- The margin level is a risk management indicator that helps you understand the influence of the currently opened positions on your account.

- Margin level is a mathematical equation that effectively tells the trader how much of their funds are available for new trades.

- The higher the margin level, the higher the amount of cash available to trade.

- The lower the margin level, the lower the amount of cash available to trade, and this is where an account could be subject to a margin call.

How is margin level calculated?

It is calculated with the following formula:

Margin level = equity/margin x 100%

If you don't have any trades open, your margin level will be zero. Once a position is opened, the margin level will depend on several factors such as:

- Volume

- Type of market

- Leverage

- Margin level example

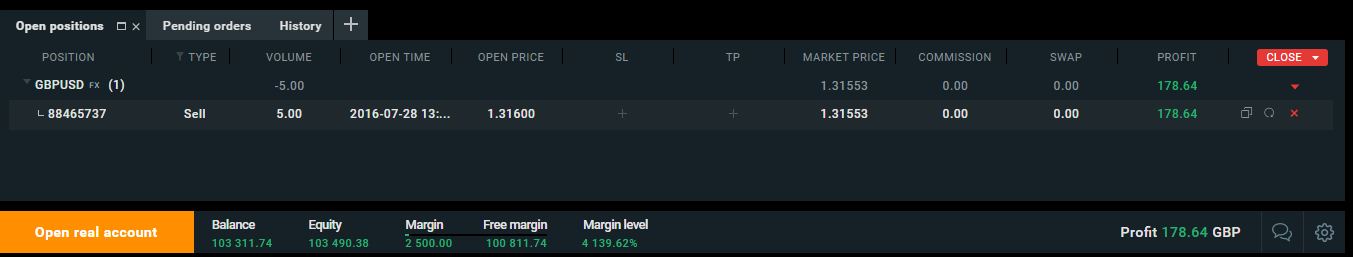

The xStation platform automatically calculates your margin level and you can view it at the bottom of your screen.

Source: xStation

In the example above, the margin level is calculated in the following way:

Margin level = 103490.38/2500 x 100% = 4139.62%