Table of contents:

- Benefitting not only from increases

- Benefitting from decreases during a slump in the market

- How to make money on betting against the market

- Betting against the market in theory

- How to make money on betting against the market - CFDs on stocks, commodities, indices and currencies

- Making money on betting against the market – summary

The financial markets provide a number of opportunities to manage one’s money and establish various investment strategies. It is generally assumed by the majority of people that making money on the financial markets is possible only by buying a given financial instrument cheaply and selling it for a high price. For example, if we buy 100 shares in a given company for e.g. GBP 100 per share because we expect that the company is going to perform better in the future, which is going to increase the value of the undertaking and in turn – the share price. If e.g. the share price increases to GBP 150 per share, then we will earn GBP 50 per share in this example by selling 100 shares.

Benefitting not only from increases

It seems that the majority of traders think that it’s only possible to benefit from the increases. That is that gold, crude oil, stocks, and foreign currencies should be bought when they are cheap and sold when they are expensive. This means thinking only in one direction. The direction of price increases. However, contemporary financial markets offer many other possibilities in every situation. At this point, economic crises such as the global financial crisis, the Greek crisis, and the Covid-19 pandemic should be listed. Also, the situation in which a trader thinks that a given company is not going to develop at a fast pace and its share prices will drop instead of increasing should be mentioned. Then there are also the bursting of economic bubbles, recessions, or economic slowdown when entire stock indices can fall, prices of crude oil can decrease, or a collapse in other instruments can occur.

Benefitting from decreases during a slump in the market

Benefitting from decreases in the value of stocks, commodities and indices can be a response to all those negative scenarios for the price. Thanks to such opportunities, the trader is not limited only to trade during a bull market, but can also use the bear market, crashes, collapses in quotations caused by various factors. This, in turn, can contribute to extending the range of investment opportunities and allow retaining flexibility under any market conditions. The only strategy for a large group of traders is betting on price increases or staying in the background and observing the events. But, thanks to the opportunity provided by betting on price decreases, there is a chance of making use of virtually any situation.

How to make money on betting against the market

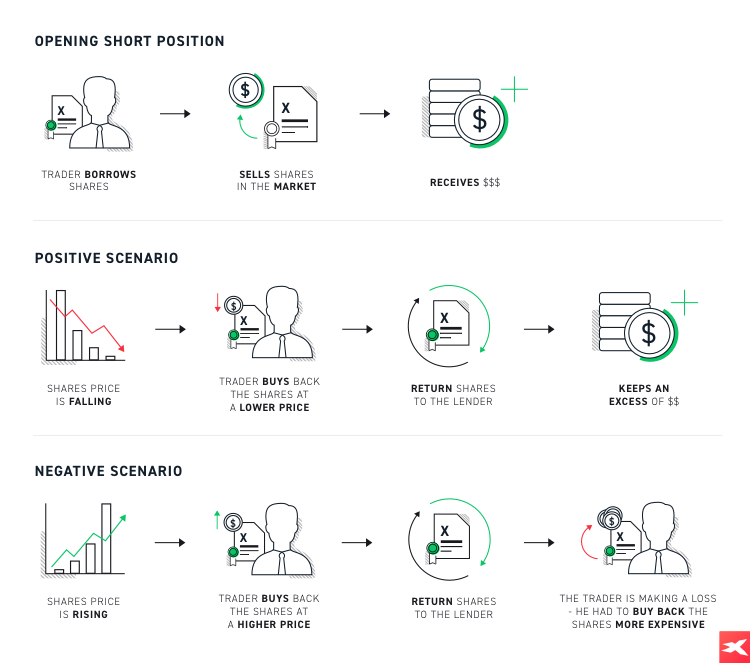

Let us explain the mechanism which was initially behind the method of benefitting from declining share prices. A short position, short sale, short – these are the terms that originated at the time when the trader decided to bet on price decreases. These terms need to be understood in order to know what we are talking about at any time. In the classic case referring to shares, which was practiced on the largest stock exchanges in the world, there was a possibility to borrow shares from institutions that owned them, sell them on the market, repurchase them at a lower price and return them to their owner, while paying an additional fee for borrowing the shares.

