Natural gas, due to its energy qualities and its "green" ecological advantage over other fossil fuels, is considered an intermediary energy source between the "dirty fuels" that leave a carbon footprint and the advanced energy future of the Earth. The energy transition could take decades or several decades, depending on the country.

Meanwhile, the demand for energy is constantly growing both in industry and households.

This situation makes trading natural gas a very interesting solution and, as we can see, high money volumes entered the natural gas stock market in the last few months, especially after panic information from China about the lack of coal resources in the upcoming winter.

The energy crisis has shown the potential there is in commodity trading and uncovered the "true price" of several unfashionable, very important and economically crucial energy commodities, like natural gas.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

The energy policy of each country varies depending on the level of the developed economy and available natural resources. However, we can recognise that humanity is in an energy transition to green energy sources that is supported by powerful institutions.

This article is a quick overview of gas trading basics and after reading it you will know more about investing in natural gas and companies from this well developed, forward looking sector.

The short history of Natural Gas

Natural gas has been known since ancient times, but its commercial use is relatively young. Natural gas has taken hundreds of years to become an effective energy source, although the history of its use dates back to ancient times.

Around 1000 BC in ancient Greece, the Delphian oracle was built on Mount Parnassus at a site that proved to be a source of natural gas. Around 500 BC the Chinese began using "pipelines" made of bamboo to transport the gas that came to the surface. The Chinese used it to boil sea water to make drinkable water.

Naturally occurring natural gas was discovered and identified in North America in 1626, when French explorers found natives who were lighting gases around Lake Erie.

Naturally occurring natural gas was discovered and identified in North America in 1626, when French explorers found natives who were lighting gases around Lake Erie.

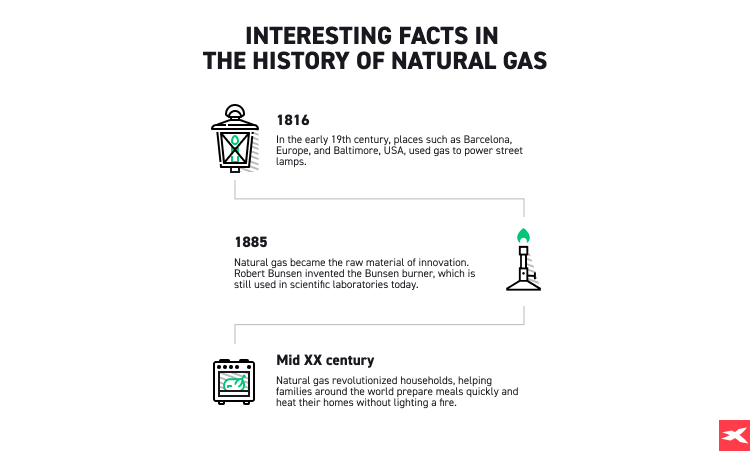

However, the first commercial use of natural gas occured 160 years later, in Great Britain. Around 1785, the British used natural gas produced from coal to light streets and households. 30 years later, Baltimore, Maryland, became the first city in the United States to light its streets with gas.

In 1821, William Hart drilled the first natural gas well, in upstate New York. Thus was founded the Fredonia Gas Light Company, which became America's first natural gas distribution company.

For most of the 19th century, natural gas was used almost exclusively as a light source, but in 1885, Robert Bunsen's invention opened up new uses for natural gas. In the 20th century, efficient pipelines began to be built.

Then the use of natural gas expanded to include home cooking and heating. Natural gas also began to power appliances such as water heaters and furnaces, manufacturing and processing plants, and boilers to generate electricity.

Then the use of natural gas expanded to include home cooking and heating. Natural gas also began to power appliances such as water heaters and furnaces, manufacturing and processing plants, and boilers to generate electricity.

Nowadays natural gas is one of the most important and basic sources of energy on Earth. The newest technology and the internet provide an opportunity to trade natural gas and make money in the energy commodity market.

Nowadays natural gas is one of the most important and basic sources of energy on Earth. The newest technology and the internet provide an opportunity to trade natural gas and make money in the energy commodity market.

