid USD strengthening, driven by pick-up in US yields. Pair halted declines at the 1.0875 support zone, marked with 200-session moving average, but a hawkish Powell - i.e. suggestions that hike may come not only in September but also at future meetings - may trigger a downside breakout and pave the way for a test of the upward trendline. Traders should keep in mind that speech from ECB President Lagarde on Friday, 8:00 pm BST may also contribute to volatility on the pair. Source: xStation5

EURUSD has pulled back recently amid USD strengthening, driven by pick-up in US yields. Pair halted declines at the 1.0875 support zone, marked with 200-session moving average, but a hawkish Powell - i.e. suggestions that hike may come not only in September but also at future meetings - may trigger a downside breakout and pave the way for a test of the upward trendline. Traders should keep in mind that speech from ECB President Lagarde on Friday, 8:00 pm BST may also contribute to volatility on the pair. Source: xStation5

US500

Bulls managed to halt a recent correction on S&P 500 futures (US500) and are attempting to launch a rebound. A dovish message from Powell - like signaling that rate hikes may be over already - would likely add fuel to the rebound and could lead to the test of the 4,490 pts or even 4,610 pts. Source: xStation5

GOLD

A pause in the USD rally allows GOLD to recover some of the recently lost ground. Price of the precious metal broke above the upper limit of the short-term bearish channel and is now testing 200-hour moving average (purple line) in the psychological $1,900 per ounce area. GOLD bulls would welcome a dovish Powell as it helps sustain the breakout from the channel and may even lead to a test of the upper limit of the local market geometry at $1,915.70. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.