Betting against the market in theory

A trader assumes that the shares of a given company are already too expensive, overvalued and that the company’s performance in the future will be poorer than it is now, which in the trader’s opinion should lead to a decrease in share prices. The trader does not hold the company’s shares, but he or she wants to make a potential profit when the downward trend occurs. One of the financial institutions is able to lend the trader 10,000 shares of the company in exchange for a commission. The trader borrows 10,000 shares and sells them at a market price of GBP 100 per share. In exchange for the sale of 10,000 shares for GBP 100 per share, the trader receives GBP 1,000,000. The share price drops to GBP 50 in accordance with the trader’s expectations. At that point, the trader decides to repurchase 10,000 shares on the market for GBP 50 per share. He or she spends GBP 500,000 for this (the example does not include the costs and commission). The trader returns 100,000 borrowed shares to the institution, while retaining the profit of GBP 500,000. In this way, he or she benefitted from decreases in share price.

What would happen if the price increased e.g. to GBP 150? The trader would have to spend GBP 1,500,000 to buy shares on the market, i.e. he or she would have to pay an additional GBP 500,000 to the initially received GBP 1,000,000. In order to secure its interests, the institution lending the shares may request that the trader pay the so-called margin. This can be the aforementioned GBP 500,000. Had the share price started to increase above GBP 150, the institution would have requested the trader to increase the margin, and if he or she had failed to do that, he or she would have to repurchase the sold shares immediately in order to be able to return them.

How to make money on betting against the market - CFDs on stocks, commodities, indices and currencies

A very similar mechanism occurs in the case of opening a short position on CFDs that make it possible to benefit from a decrease in the prices of shares or entire stock indices. The difference is that in this case, no one has to lend shares to anyone and only the difference in the transaction value is settled. It takes place in the same way as on the forward transactions market. Hence the CFDs name – contract for difference.

If we open a short position on 100 shares of the company whose share price is GBP 15 by means of CFDs on shares and spend GBP 1,500 on this (the example does not include costs), only the difference will be subject to settlement. If the share price increases to GBP 16, we will lose GBP 100, and if the price falls to GBP 14, we will gain GBP 100. In this case, the margin will also play a key role, because at the point when the price continues to increase and the margin is used up, the position will be automatically closed with a loss – like in the previous example.

Contracts for differences, which allow the trader to benefit from decreases in other financial instruments, operate on exactly the same basis. For example, if a trader expects that gold prices will decline from GBP 2,000 per ounce to GBP 1,700, he or she may open a short position (short) on CFDs on gold. In this case, if the price falls from GBP 2,000 to GBP 1,700, the trader may earn GBP 300 for each sold ounce of gold. If a trade with the exposure to two ounces of gold was opened, the potential profit will amount to GBP 600, etc. If, however, the gold price increases from GBP 2,000 to GBP 2,300, the trader will lose GBP 300 per ounce.

Contracts for differences, which allow the trader to benefit from decreases in other financial instruments, operate on exactly the same basis. For example, if a trader expects that gold prices will decline from GBP 2,000 per ounce to GBP 1,700, he or she may open a short position (short) on CFDs on gold. In this case, if the price falls from GBP 2,000 to GBP 1,700, the trader may earn GBP 300 for each sold ounce of gold. If a trade with the exposure to two ounces of gold was opened, the potential profit will amount to GBP 600, etc. If, however, the gold price increases from GBP 2,000 to GBP 2,300, the trader will lose GBP 300 per ounce.

In the case of currencies, it is also possible to bet on the decrease in the value of one currency with respect to the other. For example, a trader expects that the USD/GBP exchange rate will decrease from GBP 4 for USD 1 to GBP 3.8 for USD 1. Then, the trader can open a short position on USD/GBP. If the transaction value amounts to 1 lot, i.e. 100,000 units of the base currency, a change by 1 pips will be GBP 10. If the USD/GBP exchange rate decreases by 2,000 pips from GBP 4 to GBP 3.8, the trader can gain GBP 20,000. However, had the USD/GBP exchange rate increased from GBP 4 to GBP 4.20, the trader could have incurred a corresponding loss.

Making money on betting against the market – summary

The possibility to open short positions provides the trader with high flexibility in terms of approaching the market as compared to the traditional possibility to benefit from increasing prices. We live in very dynamic times that are not free from economic crises or bubbles. Thanks to the opportunity to benefit from decreases in stocks, indices, commodities and currencies, the trader can bet against market bulls who are only counting on price increases. Moreover, the trader can in this way also secure, for example, the portfolio of shares held when he or she does not want to sell them due to a dividend payment, but sees that potential adjustment can occur. Thus, there are plenty of possibilities – from the classic speculation on price decreases to the so-called hedging, i.e. securing the position, and all of this can be easily and intuitively performed on XTB’s trading platform, xStation 5.