The benefits and use of Natural Gas

Natural gas is used to produce fuels on an industrial and private scale. It is also a needed ingredient in the production of detergents, synthetic fibers, paints, plastics, and synthetic rubber.

Natural gas is also a convenient fuel for stationary energy equipment such as boilers, turbines, dryers, industrial heating furnaces and domestic cookers. There is no substitute for natural gas in the manufacture of light bulbs or gas turbines.

The main application of natural gas is of course the heating of households, i.e. convenient automation and regulation of the combustion process, makes more and more households use gas installations. Gas in households is also necessary for heating water and preparing meals.

Gas is also used on a mass scale in animal husbandry, drying of cereals, seeds and production of fodder or animal feed. In industry it is also used to heat production and office space, to heat halls and in technological processes.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Because of its relatively low price compared to oil, natural gas is used on a mass scale as fuel for both cars and trucks. Uniform combustion temperature, calorific value, automation of combustion processes, ease of regulation and no problem with waste disposal are powerful advantages of all gas-fired systems.

These are all important aspects for investors in investing in gas because understanding how the industry works is a very important part of every decision-making process.

How to Buy Natural Gas

You have the choice and you can choose to invest in natural gas or trade natural gas. There are several differences between these methods. Of course it’s also possible to use both of them at the same time.

Investing

Investing in natural gas is possible through the purchase of ETFs or shares of gas sector companies. Natural gas stocks like Gazprom (OGZD.UK) or Royal Dutch Shell (RDSA.UK) or Shell are well known for paying regular dividends.

Natural gas stocks like Shell or BP (BP.UK) still give good opportunities and prospects for investors who avoid high risk and high volatility in the market. At the same time, prices of these companies are still lower than prices before Covid-19 stock crash.

Trading

Trading natural gas is speculative and only the moves of the gas price are important here. Gas CFD a financial contract that you trade to earn the price difference between your open and closed positions, without physical delivery of natural gas. It’s also a good option for investors, who like high risk ventures and dynamic trading.

You can trade natural gas by opening positions on NATGAS CFD (contract on price differences) and using financial leverage. Thanks to the leverage trading NATGAS requires only a certain percentage of the whole position. For example using 1:10 leverage gives you the opportunity to open a 10,000 USD contract by using only 1000 USD margin. Thanks to CFD trading, day traders can earn money even when NATGAS price falls down - by opening short positions. This kind of speculation can be especially dangerous and volatile because of NATGAS price action. CFD Natgas trading gives traders an opportunity to maximise their profit faster even when price action is not very big, but loss can also be much bigger because of using leverage.

Our NATGAS price instrument is based on contracts from Chicago Mercantile Exchange CME Henry Hub natural gas quotations.

Trading Gas Online

There is no way to simply purchase a physical supply of gas. Especially trading physical natural gas is complicated and not similar to precious metals like gold or silver. The storage of natural gas is also an additional, big challenge for investors.

Therefore, in order to make money on the movement of the blue fuel market, the most optimal solution for individual investors and institutions is online gas trading.

Online trading is also the easiest, has the most favorable charges conditions and allows you to customize your personal investment strategy by choosing CFDs on natural gas, shares of natural gas stocks or ETFs.

Online natural gas trading gives you exposure to an extremely volatile and popular market with great perspectives without leaving your home.

How to Trade Natural Gas CFDs

First of all, NATGAS CFD trading gives traders the opportunity to open short and long positions. Short positions give investors the opportunity to take profits even when prices of NATGAS are falling.

First of all, NATGAS CFD trading gives traders the opportunity to open short and long positions. Short positions give investors the opportunity to take profits even when prices of NATGAS are falling.

By trading gas, you can use market volatility and open positions during very fast gas price movements. Financial leverage is risky and can result in large losses, but can multiply a day trader’s profit.

The only fee that you pay in this case is spread (the difference between ASK buy price and BID sell price) and swap points. The spread is very small and costs cents depending on the size of a position, swap points are the costs that the broker incurs in financing leveraged positions; swaps are accrued daily to the yield of the opened NATGAS position.

