Deposit rate: 4.0% (consensus: 3.75%; previously: 3,75%). The market was pricing around a 60% probability of a hike. Other key rates were also raised by 25 pb. On the other hand, the ECB signals that this may be the end of the hiking cycle:

-

"We consider that interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to timely."

-

"The rate increase today reflects the ECB’s assessment of inflation outlook in light of incoming economic and financial data, dynamics of underlying inflation, and strength of monetary policy"

-

The past interest rate hikes continue to be transmitted forcefully

-

Inflation continues to decline but it is still too high and remains at heightened levels for too long

-

Future decisions will ensure that interest rates will be set at sufficiently restrictive levels as long as necessary.

-

EBC will still be data-dependent in future decisions

-

EBC sees inflation at 5.6% in 2023, prior forecast at 5.4%. EBC sees also inflation at 3% next year, in line with previous projections

-

ECB revised down projections for underlying inflation: 5.1% for 2023, 2.9% for 2024 and 2.2% for 2025%

-

ECB sees GDP growth at 0.7% in 2023, prior 0.9%. In 2024: 2.9% vs 3.0% and in 2025: 1.5% vs. 1.6% previously

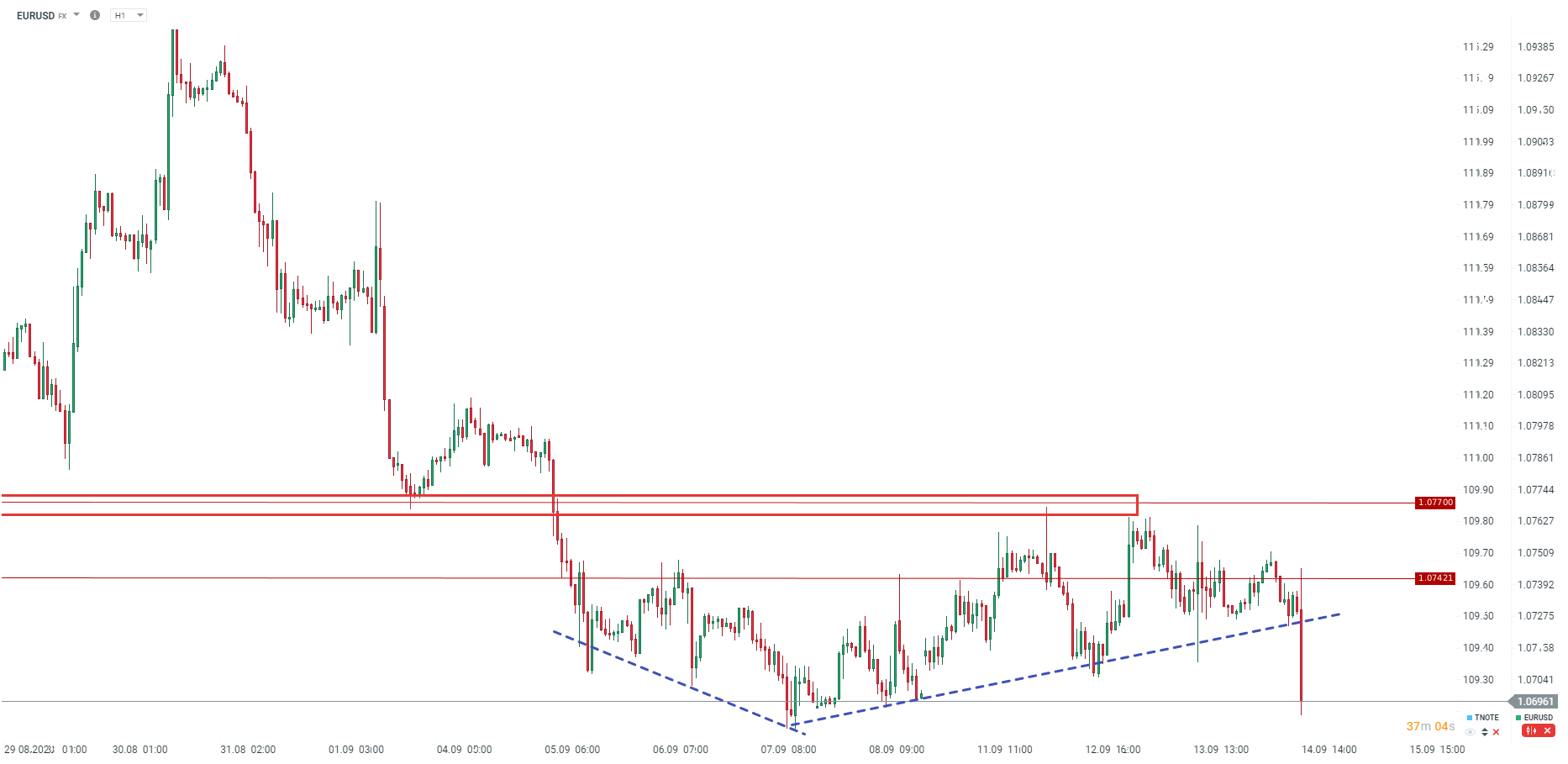

EURUSD has fallen to the lowest since September 8 as the ECB signaled that it may be the end of the hiking cycle. The ECB stated that the rate at this level for a prolonged time should bring inflation towards the goal. The market is pricing around a 30% probability that the bank will decide to hike further this year.

Of course, we should remember that at 01:45 pm BST Lagarde will deliver a speech after the decision and may try to change the market view on further decisions.

Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