Gas stocks and ETFs

Stocks

There are many ways to diversify the risk of your gas stock assets portfolio. One of them is certainly buying shares of large Russian and American companies operating in the natural gas market. Natural gas stocks in the long term are in general less volatile than natural gas spot prices. Of course smaller gas stocks are more volatile and risky but have bigger potential because of relatively smaller market capitalisation and good perspectives. Of course, if they are well managed and profitable, we recommend all investors who are interested in natural gas investment do an analysis of each company.

You can invest in natural gas by buying shares of companies from gas energy sector like Gazprom (GAZ.UK), Rosneft (ROSN.UK), Tatneft (ATAD.UK), Exxon Mobil Corporation (XOM.US), Exxon Mobil Corporation (XOM.US), Royal Dutch Shell (RDSA.UK) or Chevron (CVX.US)

Gazprom (GAZ.UK) is the biggest natural gas company in the world with a very attractive dividend ratio. It’s also one of the biggest publicly traded stocks in the market.

Gazprom (GAZ.UK) is the biggest natural gas company in the world with a very attractive dividend ratio. It’s also one of the biggest publicly traded stocks in the market.

Gazprom is a Russian state-majority energy corporation with headquarters in Saint Petersburg. In 2019, with sales exceeding $120 billion, Gazprom was Russia's largest company by revenue. In the Forbes Global 2000 ranking in 2020, Gazprom was ranked at 32 place largest public company in the world.

Gazprom operates in every area of the gas industry, including upstream and downstream, refining, transportation, marketing, distribution and power generation which allows it to diversify its gas investment risk. In 2018, Gazprom produced 12% of global natural gas production. Gazprom exports gas through pipelines the company builds and owns in Russia and abroad, such as TurkStream or NordStream. Gazprom also has subsidiaries in the financial and industrial sectors - including aerospace, media, and majority stakes in other companies.

The company has been involved in Russian government diplomacy, gas pricing, and pipeline access for other countries since 2000.

The company is in majority owned by the Russian government, through the Federal Agency for State Property Management and Rosneftgaz.

As of November 8, 2021, Gazprom's capitalisation is well over $100 billion, and has doubled the share price from 8 November 2020 with the latest paid dividend from 29 July 2021.

Rosneft (ROSN.UK) is a Russian energy company based in Moscow. Like Gazprom, Rosneft specialises in the exploration, extraction, production, refining, transportation, and sale of oil and natural gas. The company is also controlled by the Russian government through its holding company Rosneftgaz.

Rosneft (ROSN.UK) is a Russian energy company based in Moscow. Like Gazprom, Rosneft specialises in the exploration, extraction, production, refining, transportation, and sale of oil and natural gas. The company is also controlled by the Russian government through its holding company Rosneftgaz.

Rosneft was founded in 1993 as a state-owned enterprise and later became part of a series of state-controlled gas and oil assets. Rosneft has become one of Russia's biggest energy companies after buying the assets of former oil company Yukos at state auctions and acquiring OJSC TNK-BP in 2013.

Rosneft is currently the third largest Russian company and the second largest state-controlled company (after Gazprom) in Russia in terms of revenues exceeding $100 billion annually. Internationally, it is one of the largest natural gas companies, ranking 24th in terms of revenue. In the Forbes Global 2000 ranking for 2020, Rosneft was ranked 53rd among the largest public companies in the world. The company operates in more than twenty countries around the world.

Rosneft and Gazprom as the biggest natural gas stocks can be considered as a great gas investment for long-term value investors. These natural gas stocks regularly pay dividends and are profitable every year. They also have an established market position and direct influence on gas prices. Increasing gas prices and high demand from other countries can make these stocks listed even higher in the future with stable good prospects for natural gas investment.

Exxon Mobil Corporation (XOM.US) is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D.Rockefeller fortune and Standard Oil.

One of the world's largest companies by revenue, ExxonMobil has ranged from the first to the sixth largest publicly traded company by market capitalisation from 1996 to 2017. The company ranked third in the world on the Forbes Global 2000 list in 2016. ExxonMobil was also the tenth most profitable company in the Fortune 500 in 2017. As of 2018, the company ranked second in the Fortune 500 list of largest U.S. corporations by total revenue. More than half of the company's shares are held by institutions. Shareholders include such giants as The Vanguard Group and BlackRock.

ExxonMobil is one of the world's largest energy companies and has influence over American foreign policy and its impact on the nation's future.

Royal Dutch Shell (RDSA.UK) is an Anglo-Dutch multinational oil and gas company headquartered in The Hague, Netherlands and the fifth largest company in the world by revenue in 2020. Shell is the largest company headquartered in Europe and the largest company not headquartered in China or the United States. Forbes Global 2000 ranking of 2020 ranked Shell as the 21st largest public company in the world. In 2013, Shell ranked number one on the Fortune Global 500 list of the world's largest companies and in that year its revenues were equivalent to 84% of the Netherlands' GDP.

Royal Dutch Shell (RDSA.UK) is an Anglo-Dutch multinational oil and gas company headquartered in The Hague, Netherlands and the fifth largest company in the world by revenue in 2020. Shell is the largest company headquartered in Europe and the largest company not headquartered in China or the United States. Forbes Global 2000 ranking of 2020 ranked Shell as the 21st largest public company in the world. In 2013, Shell ranked number one on the Fortune Global 500 list of the world's largest companies and in that year its revenues were equivalent to 84% of the Netherlands' GDP.

Since then Shell, has slipped lower among the largest companies on the Global 500, but is still the largest non-state energy corporation in the world.

Like Gazprom and Rosneft, Shell operates in all areas of the gas industry, including exploration and production, refining, transportation, distribution and marketing, petrochemicals, and power generation. Shell is also active in renewable energy, including biofuels and hydrogen.

Shell operates in more than 70 countries and has approximately 44,000 gas stations worldwide. As of December 31, 2019. The company has subsidiaries in the US and is also a large shareholder in other energy companies; including in developing countries.

Also worthy of investors' attention are other big natural gas companies like Chevron (CVX.US), Hess Corporation (HES.US), Contango Oil & Gas Co. (MCF.US), NiSource (NI.US), Oneok Corp (OKE.US), Pembina Pipeline (PBA.US), UGI Corporation (UGI.US), BP (BP.UK), Tatneft (ATAD.UK), Total Energies (TTE.FR), Gaztransport ET Technigaz SA (RTT.FR), Rubis (RUI.FR), Avance Gas Holding AGAS.NO, Naturgy Energy Group SA GAS.ES, Enagas (ENG.ES), Italgas (IG.IT), PGNiG (PGN.PL), Grupa Lotos (LTS.PL)

ETFs

Natural gas investment by purchasing exchange traded funds instruments (ETFs) is a more diversified choice than a position in a singular gas stock company. Investing in gas ETFs gives you also a wider exposure to the market.

This kind of silver trading is more balanced and and also gives the opportunity to receive dividends from distributing ETFs like iShares STOXX Europe 600 Oil&Gas (SXEPXE.DE) or buying accumulating ETFs like iShares Oil&Gas Exploration and Production (IOGP.UK). Those instruments are tracking share prices of a group of gas sector companies from the industry. You can also choose ETFs which track moves of natural gas prices like WisdomTree Natural Gas (NGAS.UK).

WisdomTree Natural Gas (NGAS.UK) is an investment fund that enables investors to gain exposure to their natural gas investment by tracking the price of the Bloomberg sub-index Natural Gas Subindex ("Index").

iShares Oil&Gas Exploration and Production (IOGP.UK) this fund gives direct exposure to a broad range of global companies involved in the exploration and production of gas and oil. Fund IOGP.UK has a lot of gas companies in holdings like EOG Resources, Canadian Natural Resources, Conocophillips, Devon Energy Corp or Hess Corp.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

iShares STOXX Europe 600 Oil&Gas (SXEPXE.DE) is a well known fund which aims to track the performance of the STOXX Europe 600 Oil & Gas index. SXEPXE.DE is a distributing ETF, which means that the fund distributes income received to shareholders. This is especially good information for long term gas investment. The fund has such big companies i.a. Total Energies (TTE.FR), Royal Dutch Shell (RDSA.UK) and BP (BP.UK) in holdings which makes its price is not as variable.

Investments in gas by ETFs creates diversified resources portfolios with lower risk but also with lower growth potential.

What Is the Best Time to Start Investing in Natural Gas?

Many investors are wondering when to start trading natural gas and wonder if it is too late to open positions in the natural gas market.

The increase in gas prices has become a global issue and has particularly affected European countries, which are still dependent on external supplies. Russia's market policy as the world's largest supplier of natural gas has a powerful influence on actual prices; both gas spot price and real prices of commodities for households and industries in countries which import gas.

For example, in Lithuania from December 2020 to October 2021 natural gas became almost 90% more expensive. Increased natural gas energy prices like domino effect have resulted in higher prices for many raw materials and manufactured goods due to increasing production costs.

This situation is closely related to the global energy crisis. Natural gas is used in power and heat generation, heavy and light industry, and transportation. This means that as long as the industry has energy needs and households from all over the world use gas for cooking and heating, investors can expect the demand for the commodity to remain high.

A reason for the growing demand for gas is also the "green" policy of decarbonization and moving away from fossil fuels. Natural gas makes it possible to reduce emissions of CO2 and oxides of nitrogen and sulphur. This fact and competitive prices have led to gas being recognized in the European Union as a transition fuel on the road to climate neutrality.

It is assumed that the price of gas extracted by Norwegian companies, Russian Gazprom or Rosneft may increase due to increasingly expensive extraction and because of geopolitical reasons, including gas price manipulations.

In such a situation, gas imports from the US may increase because Henry Hub gas is relatively cheap. This raises the scope for companies involved in liquefied gas LNG and its transportation.

The demand for LNG supply has also increased significantly in Asia after information about a very hard winter coming and lack of energy resources facilities. Such information was passed by the Chinese government and synoptics in October and November 2021. Very hard winter in Asia in 2021 is possible because of the ‘El Nino’ atmospheric front.

Through problems with the China coal supply and lack of other energy sources, China has begun to hedge with supplies of liquid LNG, which has caused the demand in the natural gas market to rise sharply recently.

In winter household gas demand also increases because of heating, which often has results in higher profitability for natural gas stocks and higher gas market prices.

Gas is still relatively cheap and less environmentally hazardous than coal. Until the economy finds an effective technology for storing energy from renewable sources or massively builds nuclear reactors, we can expect the demand for gas to grow. Gas-fired power plants are relatively easy to operate, and can be turned on and off at any time.

Natural gas is a raw material in between fossil fuels "no green" and modern energetics of developed economies based on uranium or hydrogen. However, the energy transition may take decades. Natural gas investment seems to have very strong fundamental reasons for growth and evolving next year.

Natural Gas Trading Hours

What about available gas trading hours? This information is especially important for day traders. Spot natural gas trading is available 5 days per week from 8:30 CET to 23:00 CET from Monday to Friday. Trading natural gas is not available during weekends on our platform. Natural gas spot price is static when the market is closed. At all other times the prices are constantly fluctuating.

Of course the best time for natural gas trading is during periods of very high liquidity, when market volatility is higher. When there are high trading volumes in the market, volatility increases. This situation is a big opportunity not only for investors but also for day traders, who are using leverage to take large profits even on short positions. Also bear in mind that leverage could result in larger losses.

Of course the best time for natural gas trading is during periods of very high liquidity, when market volatility is higher. When there are high trading volumes in the market, volatility increases. This situation is a big opportunity not only for investors but also for day traders, who are using leverage to take large profits even on short positions. Also bear in mind that leverage could result in larger losses.

High volatility could be influenced by publishing important political or company news, but also because of overlapping trading hours of different locations. Natural gas is one of the most volatile raw materials and it’s still very sensitive to political issues, for example the information from Russia about the Nord Stream 2 pipeline issue. Russian strategic management still has a huge impact on the natural gas market and both day traders and gas investors shouldn’t deny it.

The weather predictions are also very important for the natural gas market; information about harsh winters can be a spark igniting the gas price.

But you don’t need to follow temporary market volatility. On our platform, xStation you have the opportunity to purchase natural gas ETFs like Natural Gas (NGAS.UK) or big and recognisable stocks like Gazprom (GAZ.UK) or Rosneft (ROSN.UK); in these cases as an investor you don’t need to look at natural gas fluctuating prices and just be longterm on natural gas investment.